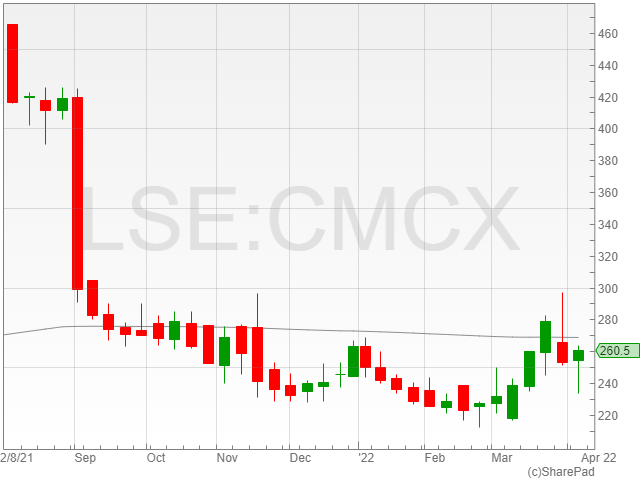

CMC Markets shares spiked 9% to 263.3p in early morning trading after the firm’s trading update for the past quarter revealed results at the high end of company projections.

CMC announced an expected FY 2022 net operating income of £280 million, hitting a record performance outside the Covid-19 pandemic.

The financial services company said it currently anticipates a gross leveraged client income of £288, representing a 14% year-on-year decline compared to its £335 million intake in 2021.

CMC also highlighted a projected leveraged trading revenue of £230 million at a 34% year-on-year fall against £349 million in 2021, alongside a 12% lowered non-leveraged trading revenue of £48 million compared to £55 million in 2021.

The company’s operating costs are currently expected to hit £173 million against £168 million in 2021, apparently reflecting higher personnel costs in the course of reaching strategic objectives.

The group cautioned that its expenses were set to climb higher on its scheduled growth in marketing expenses, along with a ramped up investment in personnel.

The firm’s notable updates included its initial internal launch of CMC Invest, the company’s UK non-leveraged platform for its British staff. CMC noted that the platform was scheduled to roll out to the wider market over the upcoming quarter.

An additional investment platform is set for launch in Singapore this year, and CMC confirmed that it was currently eyeing two other jurisdictions to launch from in the next year in an effort to expand the company’s international presence.

“I am delighted to report another year of strong performance both strategically and financially,” said CMC Markets CEO Lord Cruddas.

“Outside of the pandemic year (Financial year ending March 2021), this is a record net operating income result for the company. The performance reflects the ongoing success of our B2B technology partnerships and focus across our leveraged and non-leveraged businesses.”

“This business continues to change as we look to utilise our technology to enter new markets and expand our non-leveraged offering. I look forward to updating investors as the strategy expands over both the short and long-term.”