The FTSE 100 was down 0.1% to 7,507.6 at midday on Wednesday, as record-high rates of 9% inflation seemed to surprise few people, with investors having accounted for the estimated spike in advance and little panic spotted on the market.

“Investing is an expectations game so it’s not really a surprise that the market has shrugged off the highest levels of inflation in the UK in 40 years given the number was actually slightly behind forecasts,” said AJ Bell investment director Russ Mould.

A selection of positive results also boosted the FTSE 100 higher, as the market brushed the gloomy economic outlook off its collective shoulder.

British Land Co shares climbed 3.9% to 526.7p as the company swung to a pre-tax profit of £958 million compared to a £1 billion loss the previous year.

The property development and investment group further announced a 12% growth in net assets.

“Operationally, our leasing volumes across Campuses and Retail & Fulfilment were the highest in ten years and were ahead of estimated rental value,” said British Land Co CEO Simon Carter.

“In London, demand continues to gravitate towards the best, most sustainable space where our Campuses are at a distinct advantage.”

Mould commented: “British Land is seeing demand for the ‘right’ kind of offices as it returned to profit for the first time since 2018 and eye-catchingly revealed it is leasing space at the fastest pace in a decade.”

“The easing of restrictions may not have led to an immediate return to the office en masse but there’s little doubt that employers are looking to tempt workers back for some of the working week and that means having attractive spaces for them to work in.”

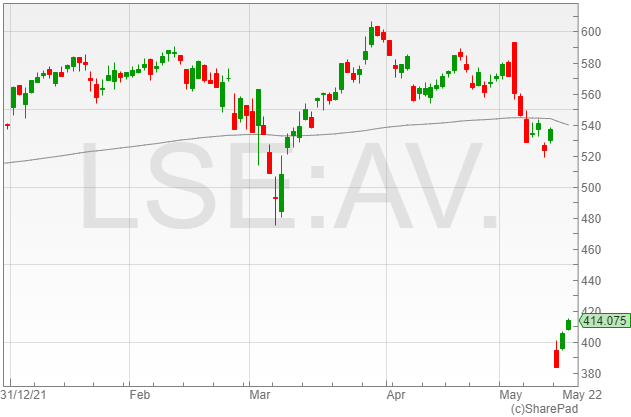

Aviva shares enjoyed a boost of 2% to 414p as a result of record-high Q1 general gross insurance premiums of £2.1 billion, which the firm attributed to strong growth across commercial lines in the UK and Canada.

“Insurer Aviva, which has been busily slimming down under chief executive Amanda Blanc, helped demonstrate its credentials as a honed corporate animal with strong first quarter trading including the best first quarter general insurance sales in a decade,” said Mould.

“For Blanc, who has made an impressive start to her leadership of the business, the low hanging fruit has now been picked and the underperforming operations sold off. She needs to work out how to maintain the momentum behind the business.”

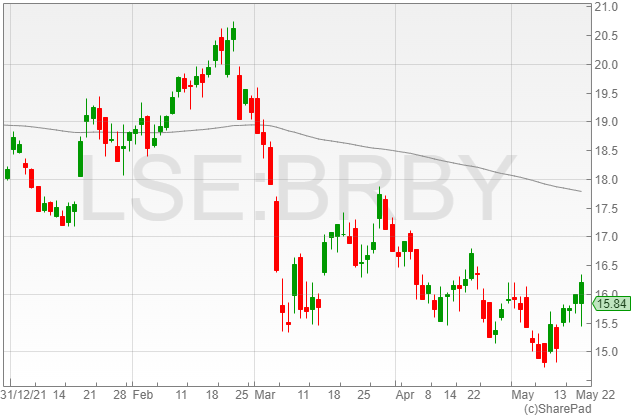

Burberry shares increased 1% to 1,600p, after the luxury brand announced an operating profit of £543 million in its full-year results, reflecting a 4.2% rise compared to its £521 million last year, reportedly in line with management expectations.

The brand has undoubtedly benefited from its wealthy clientele remaining predominantly unaffected by the snapping jaws of rising food and energy costs, with the company’s target consumer probably hardly realising the added expense to their weekly grocery shop.

“Burberry’s post-Covid recovery still has more to go, given it should see greater business once Asian tourists start travelling the world again,” said Mould.

“They have historically been keen buyers of Burberry products on their travels. China’s Covid resurgence is a headwind for now, but one might presume this is only a short-term issue.”

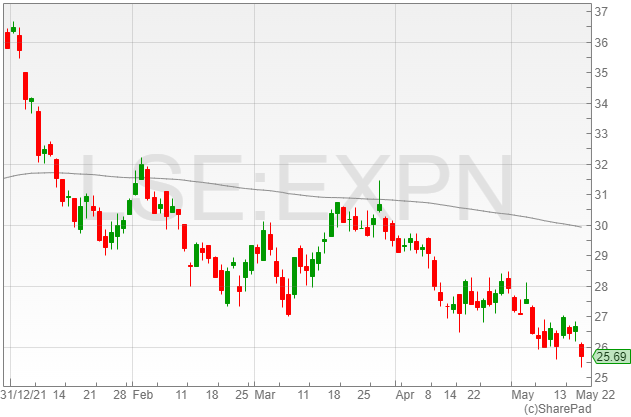

Experian shares fell 4% to 2,561p despite the credit-focused firm’s reported 17% revenue growth to $6.2 billion in FY2022 against $5.3 billion year-on-year as a result of high consumer-focused demand.

The company reported a moderate slowdown in expected growth in the range of 7%-9%, however, alongside a series of legal claims against the group “across all its major geographies.”

Experian confirmed that several claims were in enforcement, including a selection from the Consumer Financial Protection Bureau in North America and the Information Commissioner’s Office in the UK.