The recent market volatility has seen several prominent FTSE 100 companies take a blow, with the Russian assault on Ukraine impacting Russian-based firms including Polymetal and Evraz in particular.

Coca-Cola, Scottish Mortgage Investments and JD Sports have been hit by supply chain disruption linked to war in Ukraine and the Covid-19 pandemic, alongside concerns that the rising cost of energy will take a sizeable chunk out of consumer spending budgets across 2022.

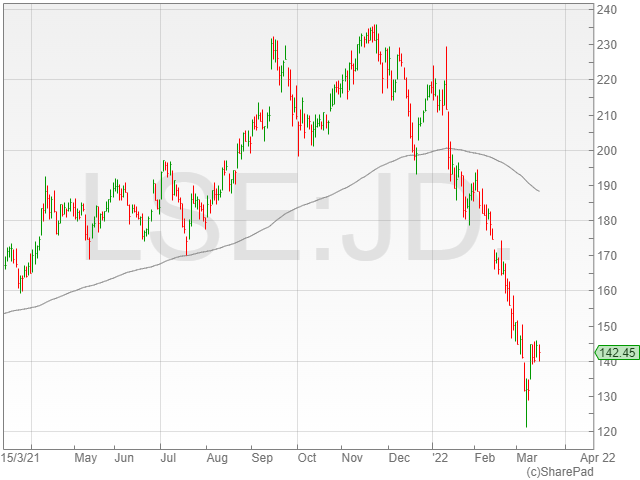

JD Sports -34%

JD Sports suffered a share price decrease of 34% since the beginning of 2022.

The increasing price of energy has seen concerns that consumers will spend less on non-essential retail purchases, as higher energy and fuel expenses eat into customer budgets.

The company was also fined £4.3 million for a violation of Competition and Markets Authority (CMA) rules, sharing confidential information in meetings concerning a merger with Footasylum in 2019 which the CMA was investigating in 2022.

The sporting goods company currently has a dividend yield of 0.2%. The retail group has a PE ratio of 22.6 and a forward PE ratio of 12.4.

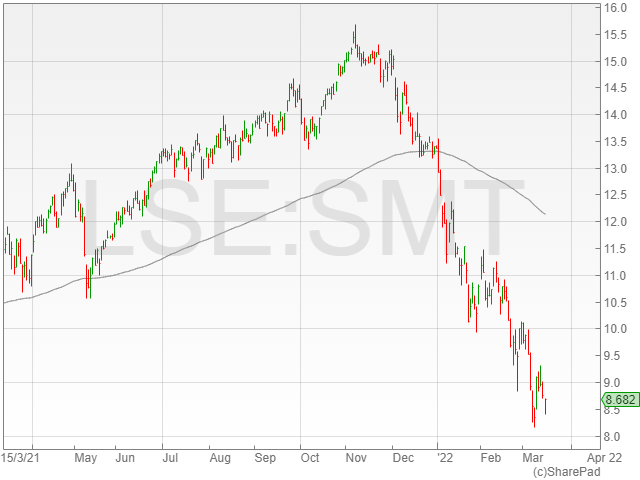

Scottish Mortgage Investment Trust -34.3%

Scottish Mortgage Investment Trust shares have a decline of 34.3% in the early stages of 2022.

The trust has its holdings split between a selection of tech stocks, including Tesla, Tencent, Nvidia and Alibaba accounting of 23.3% of its portfolio.

China’s Covid-19 lockdown of tech production hub Shenzhen, combined with concerns China will provide assistance to Russia, has dragged tech companies, and Scottish Mortgages shares with them.

With persistently his inflation, the US Fed is scheduled to increase its interest rates on a number of occasion this year which has rocked the US tech sector so far in 2022.

The Scottish Mortgage Investment Trust currently yields 0.4%.

