With prices rising sharply it is essential to safeguard the real value of your wealth

For the first time in a generation we are seeing a meaningful increase in inflation. In the UK, the consumer prices index including owner occupiers’ housing costs rose by three percent in the 12 months to the end of August, with the Bank of England forecasting that it will hit four percent by the end of the year.

This may not sound much, but every £10,000 you have invested would lose £400 of spending power unless you can keep up with the increase in prices. Unfortunately there is no risk free way to do this, but the best option would be to use investment trusts to give you exposure to real assets that should appreciate in value.

These sorts of holdings often generate inflation-linked revenues that will pass any cost increases on to their customers without it impacting the bottom line. The one caveat is that they might be negatively affected if interest rates have to rise, as the discounted present value of the future cash flows would be expected to fall.

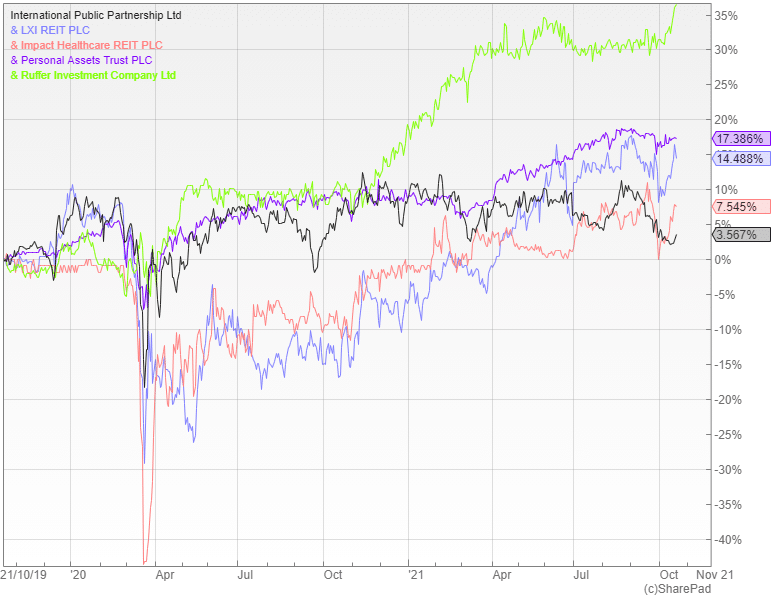

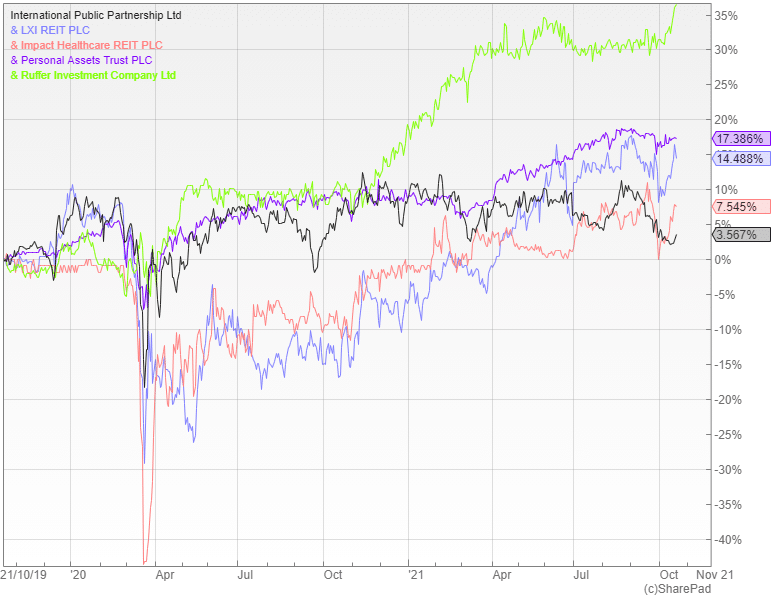

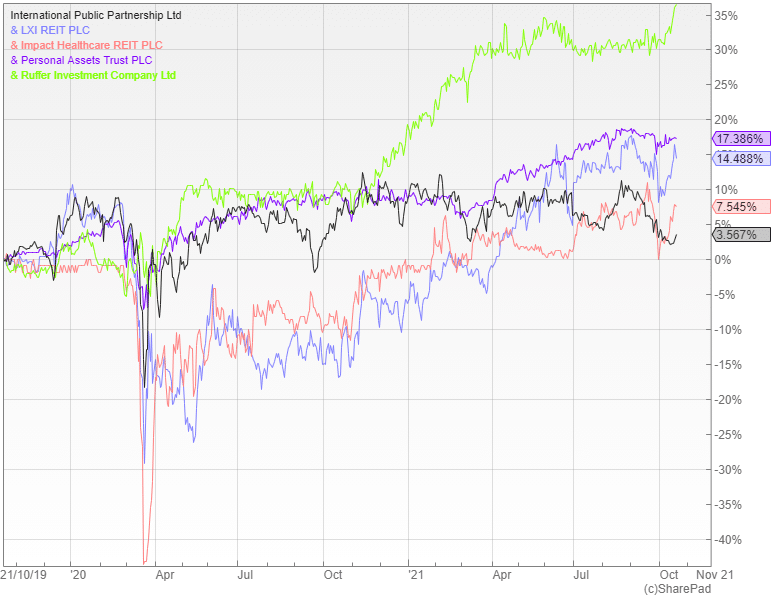

Infrastructure trusts such as International Public Partnerships (LON: INPP)are a good example. It invests in around 130 infrastructure assets, mostly in the UK, in areas such as energy transmission, transport and education.

INPP has the highest inflation linkage in the sector of 0.75%, which means that a one percent rise in inflation will produce a 0.75% increase in returns. The shares are yielding 4.6%, although they are trading on a 12% premium to NAV.

Real Estate Investment Trusts (REITs) are another option. One worth considering is the LXI REIT (LON: LXI)that holds a diversified portfolio of UK property that benefits from long-term index-linked leases with institutional-grade tenants. It is currently yielding 3.8% and trading on a nine percent premium.

Alternatively there is the Impact Healthcare REIT (LON: IHR), which owns a high-quality portfolio of UK care homes that pays an attractive yield of 5.3% and is trading on a seven percent premium. Its revenue is underpinned by the long-term, inflation-linked leases that are fully repairing and insuring with no break clauses.

The safest option would be to use one of the defensive multi-asset trusts like Personal Assets (LON: PNL)or the Ruffer Investment Company (LON: RICA). These aim to grow your investment ahead of inflation, but are based on a mentality of capital preservation.