RBS reported its first full year profit for ten years on Friday as a sharp decrease in operating costs produced an attributable profit of £752 million.

RBS, still 71% owned by the tax-payer, also improved its capital position with CET1 rising 15.9%, although investors may have to wait some time for a resumption of dividend payments.

The UK banking group also announced significant investment into digital and innovation in the coming years.

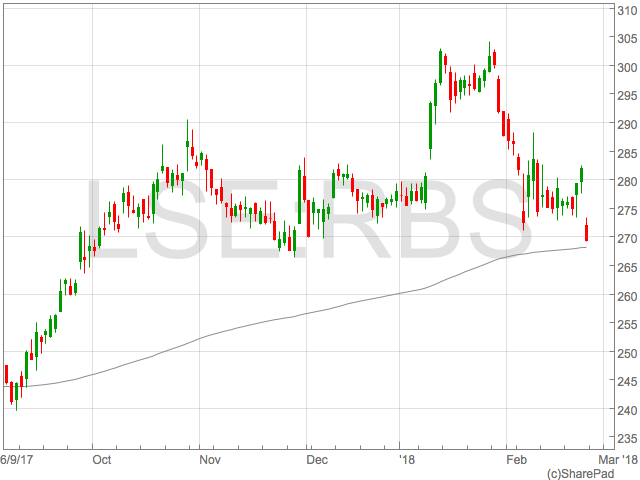

Despite posting their first profit for ten years, shares in RBS fell in early trade as upcoming litigation charges from the Department of Justice overshadowed any profits. RBS still has to settle for a mortgage-securities scandal and is unable to pay any dividends until it is resolved.

Chief executive Roos McEwan said of the results:

Chief executive Roos McEwan said of the results:

“In 2017 we continued to make good progress in building a simpler, safer and more customer focused bank. I am pleased to report to shareholders that the bank made an operating profit before tax of £2,239 million in 2017, and for the first time in ten years we have delivered a bottom Iine profit of £752 million.

We have achieved profitability through delivering on the strategic plan that was set out in 2014. The first part of this plan was focused on building financial strength by reducing risk and building a more sustainable cost base. So far, we have reduced our risk-weighted assets by £228 billion and today can report a Common Equity Tier 1 ratio of 15.9% up from 8.6% in 2013. Our financial strength is now much clearer. Over the same period we have reduced operating costs by £3.9 billion. We still have more to do on cost reduction, however this reflects the progress we have made in making the bank more efficient”