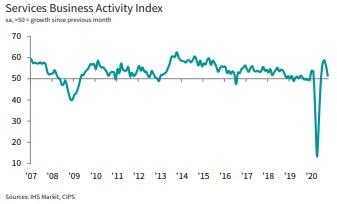

IHS Markit‘s PMI data illustrated that business activity in the service sector had demonstrated a ‘much weaker rise’ in October, with the rate of expansion at its slowest rate for four months.

The research group also noted that the rate of new work fell for the first time since June, while hospitality, transport and leisure sectors ‘widely commented’ on the adverse impact from tightening restrictions on trade due to the COVID pandemic.

Adjusted for seasonal influences, the IHS UK service sector PMI in October stood at 51.4. Still growing – with 50 being the cut-off for growth and loss – October’s level was a notable drop from 56.1 in September, and below the 52.3 October flash PMI reading.

Between a recovery in business operations and consumer activity, all probable causes of the summer spike pointed to the move out of national lockdown after the second quarter, and the policies designed to reinvigorate demand.

Between a recovery in business operations and consumer activity, all probable causes of the summer spike pointed to the move out of national lockdown after the second quarter, and the policies designed to reinvigorate demand.

It is also worth noting that overall service sector PMI data masks the worst-hit businesses, namely hoteliers, restaurants and broader catering industries. Of these latter categories, survey respondents ‘overwhelmingly attributed’ lower business activity to COVID restrictions being put in place in October, with the subsequent fall in demand for hospitality and leisure services set to intensify during November’s national lockdown.

Commenting on the Group’s data, Tim Moore, Economics Director at IHS Markit, said:

“October data indicates that the UK service sector was close to stalling even before the announcement of lockdown 2 in England, with tighter restrictions on hospitality, travel and leisure leading to a slump in demand for consumer-facing businesses. This was only partly offset by sustained expansion in areas related to digital services, business-to-business sales and housing market transactions.”

“The service sector as a whole recorded its slowest output

growth since June, while new orders declined for the first

time in four months. A lack of forward bookings in parts of

the economy most affected by lockdown measures led to

widespread reports of redundancies and another sharp fall

in total employment numbers during October.”

“November’s lockdown in England and a worsening COVID-19 situation across the rest of Europe means that the UK economy seems on course for a double-dip recession this winter and a far more challenging path to recovery in 2021.”