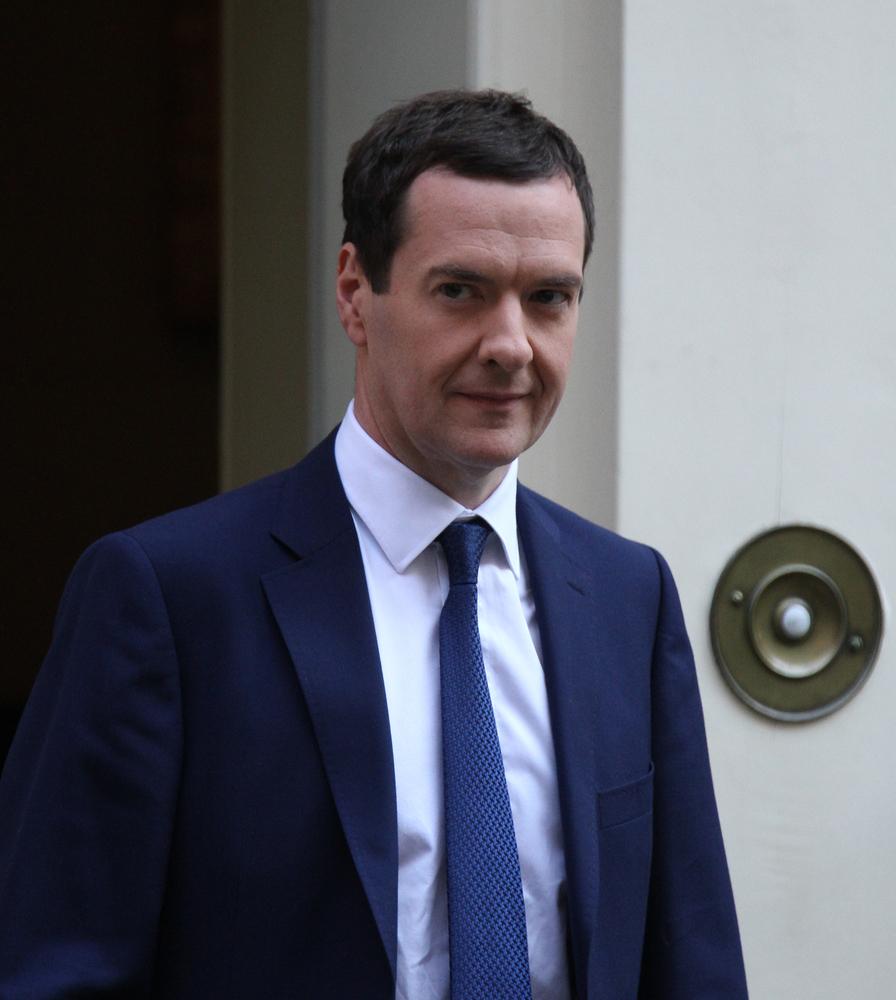

The Chancellor of the Exchequer is set to release 2016’s budget at 12.30pm on Wednesday 16th March, which will set out the governments future plans for the economy based the latest forecasts from the Office for Budget Responsibility.

Osborne has previously hinted at possible outcomes of Wednesday’s budget, including promises to raise the personal allowance and introduce a new help-to-save-scheme. Along with this, the Chancellor of the Exchequer has also hinted towards some nastier surprises after saying there was a need to “act now to make sure we don’t pay later”.

What is currently certain is the deterioration in public finances that will undoubtedly force the Treasury to make £4bn of savings by the end of the current parliament, something that Osborne has claimed to be “not a huge amount in the scheme of things”, a statement many Britons are likely to disagree with.

Some of these reforms and cuts have already been announced by the government, which hugely affect the disability benefits – something that has been resisted by the Labour party and many disability charities. Labour has calculated that these reforms will result in 200,000 people losing the benefit all together and a further 40,000 receiving less money.

What else are we likely to expect?

Pensions

In attempts to keep peace among backbench MPs, Osborne has already scrapped a package of pension reforms that would have reduced tax relief for higher earners however still hopes to makes some changes to pensions, with suspicions that he could end employers’ exemption from paying National Insurance on pension contributions, which costs the Treasury an estimated £13.8 billion a year.

Petrol Prices

The Chancellor is expected to increase fuel duty, despite backbenchers urging him against the move. This prediction is following figures in last year’s Treasury documents, which suggest that fuel duty is expected to continue to keep rising until 2010. Osborne also has not mentioned a fuel duty freeze, a topic he usually covers in his Autumn statement. The rise of fuel duty would inevitably lead to a backlash, with Richard Burnett, the chief executive of the Road Haulage Association, saying he would be “unbelievably disappointed” arguing it would amount to £450 or more per truck per year.

Corporate Tax Avoidance

In attempts to recover his reputation, Osborne is likely to announce new measures to crack down of corporate tax avoidance. He is expected to cut tax relief for large corporations who shift debt to the UK to take advantage of HMRC’s generous tax credits system.

What can be safely predicted it that there will not be any changes that prove to be too controversial, so as not not distract from the government’s main focus at the moment, the EU referendum, set to be held on the 23rd June 2016.

Safiya Bashir - 15/03/2016