Lloyds share price (LON:LLOY) took a hit during 2020, but despite making a recovery, investors could be tempted to look elsewhere in the coming months.

Lloyds Earnings

The bank announced in February that its pre-tax profit fell by over 72% to £1.2bn, while loan losses totalled £4.2bn during 2020. Lloyds’ profit could be further impacted if low interest rates remain, narrowing the difference between the rate the bank offers borrowers and savers.

Lloyds has a price-to-earnings ratio of 25.8. While it could be a signal of the market’s expectations of higher earnings going forward, it does make the Lloyds share price seem expensive. The bank’s price-to-NAV ratio is currently 0.6. With Lloyds trading below a Price-to-NAV of one, it suggests the market doesn’t have a high degree of confidence in the current health of banking assets such as loans and mortgages.

Lloyds Share Price

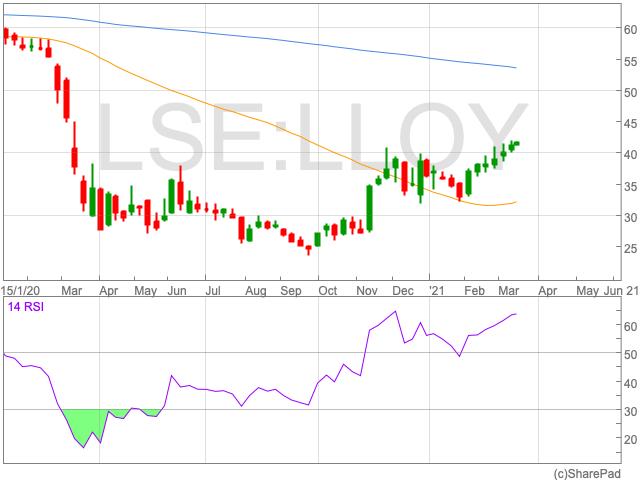

Since February the Lloyds share price moved from below 35p per share to above 40p per share. It also moved away from its 50-day moving average, as the 200-day moving average continues to trend to the downside. Over time the moving averages are expected to converge as the 50-day moving average acts as a magnet for the Lloyds share price. This means Lloyds shares could retrace over the coming months.

Lloyds RSI, as seen below, was knocking on 70 at the end of 2020 and again during March. This suggests that Lloyds shares are overbought which could mean a sell-off in the near future. From March through to April, Lloyds’ RSI was below 30, meaning its shares were underbought. The bank’s share price has risen since then.

Lloyds Dividends

Lloyds confirmed a final dividend for 2020 of 0.57p after shareholder payouts were cancelled in 2019. The dividend is well down on 2018 and 2017 when it was 2.14p and 2.05p respectively. In comparison, Natwest confirmed in February that it paid its shareholders 3p per share.

These dividends are a long way off the yields investors had become accustomed to prior to the pandemic. Due to ongoing guidance from regulators, payments to investors may remain tepid in the short-term. The bank’s dividend is historically a big pull factor for investors. At the current rate they could be tempted to look elsewhere.