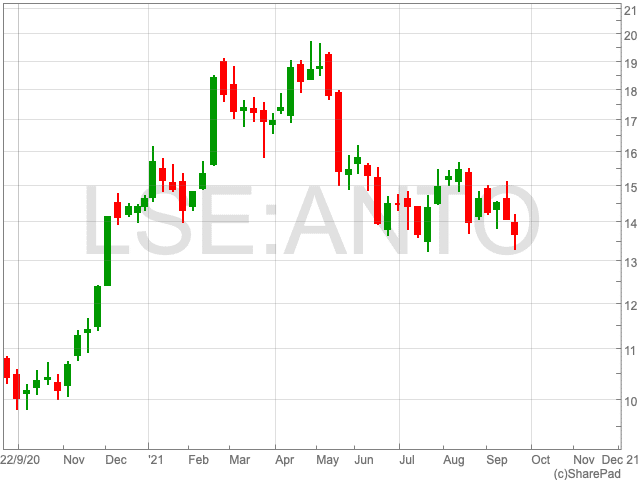

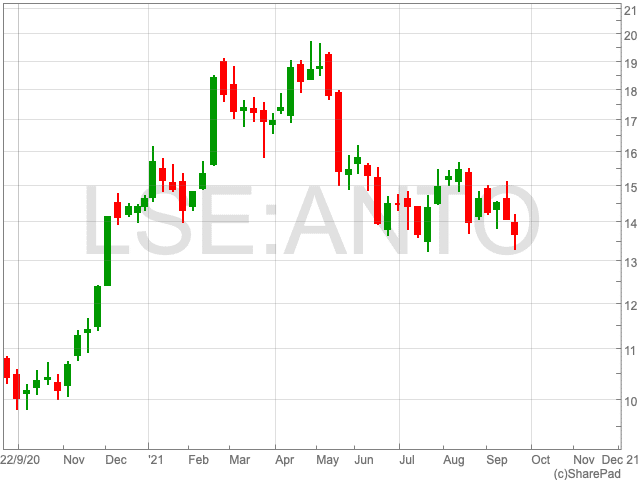

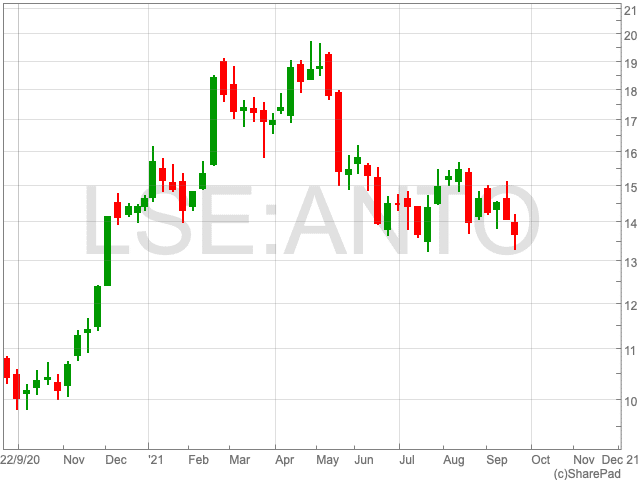

Antofagasta Share Price

The Antofagasta share price is up by 4.85% on Wednesday as the mining giant enjoyed a bounce back from recent woes on the stock market. Over recent weeks the FTSE 100 company saw its share price dip along with the price of copper and other commodities. The miner saw a resurgence today as there was a glimmer of hope that Evergrande could strike a deal over a bond interest payment that is due.

Year-to-date the Antofagasta share price is down by 7.22%, after it surged in 2020 following the pandemic. Clearly, there is a lot going on, and copper prices can depend on demand in China. This article will take a look at the outlook for Antofagasta heading into the future.

Economic Uncertainty

A key question for the Antofagasta share price is the economic uncertainty that plagues the global economy. The miner’s ability to withstand economic shocks, wherever they may come from, could be vital.

One way to make this judgement is to examine the stock’s value. This can be done by looking at Antofagasta’s earnings yield, which is worked out by dividing its operating profit by its enterprise value. Generally speaking, the higher the Earnings Yield, the more valuable a share.

Antofagasta’s Earnings Yield is currently at 13.9%. This means, compared to the general rule, the company has a low valuation. This could be appealing to investors and reflects well on the company’s ability to withstand difficult economic conditions.

It must be added that while this measure of the FTSE 100 company’s ability to deal with turmoil bodes well, it by no means serves as a guarantee. Furthermore, economic shocks are impossible to predict.