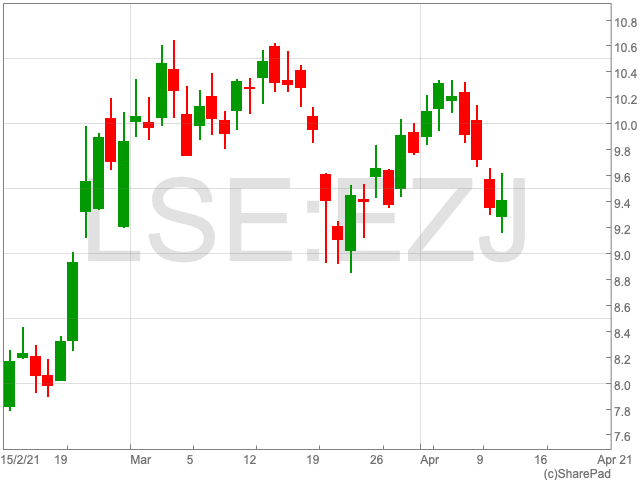

Audioboom share price up 4% in morning session

Audioboom (LON:BOOM), the podcast company based Jersey, recorded its first ever profit during Q1 as demand has continued to grow during the pandemic.

The AIM-listed company has released its adjusted earnings before interest, tax, depreciation and amortisation of $30,000 during the first quarter of the year, a swing from a substantial $500,000 loss the year before.

Revenue over the period rose by nearly 50% to $9.5m.

The average number of downloads across the world grew by 37% from the year before to 87.1m, getting as high as 91.6m in March.

As well as being a platform for podcasts, Audioboom expanded its range of content by launching Relax! hosted by Colleen Ballinger and Erik Stocklin. The show made it to number one on the Apple US podcast chart.

Audioboom is expecting its revenue for the year to exceed its market expectations, as it has now signed 90% of its forecast advertising bookings.

Shares in the company are up by over 4% on early morning trading.

Stuart Last, CEO of Audioboom, commented: “Q1 2021 was a breakthrough period for Audioboom, reaching adjusted EBITDA profitability for the first time and demonstrating the strength of our business model. I am delighted with our revenue performance and continued cost control. It is important to note that the 49% year-on-year revenue growth we have delivered is benchmarked against the one quarter in 2020 that was not significantly impacted by Covid-19.”

“Our record performance is driven by our content focused expansion strategy. New content partnerships and successful Audioboom Originals Network launches delivered strong growth in our Global Downloads key performance indicator, with more than 90 million downloads in March. As a result, Audioboom became the fourth largest podcast publisher by number of average weekly users in the US on the Triton Digital ranker.”