A new report by the London Central Portfolio (LCP) reflecting on lettings trends across 2020 has revealed that almost 50% of new tenants in prime London properties were from the European Union.

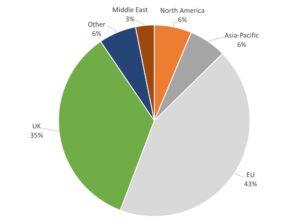

New tenants in 2020 by region (%)

The LCP’s data outlined the home regions of new tenants letting London properties in 2020. Travel restrictions during the pandemic resulted in a smaller proportion of tenants arriving from the Middle East and Asia-Pacific, leaving the EU to represent the largest share of new tenancies. The high proportion of UK tenants highlights the increasing affordability of prime London rents and a desire to live in Central London.

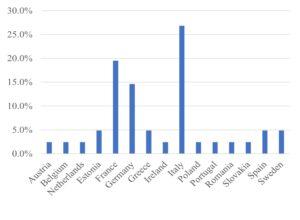

New tenancies by country in EU 27 (%)

The data was also used to collate new tenancies in 2020 by their home country from the EU 27 nations. Italian and French nationals represented the largest proportion of new EU tenancies in LCP’s portfolio for the year – at 26.8% and 19.5% respectively. Despite the disruption from both Brexit and the pandemic, the appetite to live in London appears to be as strong as ever, as the city continues to flaunt its credentials as an employment and cultural hub.

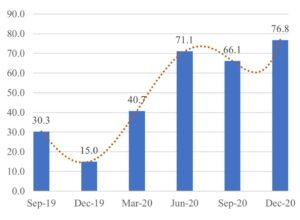

Average vacant period between tenancies (days)

The average vacant period between tenancies in 2020 was varied across the year, reaching a peak of 76.8 days on average in the final month of the year. Stock that was not let out in the “traditionally buoyant” period in September due to the impact of the pandemic remained available in the winter months, increasing vacancy periods in Q4. Longer vacancy periods could also be reflective of increased hygiene efforts on the part of landlords who were advised to deep clean their properties weekly and in between tenants, extending vacancies so that there was enough time to ensure properties were adequately disinfected.

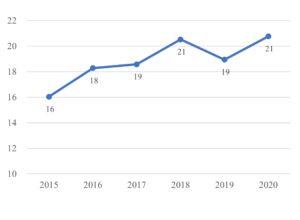

Average length of tenancy (months)

The average length of tenancies increased across 2020 as tenants were less inclined to move during the pandemic. During the spring lockdown, the UK government advised people not to move house, citing the increased risk of spreading Covid-19 as they travel. Average tenancy length also remained “sticky” in 2020 due to the “high quality of LCP’s rental properties and refurbishments encouraging tenants to stay put”.

Profile of new tenants, 2020 vs 2019

New tenants in 2020 were overwhelmingly younger people, between the ages of 18 to 29, with 90% of total tenants all under the age of 40. The data confirms the continuing trend of young adults heading to the capital for employment opportunities, but perhaps also reflects the growth in older adults and families opting to move away from city centres to minimise infection risk during the pandemic.

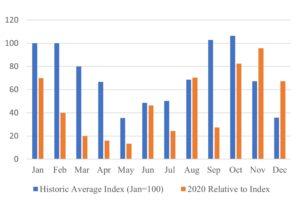

New tenancies, historic vs 2020

The spring of 2020 saw fewer new tenancies than the historical average due to the impact of the pandemic, although there was a brief recovery once the property market reopened in early summer. This was then followed by a slower September due to the fall in overseas students.

Andrew Weir, CEO of LCP, commented on the 2020 market trends:

“Notwithstanding the pressures of a global pandemic and Brexit negotiations, London remained attractive to EU nationals who made up 43% of new tenancies. Italy and France led the way representing 46.3% of these tenancies. Happy to capitalise on the lack of overseas demand, a large proportion of UK tenants (35%) moved to prime London attracted by widely advertised rent reductions, as landlords competed within a depleted pool of tenants.

“The impact of travel restrictions, on a market predominantly reliant on overseas students and young professionals, has been reduced demand, surplus of stock and longer void periods. Existing tenants have stayed in situ where the property is of a high standard and diligently managed. They have broadly been comfortable with paying passing rents during a time when new tenants have been able to negotiate significant discounts. This highlights the importance of tenant retention during periods of increased competition where prime London in 2020 was labelled as a renter’s market. The strength of covenant for those tenants within LCP’s managed portfolio has resulted in zero defaults in 2020.

“Looking to the future, landlords and buy-to-let investors should take reassurance that once the vaccine has rolled out and travel restrictions are lifted, London will again experience an influx of overseas tenants waiting in the wings to continue their metropolitan life that they have missed over the last year”.