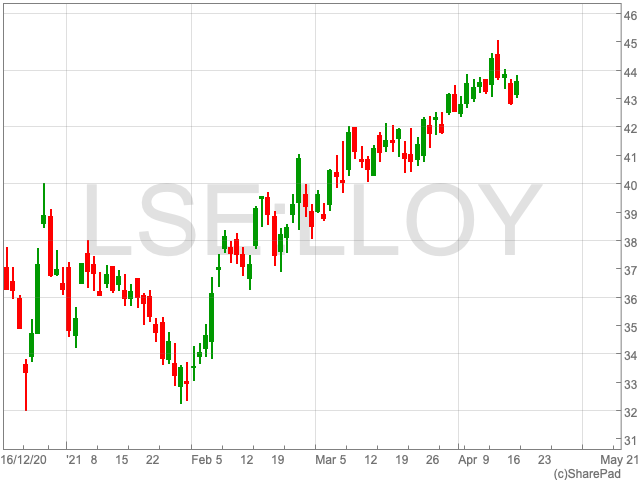

FTSE 100 is up by 0.26% to 7,037.60 on Monday morning trading, a 14-month high.

“Though there’s still some ways left before it gets there, a return to the 7,900-approaching records highs of May 2018 all of a sudden don’t feel as far off as they once did,” said Connor Campbell, financial analyst at Spreadex.

Beating its blue-chip brother to the chase, the FTSE 250 hit another record peak after the bell, rising a further 0.3% to touch 22,650.

“Sunny weather should have given retailers and hospitality businesses in England a boost over the weekend and this helps explain why the more domestic-facing FTSE 250 outperformed its large-cap counterpart and is marking new record levels,” said Russ Mould, investment director at AJ Bell.

All eyes will now be on whether the FTSE 100 itself can push yet higher and challenge its own all-time high of nearly 7,900 as the economy continues its recovery from the pandemic.

After a lacklustre fortnight the DAX burst into action last Friday, breaking away from 15,250 to reach a fresh all-time high. A quiet start meant the German bourse couldn’t really build on that feat, lurking around 30 points shy of 15,500.

“The Dow Jones is still expected to start the session above 34,100. It’s been a steady climb for the Dow this month, opening at 33,030, with a good chunk of April left if it wants to strike 35,000,” according to Campbell.

“There isn’t too much going on this Monday, which might inhibit the market’s ability to really push forward and break records. Then again, said calm may be the kind of environment the Western indices want if they are to stretch their legs,” Campbell added.

FTSE 100 Top Movers

Ocado (3.05%), Fresnillo (2.46%) and London Stock Exchange Group (2.18%) made the most gains on the FTSE 100 on Monday morning.

Evraz (-1.84%), Phoenix Group Holdings (-1.11%) and Smith and Nephew (-1.02%) were the bottom thee companies on the FTSE 100 a couple of hours in on Monday.