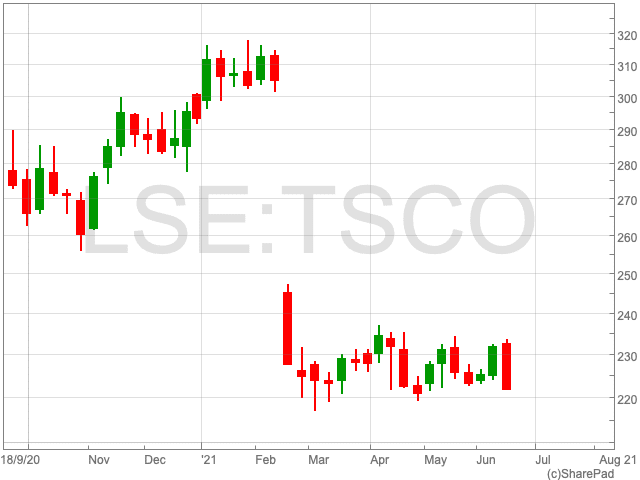

Tesco Share Price

The Tesco share price (LON:TSCO) is down by 3.75% on Friday as the FTSE 100 company released its Q1 trading statement. Following a large drop in the stock’s value in February, due to the price effects of the £5bn special dividend, it has broadly traded sideways in 2021, rangebound between 220p and 240p per share. Since the beginning of the year the Tesco share price is down by 25.85% to 222.45p at the time of writing. This article will take a closer look at the company’s recent performance to give an insight into the supermarket’s broader outlook.

Trading Update

Tesco saw its underlying UK sales growth slow during Q1, in contrast to the same period a year ago when many rushed to the supermarket to bolster their supplies for the first lockdown.

For the quarter ending in May, the company’s sales rose by 0.5%, above analysts’ predictions of a drop of 1%. However, it was way down from a growth rate of 8.8% in the quarter before. Fuel sales rose by 68.1% in a signal of a recovery as the vaccine roll-out continues apace in the UK.

The Tesco share price received a boost as the firm retained its profit guidance for the 2021/22 fiscal year.

“Tesco’s first quarter 2021 figures were never going to live up to last year’s comparable period, as the three months to May included the period where the nation went crazy stockpiling food and drink as the pandemic took its grip. The supermarket saw 7.9% like-for-sales growth in Q1 2020, setting the bar very high this time around,” said Russ Mould, investment director at AJ Bell.

That might explain why Tesco is trying to push two-year figures in its latest update, to emphasis the unusual nature of last year’s performance and to convince the market that its business hasn’t ground to a halt.

“To its credit, 1% like-for-like growth on a one-year basis is not a disaster. It implies that Tesco is holding its own against tough competition in the grocery space and no doubt retained lots of the customers it won in 2020 from having wider availability of online delivery slots than its peers,” Mould said.

The issue of inflation remains a concern that Tesco may have to face up to. It may have to decide if it can pass on all the extra costs to customers or risk a squeeze on profit margins.

“The forthcoming launch of Russian discount supermarket Mere in the UK will add to the competition, so Tesco needs to be very careful that any changes to its prices don’t alienate its customers,” Mould said.

While Tesco is not the most exciting company in the world, it provides and essential service, and shows an appetite to innovate. That, in addition to its 4.3% annual dividend yield, means the Tesco share price could be considered a good bet for the near future.