The FTSE 100 was up 0.8% to 7,528.9 following a recent report from the Office of National Statistics (ONS) that job vacancies outnumbered unemployment figures for the first time on record and total pay across the UK rose 7%, sending investors surging on a wave of optimism.

The market was perhaps more grounded than it would have been, if not for Bank of England governor Andrew Bailey’s gloomy statement before cabinet ministers on Monday that the institution had exhausted its resources to tackle skyrocketing inflation, which is currently on track to reach 10% by October this year.

“This is not the message you want to hear from the Bank of England Governor. Andrew Bailey as a latter-day King Canute has told everyone he and the Bank are helpless in the face of runaway inflation,” said AJ Bell investment director Russ Mould.

“But despite this, and employment data showing a record jump in pay to underline his point, the FTSE 100 managed to start on the front foot on Tuesday.”

FTSE 100 Companies

Imperial Brands shares surged 7.4% to 1,840p after the company reiterated it FY 2022 profit guidance, and noted a stabilisation of its core Combustible business.

“Imperial Brands’ sales may have been flat in the first half but, if you put to one side the impact of its exit from Russia, it is notable that profit is up. Imperial has also been able to push through price increases and is generating mountains of cash,” said Mould.

Fresnillo shares gained 5% to 795.2p, Anglo American climbed 4.2% to 3,492p, Antofagasta increased 4% to 1,439p and Glencore rose 3.8% to 495.4p, with a strong Asian market lifting commodities on a sell-off on concerns related to Chinese interests.

“A decent session in Asia helped lift the mood with commodities stocks in demand after the recent sell-off on China-related concerns,” said Mould.

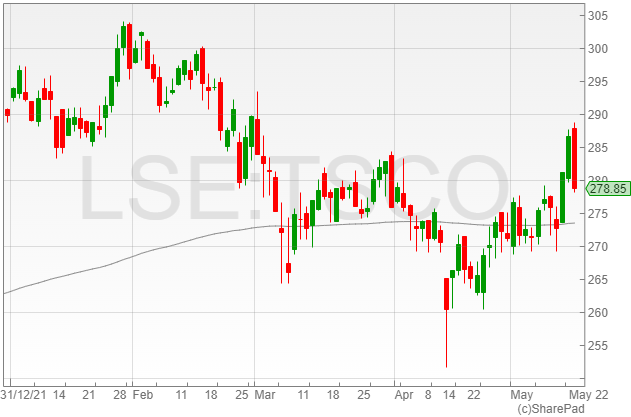

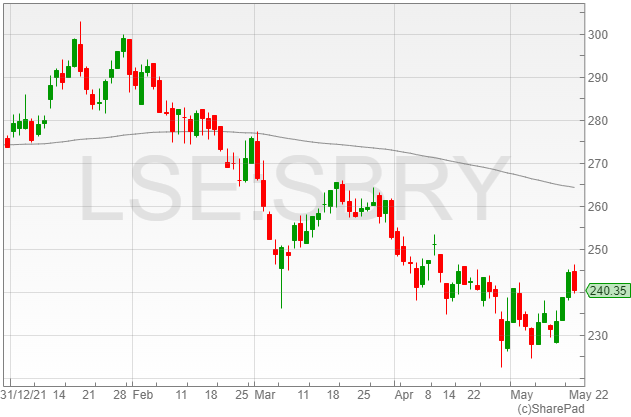

Tesco shares dropped 2.8% to 278.5p and Sainsbury’s shares fell 2% to 239.7p as Andrew Bailey’s comments on rising food inflation hurt sentiment as the market braced for higher wheat prices on the back of India’s wheat export ban, along with the almost 30% of wheat produced in Ukraine and Russia which remained locked in as war raged in the “breadbasket of Europe.”

“Food prices, which Bailey apologised for being apocalyptic about yesterday, remain in focus as the impact of India’s wheat export ban are felt and the conflict in the ‘breadbasket of Europe’ continues to rage,” said Mould.

“This will push up prices on supermarket shelves in developed countries but could have a more destabilising impact in emerging economies where food takes up a much bigger proportion of average incomes.”

A wide selection of consumer goods companies lost ground on the market, as rising inflation continued to bite chunks out of consumer wallets.

Unilever fell 1.8% to 3,663p, fashion group Next declined 1% to 6,465p and alcohol company Diageo slid 1% to 3,828p.