Online travel agent (OTA) Hostelworld is focused on helping travellers book hostel accommodation. Hostelworld’s saw bookings increase by 6% in 2017 with this driven by a strong performance in the first half of the year.

The backdrop in prior years has been mixed with bookings down 1% in 2016 and up by 1% in 2015. Europe makes up half of Hostelworld’s bookings and in 2016 was impacted by a number of terrorist events.

Travel is still a growth area and hostel accommodation offers a uniquely social travel experience. Modern hostels typically include communal lounges and bars while some even feature outdoor swimming pools.

The modern, social hostel experience: some even have pools

Another attraction of hostel accommodation is that room sharing makes it relatively cheap. Sector bed capacity increased 3% in the 12 months to 30 June 2017 and a number of large hospitality groups are investing in hostel expansion.

Against this backdrop the future appears to be bright for online travel agent Hostelworld. The company makes hostel booking relatively easy but does charge an additional fee versus booking directly with a hostel.

Hostelworld’s business model: as easy as 1, 2, 3

Hostelworld is, however, a relative minnow in the online travel agent (OTA) with a market value of circa £400m. The US group Booking Holdings has a market value of £75bn and has a range of heavily marketed brands.

A key issue for Hostelworld investors, therefore, is whether it can successfully defend its niche. New features to improve loyalty include an online Hostel Noticeboard (launched December 2016) and a language translation service.

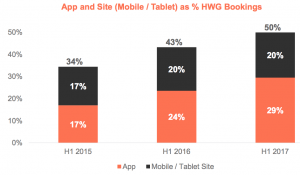

Hostelworld’s mobile application (app) was used in 29% of bookings in the first half of 2017. This compares to only 17% in the first half of 2015 and suggests that customer loyalty is improving.

Hostelworld’s customers go mobile

If Hostelworld continues to grow in popularity then profitability should also improve. This is because bookings from paid channels, such as search engines, will decline as more users go directly to Hostelworld.

Marketing investment as a percentage of revenue was 50% in the first half of 2015 but had fallen to 41% in the first half of 2017. This trend has a significant impact on the bottom line with marketing the largest single cost for Hostelworld.

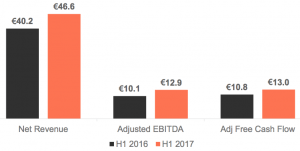

Looking at the numbers and in the first half of 2017 the group generated €46.6m net revenue and adjusted EBITDA came in at €12.9m. This compares to net revenue of €40.2m the first half of 2016 and adjusted EBITDA of €10.1m.

Hostelworld in the first half of fiscal 2017

Hostelworld will report results for 2017 on 10 April and may announce a special dividend. The forecast dividend yield for 2017 is 3.4% (excluding special dividends) and cash on the balance sheet was €17.7m at mid-2017.

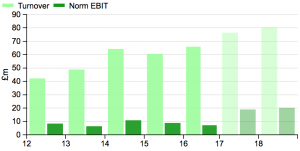

The consensus forecast P/E for 2018 is now 21.7X with share price appreciation having increased the multiple. Investors have brushed aside issues that hit trading in 2016 and the weak momentum seen in the second half of 2017.

Hostelworld’s financial backdrop: growth is expected to continue

If Hostelworld can defend its niche then it is well placed to benefit from long-term growth in the travel sector. The increase in mobile application (app) usage suggests that the company has a reasonable chance of seeing off competitors.

Risks include the possibility that a larger rival will develop a branded hostel booking service. Travellers could also increasingly book hostels directly, to save money, or move to alternative booking platforms such as Booking.com.

Disclosure: The writer holds shares in Hostelworld.