The £1.7bn Murray International (LON: MYI) is a global investment trust that aims to achieve an above average dividend yield, with long-term growth in dividends and capital ahead of inflation. It is currently yielding an attractive five percent with the shares available on a wider than normal discount to NAV of seven percent.

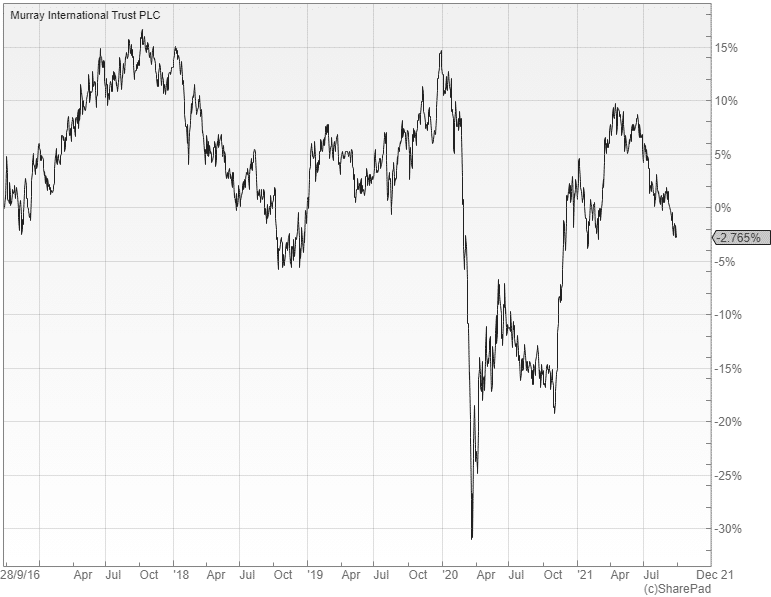

Manager Bruce Stout has been in place since June 2004 and has achieved 16 consecutive years of dividend growth. He has delivered decent overall returns since his appointment, although the relative performance has been disappointing in recent years because of the portfolio’s tilt towards dividend-paying stocks in emerging markets that have been out-of-favour with investors.

Murray International has the highest yield in its Global Equity Income peer group and has substantial revenue reserves that should enable it to continue to increase the dividend in future years. The Board is committed to limiting the discount through the use of share buybacks, so there is real scope for the rating to recover, especially if revenue returns from Asia improve in the coming months.

At £164m, Middlefield Canadian Income (LON: MCT) is a lot smaller, but it is paying a similarly attractive yield of 4.8% with the shares available on a wide 16% discount to NAV. It aims to provide investors with a high level of income, as well as capital growth over the longer-term, from a portfolio of US and Canadian dividend-paying stocks.

Since its inception in July 2006 the fund has generated a NAV total return of 200%, which is well ahead of the increase in the benchmark of 158.7%. Canadian companies currently trade at a discount to their US peers, hence the reason the manager has reduced his US weighting to just eight percent of the portfolio.

The largest sector exposures are financials and real estate that account for a massive 60% of the assets. If inflation takes hold and interest rates are kept low, as looks likely, the fund could do extremely well with the broker Investec having a buy recommendation on it.