Barclays (LON:BARC) released full year results on Thursday which revealed a 10% jump in pretax profit despite a drop in total income.

The profit increase was facilitated by falling costs and a reduction in litigation payments.

Barclay’s financial position has also improved with CET1 increasing to 13.3% from 12.4% a year prior.

The results have given the bank confidence to outline plans for share buybacks and other capital distributions in the future.

The results have given the bank confidence to outline plans for share buybacks and other capital distributions in the future.

Chief Executive, Jess Staley commented on the results:

“2017 was a year of considerable strategic progress for Barclays. The sell down of our shareholding in Barclays Africa, closure of our Non-Core unit, the establishment of our Service Company, and the creation of our UK ring- fenced bank, mean that, in terms of size and structure, we are now the diversified Transatlantic Consumer and Wholesale bank we set out in our strategy in March 2016.We have a portfolio of profitable businesses, producing significant earnings, and have plans and investments in place to grow those earnings over time.”

“We have already started to see some of the benefits of our work in 2017. Group profit before tax increased 10% year-on-year as a result of our team’s focus on execution. Barclays UK navigated the year well, reaching a digital banking milestone with our ten millionth customer. Within Barclays International, we increased Banking fee share in our Corporate and Investment Bank in 2017, and our Consumer, Cards and Payments business continued to produce very strong income while managing risk effectively.”

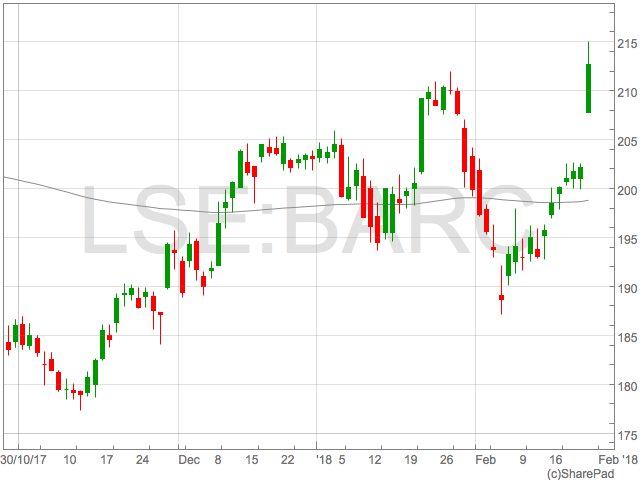

Shares in Barclays rose over 5% in early trade on Thursday.