2020 was something of a boom year for ETFs, which saw the sector grow to $189bn and record almost 200 new listings, after capturing $97bn of flows over the course of the year. There are now more than 540 ESG ETFs available.

While the Covid-19 pandemic stranded global markets in the eye of the storm, many investors switched their usual holdings for ESG stocks as the merits of investing responsibly became more apparent.

Data from TrackInsight (the world’s first ETF analysis platform) revealed that, while wider stockmarkets were falling 20% in the spring of last year when the impact of the pandemic truly unfolded, ESG portfolios outperformed due to their higher exposure to the healthcare and technology sectors.

As well as this, investors have begun to realise that business models which support and capitalise on a sustainable future will no doubt become “more robust” as the implications of climate change materialise.

According to ESG Clarity, investors also increasingly want to put their funds behind companies supporting all stakeholders – employees, clients, supply chains and shareholders – at a time when societies are “united in the face of the pandemic” (the ‘social’ element of ESG).

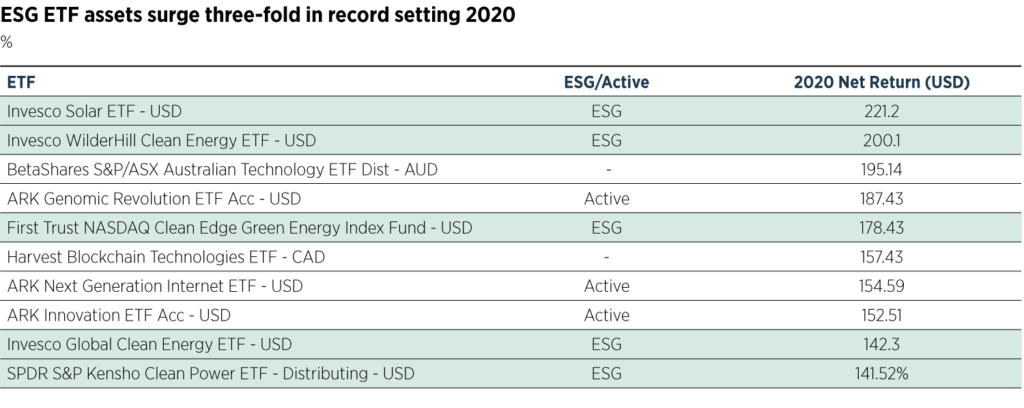

Among the top successes of 2020 were Invesco Solar ETF, which championed a net return of 221.20% over the year, while the Invesco WilderHill Clean Energy ETF also recorded an impressive 200.1% net return.

Anaelle Ubaldino, head of ETF research and investment advisory at TrackInsight, commented:

“It’s clear that 2020 was a long-awaited turning point for ESG ETFs with huge growth in this sector. As competition for potentially trillions of dollars of new ESG assets heating up, we expect to see more issuers enter the ESG ETF market over 2021″.

On Monday, TrackInsight announced the launch of ESG Observatory, an online hub that provides tools, data and analysis on the global market for ESG ETFs, for investors “looking to build sustainability into their ETF portfolios”.

The project has been formed of a “unique triumvirate with unsurpassed knowledge of the ETF and Sustainable Investment industries; combining the ETF expertise of TrackInsight, the independent ESG Consensus® methodology of Conser and guidance on mapping ETFs against the Sustainable Development Goals provided by the SDG Investors Partnership of UNCTAD – the United Nations Conference on Trade and Development”.

ESG Observatory is supported and sponsored by Amundi Asset Management.

The aim is to provide transparency for users who seek to “invest with purpose” by helping them to monitor and analyse key ESG investment trends, compare the different ESG strategies offered by ETF issuers, and measure which products are contributing most towards meeting the United Nations Sustainable Development Goals (SDGs).

James Zhan, Senior Director of Investment and Enterprise at UNCTAD, commented on ESG Observatory’s launch:

“In view of the material risks posed by issues such as climate change and the global pandemic, investors are paying increasing attention to sustainability in their investment decisions. By looking into the impact of ESG ETFs from the SDG angle, we believe TrackInsight’s ESG Observatory can help align financial products with sustainable outcomes, and ultimately contribute to channelling finance to key SDG sectors”.

And TrackInsight’s founding CEO, Jean-Rene Giraud, added:

“The astonishing pace of adoption for ESG ETFs is being driven by demand from institutional and retail investors who realise that their investment decisions have consequences and who want to invest with purpose. With the market for ESG ETFs exploding worldwide, ESG Observatory provides a valuable resource for those investors who want independent data and information on the market, knowledge of the investment choices they have and metrics to gauge which ETFs are contributing most to a sustainable future”.