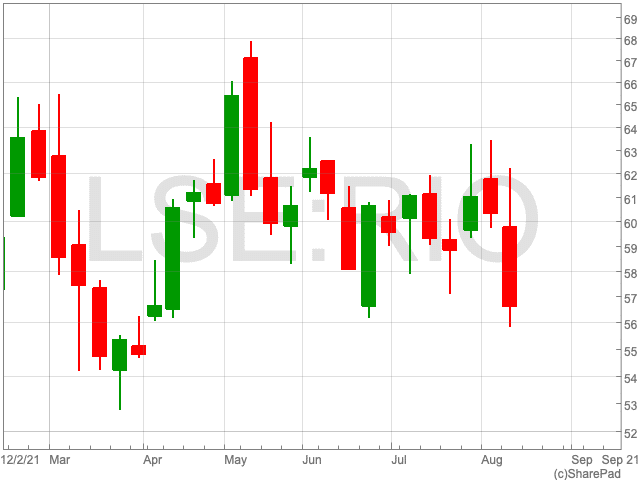

Rio Tinto Share Price

The London-listed Rio Tinto share price (LON: RIO) is down by 7.21% during the afternoon session on Thursday, and is the day’s worst performing stock on the FTSE 100. To the relief of investors in the mining giant, the move is a result of the company’s stock trading ex-dividend. If one purchases a stock on its ex-dividend date or after, they will not be entitled to the next dividend payment. Therefore the value of the Rio Tinto share price fell today, and not due to any performance related issues within the company.

Aside from the ex-dividend date passing there is other news which could set the miner on a better path, following what has been an underwhelming 2021 so far. Year-to-date the Rio Tinto share price is now down by 3.56%.

Finances

Rio Tinto revealed record half-year profits that surpassed its total for all of 2020 its key commodity, iron ore, reached an all-time high. Rio said pre-tax profits increased by 240% to a record $18bn in the half-year to June on revenues of $33bn. Additionally, the FTSE 100 miner swung to a net cash position of $3.1bn from net debt of $664m at the beginning of the year.

Rio’s chief executive Jakob Stausholm didn’t get carried away with the results, suggesting good fortune of rising commodity prices helped. “We have seen significant price hikes and fortunately we have reaped the benefit from it,” he said. “But there a still a number of things that can be done better.”

Stausholm also suggested that the high price of iron ore would not last forever. “We never give price predictions on price but I would always say that when the iron price is above $200 a tonne it is not sustainable . . . it is bound to reduce.”

Fortunately for the Rio Tinto share price, there could be another commodity to help take the burden off of iron ore.

Jadarite

Rio Tinto is doing its best to position itself to profit as internal combustion engine vehicles get replaced over the remainder of this decade. One way the company will look to do this is via a little-known commodity called ‘jadarite’.

Back in 2004 the mining giant discovered the substance, named after the Jadar valley in Serbia, a high-grade mineral compound of lithium and borates which has never been located anywhere else.

While lithium is vital to the production of lithium-ion electric batteries, Borates are contain salts known as boron, which is used in fertilisers, and also materials for solar panels and wind farms.

Rio Tinto has allocated £1.7bn to a site close to the radar river in an effort to extract the commodity after it figured out how to process the compound economically and at scale.

The miner said the site could allow the company to become Europe’s biggest supplier of lithium for the next 15 years. Rio expects to be able to extract 58,000 tons of jadarite per year, enough for 1m electric car batteries.

For those with eyes on the Rio Tinto share price, this could be an interesting development to watch unfold, and could boost the miner’s balance sheet for years to come.