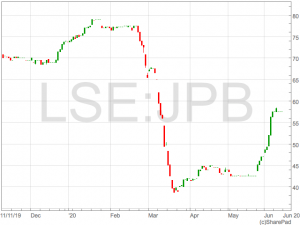

JP Morgan Brazil Investment Trust stands out as a recovery play to the global coronavirus recession with exposure to Brazil’s domestic market, and companies operating on the global stage.

Brazil has recorded the second highest number of coronavirus cases globally, as well as the third highest number of deaths.

Sadly, as with many other countries, the true number is likely to be a lot higher.

The government of Brazil was one of the administrations that failed to act quickly with lockdown measures as the Brazilian president pointed to the possible deaths associated with economic deteriorated as a result of coronavirus economic shutdown.

“Are people dying? Oh, yeah. And I feel for them. I feel for them. But there will be more people dying, many many more, if the economy is destroyed by these lockdown measures imposed by governors,” said Brazil’s President Jair Bolsonaro.

The Presidents decision to prioritise the economy over coronavirus was met with condemnation and the ratings agency Fitch still predicts the economy will fall 6% in 2020.

However a 6% drop is still significantly better than the 11.5% drop the OECD predicts the UK will shrink in 2020. Brazil has roughly the same number of deaths recorded from coronavirus as the UK.

The Brazilian economy has also been dogged by the disappointment over the failure of the government to deliver on promises of economic growth, despite massive spending and borrowing.

The Brazilian government is proving incredibly unpopular with prior failings and approach to tackling COVID-19, and investors have made there feelings heard.

Despite these hurdles, over time, the virus will be brought under control, and the government will either be replaced or push on with its pro economy agenda.

It would actually be hard for sentiment around Brazil to get much worse.

Coronavirus has caused disruption to Brazils financial assets, but the underlying demographics and natural resources of Brazil remain.

With this in mind, any further weakness in JP Morgan Brazil Investment Trust could provide an attractive opportunity with a long term view that the situation in Brazil improves.

The trust is highly cyclical in it’s composition with the top ten holdings dominated by natural resources, financials and industrials.

Diversified miner Vale accounts for 10% of the trust and is poised to benefit from a global economic recovery and higher demand for commodities.

In addition, the financials will facilitate the economic recovery as well as being beneficiaries of it.

The trust trades at a significant 17% discount to NAV which represents negative sentiment to Brazil in the market and offers the opportunity for appreciation in the price as sentiment approves.