The UK’s High Court has ruled against the Venezuelan government in a legal battle over access to $1 billion worth of gold currently held by the Bank of England.

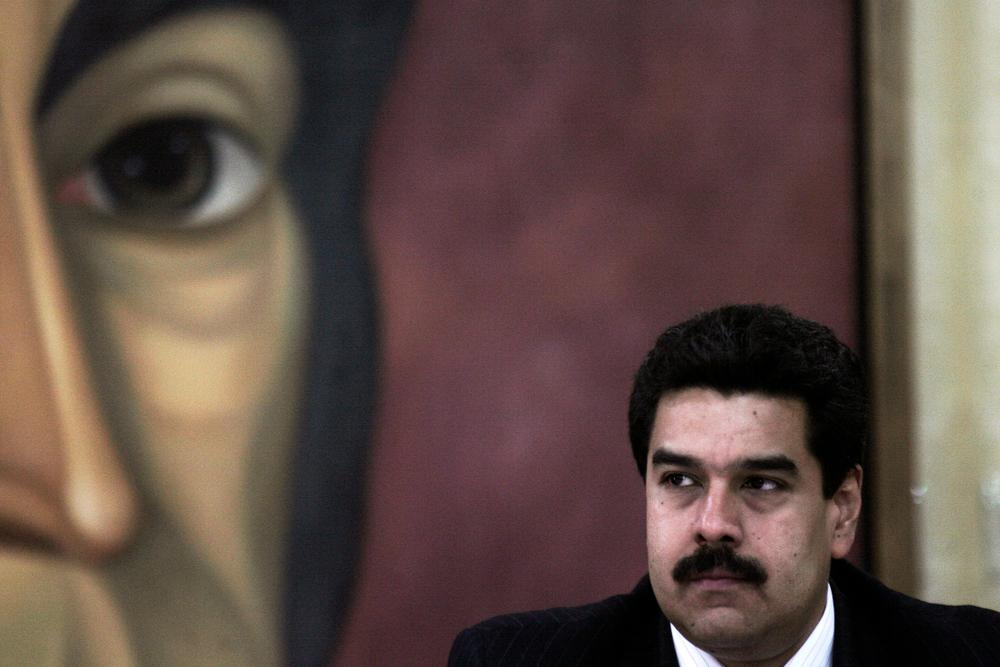

Incumbent president Nicolás Maduro launched legal action against the Bank when it refused to hand over the gold, following opposition leader Juan Guaidó’s warning that it would be used for “corrupt purposes”. The Bank has been postponing the transfer of 31 tonnes of gold since 2018.

In a painful blow to Maduro’s struggling administration, the court “unequivocally recognised opposition leader Juan Guaidó as president”, in a reference to claims of illegitimacy during the country’s controversial 2018 presidential election.

The Venezuelan government has been internationally condemned, with accusations of banning opposition parties from participating in the vote and placing prospective leaders under house arrest. The USA and the European Union are among the critics of the 2018 election results, refusing to recognise Maduro as the legitimate winner in the polls.

Last year, Maduro publicly defended his administration’s legitimacy after the opposition-backed National Assembly called for the military to “restore democracy” in the oil-rich South American state. In a widely-shared tweet, the president declared: “To those who hope to break our will, make no mistake. Venezuela will be respected!”.

Crippling sanctions posed by the US have left Maduro with little room to manoeuvre as the poverty-stricken state battles the coronavirus pandemic. Selling its gold reserves might have generated a much needed cash boost for its struggling health service, currently battling over 6,000 virus cases.

Earlier this month, The New Humanitarian warned that Venezuela’s reported cases may only make up a percentage of the total number across the country, citing historic data appropriation and an ongoing humanitarian crisis.