ESG and Impact Investing were rapidly growing investment themes before the coronavirus pandemic and the latest data from TrackInsight highlights investors continued to allocate capital to ESG ETFs. This was despite volatility in the wider market that presented a plethora of opportunities across more established themes,

Analysis by ETF research platform TrackInsight found ESG ETFs enjoyed a 223% increase in assets under management in 2020 to $189bn.

The growth in ESG ETFs helped overall ETF assets under management grow to $7.6 trillion at the beginning of 2021

ESG ETFs

ESG investing is multifaceted pursuit as investors can embark on investment allocation that ranges from omitting firms such as alcohol, fossil fuel and defensive companies through to only investing in companies that have diverse boards that promote equality.

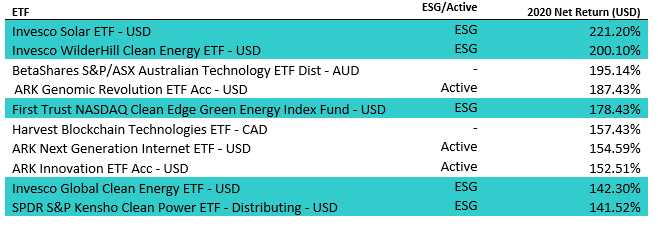

However, with the urgency around climate change front and centre, investor appetite for ESG ETFs has largely been directed at those with exposure to green energy. Indeed, these were some of the best performing ETFs of 2020.

Data from TrackInsight shows Invesco Solar ETF and Invesco WilderHill Clean Energy were by far the best performing ETFs of 2020 returning 221% and 200% respectively.

The Invesco Solar ETF tracks the MAC Global Solar Energy Index that includes companies such as Enphase Energy Inc, which traded at $31 in January 2020 and surged through 2020 to trade $213 in early January 2021.

“ETFs faced an acid test in 2020 and passed with flying colours. The tremendous growth we have witnessed demonstrates how ETFs have successfully convinced investors of the benefits of a liquid, tradable and transparent product – especially during volatile markets,” said Anaelle Ubaldino, Head of ETF Research and Investment Advisory at TrackInsight.

“It’s also clear that 2020 was a long-awaited turning point for ESG ETFs with huge growth in this sector. As competition for potentially Trillions of dollars of new ESG assets heating up, we expect to see more issuers enter the ESG ETF market over 2021.”