Investors seeking robust capital growth should look no further than technology

The best performing sector of the market over the last decade is technology and there is every chance that the innovative companies that operate in this area will continue to thrive as we move towards a more automated and digital future. There are various ways to profit from this with one of the best options being the £1.4bn Allianz Technology Trust (LON: ATT), which has a buy rating from the Winterflood investment trust team.

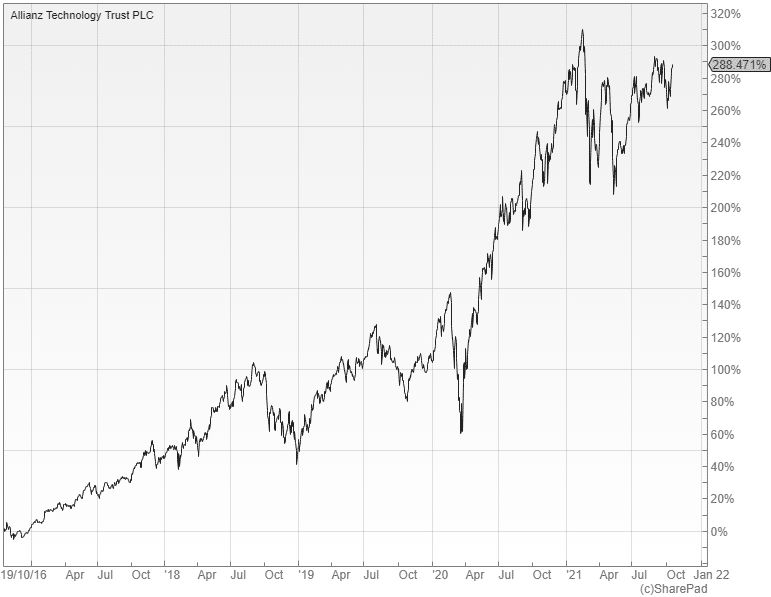

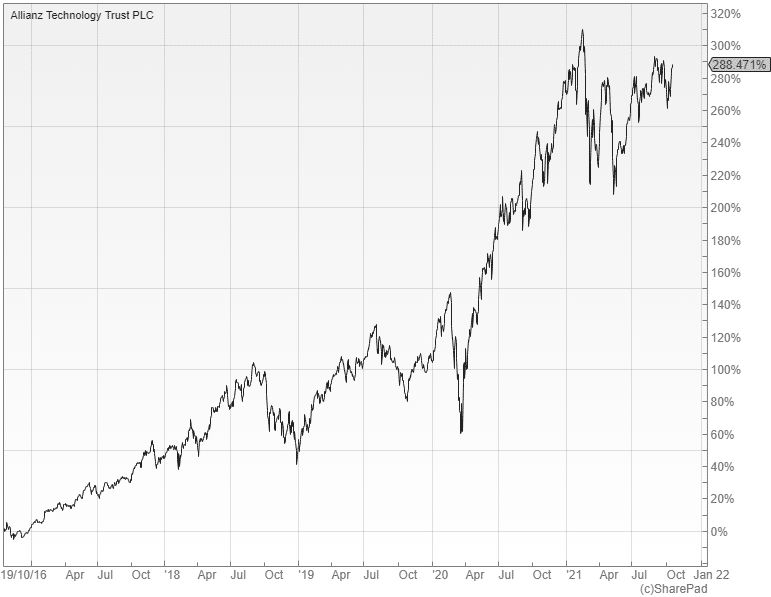

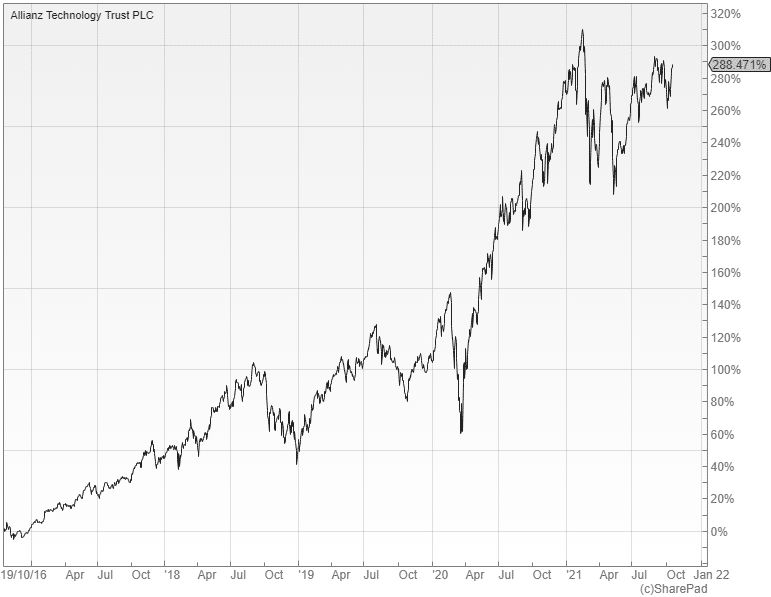

Manager Walter Price and his associates are based in Silicon Valley at the heart of the action and have ready access to the world-beating tech businesses that are located in the region. He employs an active and unconstrained approach that has enabled him to deliver a five year return of 280%, yet the shares are currently available on an eight percent discount to NAV.

Price believes that there are opportunities to create whole new sub-industries within the technology space. He aims to capitalise on this by identifying the major growth trends and then investing in attractive companies that are set to benefit.

The sort of stocks he targets are typically market leaders that can enjoy sustained earnings growth, have high quality management, strong balance sheets and barriers to entry, but are available at a reasonable valuation relative to growth rates and industry peers.

Most of these types of companies are based in the US with the trust’s largest holdings comprising well-known names like Alphabet, Microsoft, Amazon and Apple, alongside less familiar businesses such as CrowdStrike, Zscaler and Seagate Technology.

Price believes that the pandemic will spur the use of technology and change how we live and work in the future. He also points out that many businesses are struggling to find workers to meet customer demand and need technology solutions to improve the productivity of their limited workforces.

“As companies need to reduce costs and improve productivity, we expect to see accelerating demand for innovative and more productive solutions such as cloud, software-as-a-service, artificial intelligence and cyber security. We continue to believe the technology sector can provide some of the best absolute and relative return opportunities in the equity markets.”