The doomed mini-budget raised fears of a UK housing market crash as mortgage rates soared and many products were removed from the market.

This proved to be knee-jerk reaction and mortgage rates have since fallen and interest in UK housing has not completely dried up.

“Buyers have fled the horrors of the housing market in their droves since the mini-budget, thanks to alarming interest rates and predictions that property prices are set to plunge. But this doesn’t necessarily mean sellers are safe to sell up and sit it out in the hope of a cut price deal next year either,” said Sarah Coles, senior personal finance analyst, Hargreaves Lansdown.

Housing transactions were down sharply in September year-on-year, but this was largely down to a spike in activity in September 2021 due to the end of Stamp Duty holidays.

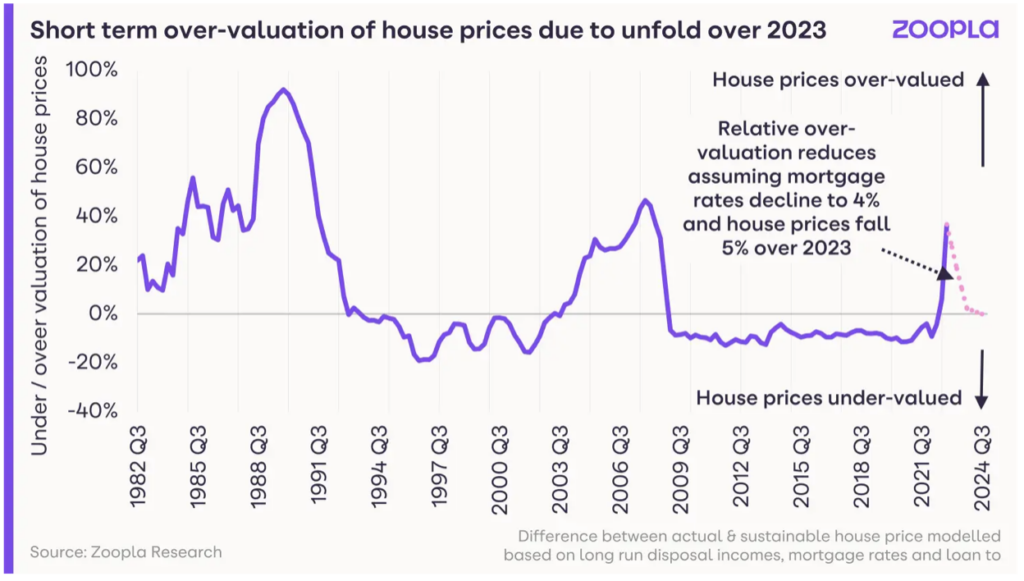

Zoopla housing prediction

The dynamics of the current housing market saw both Lloyds and NatWest forecast declines in UK housing prices for 2023 as part of their quarterly earnings reports last week.

Zoopla joined them today in forecasting downside in UK average house prices – but only a minor 4-5% correction. Zoopla argued mortgage rates were already starting to fall, meaning the drop in housing prices may not be as drastic as first thought.

However, this carried a warning a return to 6% mortgages would once more send waves through the housing market.

“Sustained 6% mortgage rates would lead to double digit price falls. If mortgage rates fall back in the next quarter, the outlook for 2023 will be very different,” said Richard Donnell, Research Director at Zoopla.