Likely to be a crucial day of results and potentially influential on global equities, the Australian, European, and Asian economies posted their manufacturing PMI data on Thursday, and September’s results displayed various degrees of success across some of Asia fastest-growing economies

India manufacturing moves up a gear

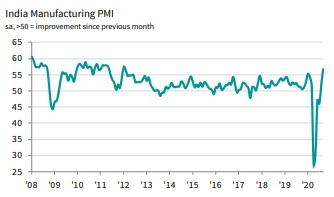

Continuing the boom it began in August, India’s manufacturing sector enjoyed an orders and production renaissance, pushing its PMI to its highest mark since January 2012.

With renewed expansions in export sales and input stocks, and improved business confidence, output rose for the first time in six months, reflecting an uptick in input costs.

IHS Markit (NYSE:INFO) stated that India’s PMI increased from an already-positive levl of 52.0 in August, to 56.8 in September, signalling not just back-to-back growth but its highest reading for more than eight-and-a-half years.

With reports of loosened Covid restrictions and recovery in demand, Indian manufacturers lifted output by around 30 points in a matter of months – the third quickest recovery in the history of IHS’ surveys.

Speaking on the data, IHS Markit Economics Associate Director, Pollyanna De Lima, added:

“Exports also bounced back, following six successive months of contraction, while inputs were purchased at a sharper rate and business confidence strengthened.”

“One area that lagged behind, however, was employment. Some companies reported difficulties in hiring workers, while others suggested that staff numbers had been kept to a minimum amid efforts to observe social distancing guidelines.”

Vietnam PMI bounces back to green

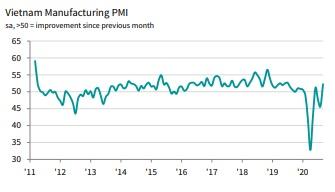

On a more modest but similar trajectory is Vietnam, whose manufacturing PMI returned to growth in September as Covid concerns somewhat eased. With this, output and new orders regained their footing, while business confidence grew and the rate of job cuts slowed down.

This saw the manufacturing PMI of Asia’s fifth-fastest-growing economy recover from the negative level (sub-50) of 45.7 points in August, and back into the green, at 52.2 points for September.

This latest reading marks the first upturn in business conditions for three months, and the most notable improvement since July 2019, according to IHS.

Anecdotal evidence also suggests that control over the pandemic has been a key factor in supporting a recovery in operating conditions, as increasing case numbers had been seen in the previous survey period.

With the recent reduction in cases, client demand increased, leading to a ‘solid’ increase in new orders. Alongside this growth, production expansion was also registered, along with new business from abroad increasing for the first time since January.

Speaking on the positive impact of controlling the virus, IHS Economics Director, Andrew Harker, commented:

“After a rise in COVID-19 cases in late-July and early August briefly threw the sector’s recovery off track in August, the September PMI results were much more positive.”

“With control of the pandemic regained, firms saw an influx of new orders, ramped up production and were at their most optimistic for over a year. As ever though, sustaining these positive trends is dependent on virus cases not picking up again.”

Philippines regains stability

On a more tentative note, Filipino data indicated that operating conditions for manufacturers had returned to something broadly resembling stability.

While at a marginal pace, new orders rose for the first time since February – led by improving customer demand as more part s of the country’s economy reopened due to the easing of Covid restrictions. Similarly, business sentiment improved to its highest point since February, with upbeat forecasts attributed to hopes of rising demand and Covid becoming a thing of the past in the not-too-distant future.

Meanwhile, output fell to its weakest level in three months, though this, also, was only a marginal change. However, unemployment continues to expand at a notable rate, which manufacturers often link to non-replacement of voluntary leavers and sufficient capacity. Further, cost burdens rose as shortages led to higher prices, and respondents only partially passing on higher costs to clients, due to market pressures forcing them to keep prices competitive.

Following a downturn, with 47.3 points in August, September saw a very slight return to positivity, with Philippines manufacturing PMI rising to 50.1. This latest reading represents extremely modest expansion, and its the highest since conditions were last stable in the goods producing sector, back in February.

Talking on potential improvements in operating conditions, IHS Economist, Shreeya Patel, commented:

“According to firms, the ongoing restrictions related to the COVID-19 pandemic continued to limit the performance of the sector, with some businesses forced to pare back operations.”

“On a more hopeful note, stronger business sentiment and efforts to rebuild stocks suggest panellists are preparing for an improvement in demand over the coming months, although optimism continues to rest on the development of the pandemic.”

Myanmar hampered by a surge in Covid cases

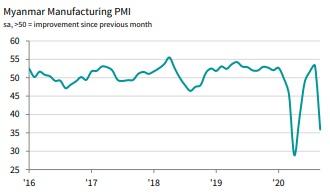

Unfortunately unable to gain traction away from Covid was Asia’s sixth-fastest-growing economy, Myanmar, whose manufacturing PMI suffered as performance indicators were scuppered by a resurgence in new cases.

With factories temporarily closing to combat the spread of the virus in September, both output and new orders ‘declined rapidly’ according to IHS Markit. Alongside these considerations, a deterioration in business conditions, and contraction in workforce numbers, both saw the July-August recovery stopped in its tracks.

As stated by IHS, Myanmar manufacturing PMI fell from a 15-month-high in August, at 53.2 points, to 35.9 in September – representing a notable contraction.

This new figure is the second-lowest recorded in the country since the IHS survey began in December 2015, and only above April’s score of 29.0, when the virus was at its peak. Further, the month-on-month decrease of 17.3 points is actually the largest on record, and even more severe than the previous record of 16.3, witnessed between March and April.

According to IHS, four out of five of the PMI indicators had negative trajectories in September, with the exception being suppliers’ delivery times. Output and orders declined at their second fastest rate since the group’s surveying commenced, with these indices both recording month-on-month declines of over 28 points.

Speaking on a bleak month for Myanmar manufacturing, IHS Economics Director, Trevor Balchin, stated:

“The impact has so far been less severe than the record deterioration in business conditions seen in April. But the month-on-month decline in the PMI was the largest on record as it collapsed by over 17 points from August’s 15-month high of 53.2 to 35.9.”

“With a two-week lockdown introduced in Yangon towards the end of September, the trajectory in cases over the coming weeks will be crucial as authorities judge when to ease the new restrictions and enable the manufacturing sector to resume its recovery. The October PMI will provide the first signs of any rebound in activity, or indeed further retrenchment.”