iShares UK Dividend ETF

In an era of diminished dividend pay-outs due to the COVID-19 pandemic, the iShares UK Dividend ETF (LON:IUKD) offers a diversified approach to high yielding UK companies.

With a distribution yield of 4%, this ETF provides investors with a basket of income shares with a higher yield than peer funds that track the FTSE 100 index.

For example, the iShares Core FTSE 100 ETF now yields just 3%.

iShares UK Dividend ETF achieves a higher yield than the broader benchmark by selecting the top highest yielding 50 companies from the FTSE 350, excluding investment trusts.

| IUKD TOP TEN HOLDINGS | % |

| MICRO FOCUS INTERNATIONAL PLC | 5.02 |

| AVIVA | 4.08 |

| IMPERIAL BRANDS | 3.81 |

| PERSIMMON | 3.76 |

| EVRAZ | 3.40 |

| LEGAL AND GENERAL | 3.27 |

| BRITISH AMERICAN TOBACCO | 2.81 |

| VODAFONE | 2.71 |

| VISTRY GROUP | 2.67 |

| STANDARD LIFE ABERDEEN | 2.45 |

iShares UK Dividend ETF is listed on multiple exchanges, including the London Stock Exchange, and has a Total Expense Ratio of 0.4%.

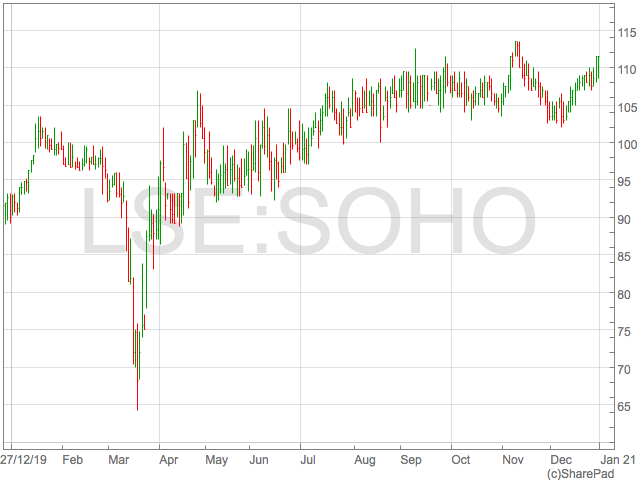

Triple Point Social Housing REIT

The Triple Point Social Housing REIT (LON:SOHO) will provide investors with the assurance their investments are making a positive impact in 2021, whilst yielding 4.7% (share price of 111p).

The Triple Point Social Housing REIT has a portfolio of specialised social housing that accommodates some of the most vulnerable people in the UK.

As of October 2020, Triple Point operated 404 properties in the UK which are specially adapted with features such as widened hallways and full wet rooms to meet the needs of their residents.

The social housing market is a very different proposition to commercial or residential property due to the government funding of rental payments.

Demonstrating the resilience of the social housing sector, Triple Points defaults rates far outperformed that of the private residential and commercial sectors through the pandemic.

In fact, when Triple Point Investment Director, Freddie Cowper-Coles, presented at the UK Investor Magazine Virtual Conference in October 2020, he highlighted the fund had collected 100% of their rents during the first half of 2020, despite COVID-19 ravaging the residential and commercial property sectors.

The trust’s resilience was reflected in a strong share price in 2020 that helped a Total Return of 25%.

The Triple Point Social Housing fund is structured as a Real Estate Investment Trust and trades on the LSE under the ticker LON:SOHO.

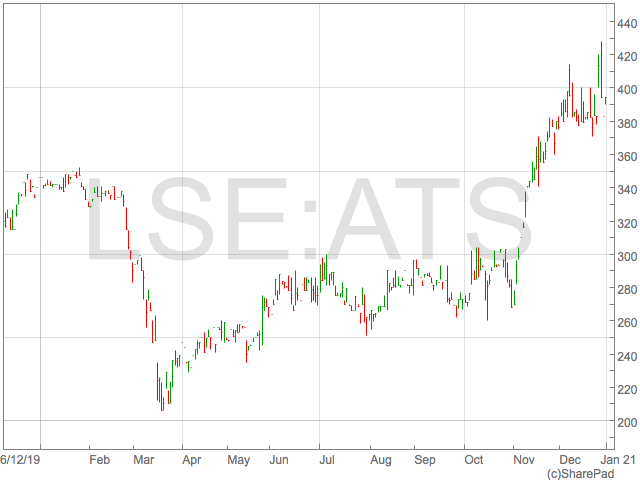

Artemis Alpha Trust

The attractiveness of the Artemis Alpha Trust (LON:ATS) stems from a portfolio highly weighted to the UK consumer with 45.5% of the portfolio allocated to consumer services, and 24.2% to consumer goods.

The UK economic recovery will likely be driven by increased consumption as the economy reopens post-COVID, and something resembling normal life resumes.

The top ten holdings are deftly balanced between those companies that have benefitted directly from the restrictions imposed by the pandemic, and those set the benefit from a broad economic reopening.

Holdings such as Just Eat Takeaway, Hornby and Plus 500 are perfect examples of companies that have harnessed and benefitted from the changes to consumer behaviour during COVID-19.

In the third quarter of 2020, Just Eat processed 151 million orders globally, up 43% from the year prior whilst model-maker Hornby enjoyed a 33% jump in first-half sales as hobbyist spent more sore time in the home. Hornby investors will look forward to second half sales results – up to 60% of revenue is typically recorded in the period encompassing the festive season.

Looking to those ripe for recovery as the UK economy reopens, easyJet and Redrow exhibit cyclical characteristics in sectors that have been heavily hit by the pandemic and now presents themselves as value propositions.

Trading at 394p, the Artemis Alpha share price has a 10.9% discount to NAV.