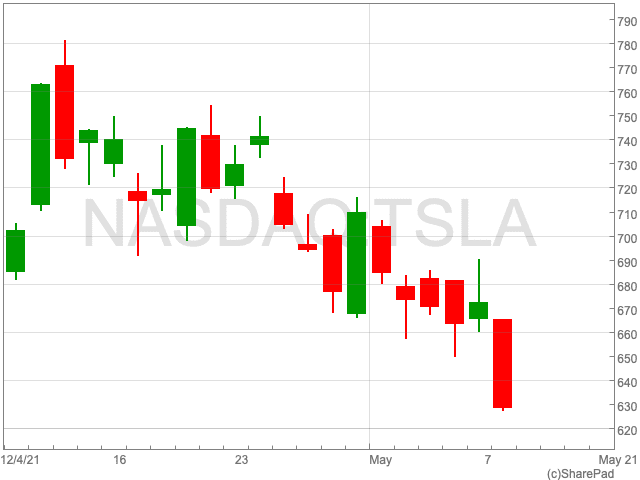

Tesla Share Price

The Tesla share price closed 7% down yesterday as it was revealed the company’s sales fell in China during April while the electric vehicle manufacturer faced a PR crisis. If the stock falls again today it could reach its lowest point in two months, when Tesla crashed from $863 to $563 in the space of a month. It has been a testing year so far for Elon Musk’s company which is just under 11% down since the end of 2020. As investors turn away from high-valued growth stocks, and Tesla faces ongoing issues in China, now is an opportune time to analyse the stock’s present outlook.

Tesla Halts Plans to Buy Land in Shanghai

Elon Musk appeared to curry favour with China back in March in an effort to secure Tesla’s market position for the long-term. More recently the Nasdaq-listed company was exploring plans buy land to expand its Shanghai plant and make it a global export hub. However, according to reports by Reuters, the plan is no longer going ahead.

Tesla’s factory in Shanghai was built to produce up to 500,000 vehicles every year, and is currently manufacturing the Model Y and 3. According to sources close to Reuters, Tesla is, for now, not looking to boost China production capacity significantly.

Although its sales dropped during April, Tesla made $3bn in revenue in China during the first three months of this year, amounting to 30% of its overall revenue.

Subsequently, the stock fell 3.74% to $605.50 in premarket trading on Tuesday, while shares dipped by 6.44% in Monday’s tech selloff.

PR Issues in China

Tesla is in the midst of an ongoing and significant crisis of confidence in the car maker in China, a market seen as vital for the company’s long-term growth.

In April, a lady climbed onto a Tesla at an auto show to protest against the brakes of the cars not working in her car. The protest went viral on Chinese social networks and state media.

Chinese state media issued a firm disavowal of Tesla’s handling of the women in questions compensation demands.

“The arrogant and overbearing stance the company exhibited in front of the public is repugnant and unacceptable, which could inflict serious damage on its reputation and customer base in the Chinese market,” the state-backed tabloid Global Times said in a separate opinion piece published Wednesday.

A significant portion of Tesla’s growth is coming from China, and the company’s continued success depends on this remaining so. As Elon Musk knows, if the Chinese people or government turn against Tesla, then it will face a major and immediate obstacle. Investors will do well to pay attention to Tesla’s progress in the country in an effort to maintain its meteoric success.