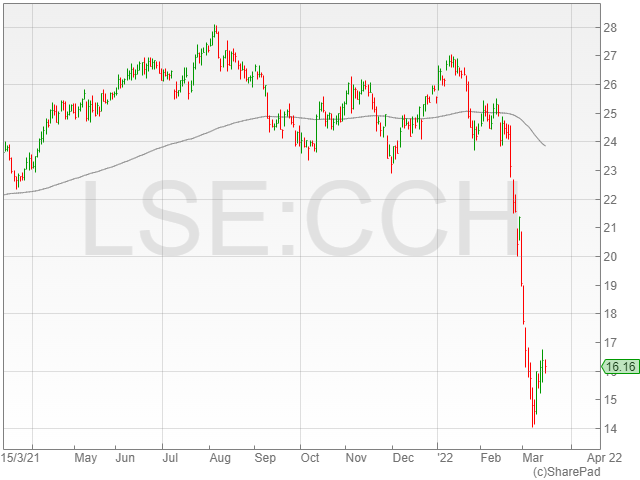

Coca-Cola HBC -37.2%

Coca-Cola HBC has seen its share price take a hit of 37.2% thus far in 2022.

The drinks producer’s stock fell after it withdrew from its Russian operations and shut down its Ukraine plant, which collectively accounted for 20% of the company’s 2021 production.

The shock to the company’s earnings outlook has caused the group’s shares to take a steep dive as investors prepare for the fallout in their next trading update.

Coca-Cola HBC yields of 3.3% which was 2.6x, as their last set of results. This will likely change if earnings are particularly heavily hit.

The FMCG giant has a current PE ratio of 12.3 and a forward PE ratio of 14.

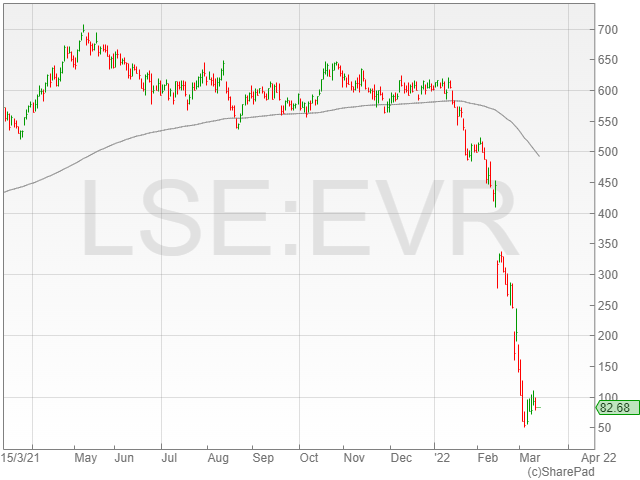

Evraz -86.3%

Evraz has been severely impacted by the Russian war on Ukraine, with its shares tanking 86.3% since the start of 2022.

The company is scheduled for removal from the FTSE 100 on 21 March, due to the extreme destruction of its stock.

The company was paying a dividend but investors shouldn’t hold their breath waiting for another pay out.

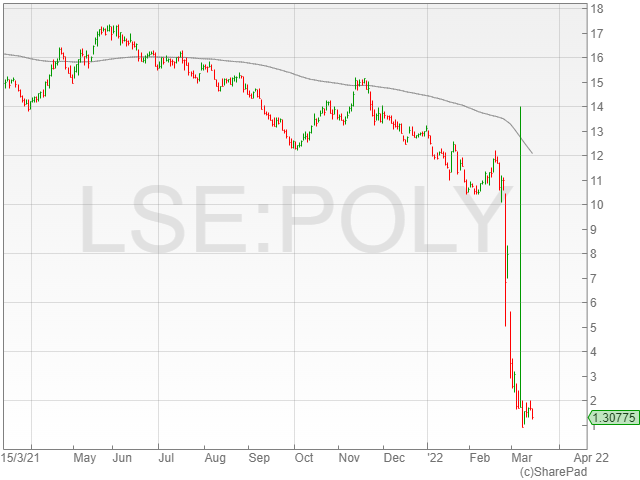

Polymetal -90.1%

Polymetal is the worst performer on the FTSE 100 so far in 2022 as the Ukrainian conflict rocked the Russia-focused Gold miner.

The precious metals mining group has experienced an extreme share price dive of 90.1% since the start of 2022.

The company is in the same boat as Evraz, and is scheduled for removal from the FTSE 100 on 21 March.