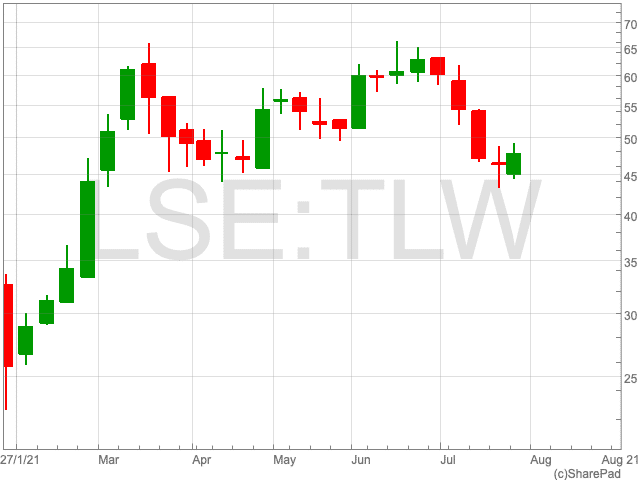

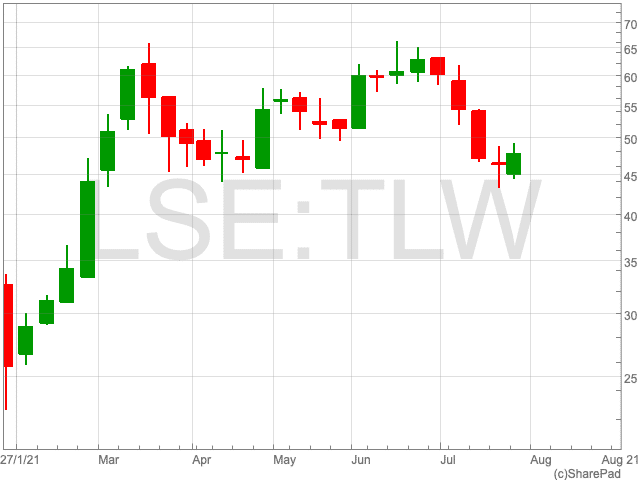

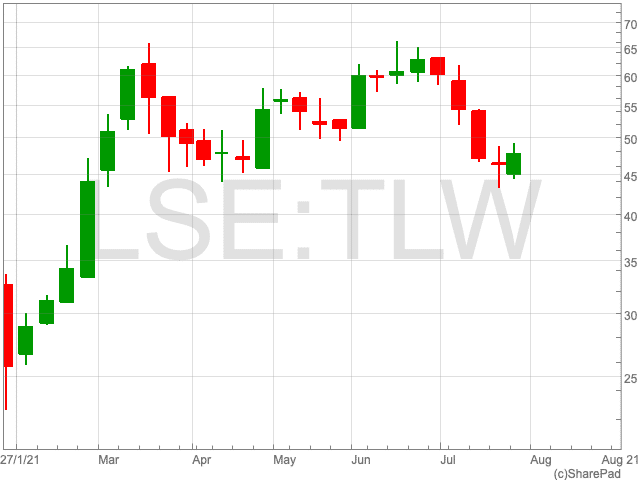

Tullow Oil Share Price

Tullow Oil (LON:TLW) enjoyed a strong start to 2021, as demand picked up and OPEC+ kept its hand firmly on the supply of oil. However, the last month has seen a downturn in the Tullow Oil share price, falling by 20.8%.

While the fate of oil over the remainder of the year remains uncertain, Tullow is facing its own issues. Investors will be keeping an eye on both factors to see the direction of travel of the Tullow Oil share price in the coming months.

Trading Update

Tullow Oil has struggled with its production levels at points throughout the year, although its gross production just about surpassed expectations in Ghana, according to a trading update this month.

Tullow’s production came in at 61,200 barrels of oil per day (bopd) in H1 of 2021, however its full year guidance was revised down by 6,000 bopd to 55,000.

From the Jubilee assets production averaged 70,600 bopd gross (25,100 bopd net), while the TEN fields yielded 37,000 bopd (17,400 bopd net).

“Our producing fields in West Africa are performing well and we have successfully started our drilling programme in Ghana,” said chief executive Rahul Dhir.

In addition, the FTSE 250 company completed a debt refinancing and the divestment of assets in Equatorial Guinea and Gabon.

“The successful debt refinancing is a crucial milestone which gives Tullow a chance to regroup. Multiple asset sales have given a much needed boost to cashflows too, and together with cost cutting means the balance sheet’s in much better condition,” said Sophie Lund-Yates, Equity Analyst at Hargreaves Lansdown.

Tullow is waiting patiently for the go ahead for the Lake Albert project in Uganda, after which it will receive $75m from French oil giant Total.

Oil

The other question for the Tullow Oil share price is what happens next to the price of oil.

As demand appeared as though it was going to outpace supply through 2021, Morgan Stanley predicted that global benchmark Brent will trade between $75 and $80 per barrel for the remainder of 2021.

“In the end, the global GDP (gross domestic product) recovery will likely remain on track, inventory data continues to be encouraging, our balances show tightness in H2 and we expect OPEC to remain cohesive,” Morgan Stanley said.

However, Barclays is expecting a quicker return in the supply of oil to pre-pandemic levels, forecasting oil for 2021 at $69 per barrel.

There are a multitude at factors at play, making it very difficult to know what the trajectory of the oil price will be for the remainder of the year. But for those with a vested interest in the Tullow Oil share price, it will certainly be of high importance.