Tullow Oil reported the completion of its pre-emption of the Deep Water Tano component linked to the sale of Occidental Petroleum’s stake in the Jubilee and TEN fields based in Ghama to Kosmos Energy.

The company noted a cash consideration of $118 million paid on completion which was funded from cash on the balance sheet.

Tullow Oil reported that the transaction takes its equity interests to 38.9% in the Jubilee field and 54.8% in the TEN fields.

The transaction further adds c.5 thousand barrels of oil per day (tbopd) of unhedged daily production, bringing the company’s production to c.4 kbopd on an annualised basis.

Tullow Oil reported that the additional equity is set to increase the oil producer’s capital expenditure forecast by $30 million to $380 million.

The company noted an expected production of $300 million in incremental free cash flow at $75 per barrel of crude oil between 2022 and 2026.

The transaction will further increase Tullow Oil’s net 2P reserves by c.21 million barrels of oil (mmboe), amounting to a 9% gain.

“I am delighted that this important transaction has completed and I am grateful for the continued support of the Government of Ghana and, in particular, the Honourable Minister of Energy whose leadership has been paramount in getting to completion,” said Tullow Oil CEO Rahul Dhir.

“This transaction underscores our confidence in the assets and meets our objectives of value accretion and deleveraging.”

Analysts pointed out that despite the good news, Tullow Oil remained behind its competitors, who were using the current market conditions to build infrastructure in green energy.

“With its finances largely under control, Tullow’s finally able to make some strategic moves,” said Hargreaves Lansdown equity analyst Laura Hoy.

“Hopefully this is the first of many. But the fact remains that Tullow is behind the curve compared to peers, who are using current conditions to shore up clean energy operations.”

“Tullow risks being stuck clawing its way back to profitability while the rest of the industry marches ahead.”

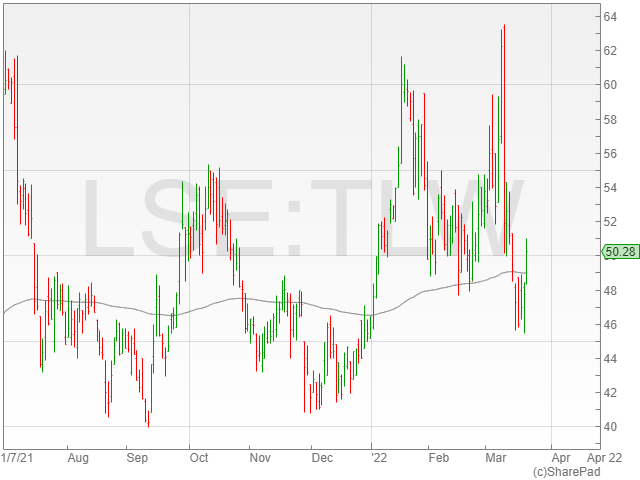

Tullow Oil’s share price increased 5.3% to 50.2p in late morning trading on Monday following the news.