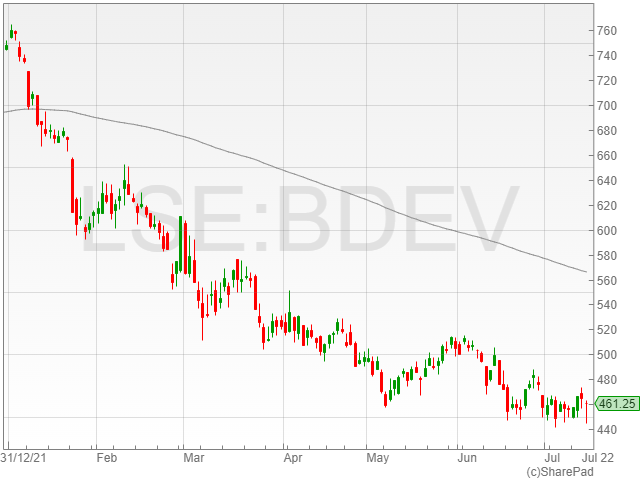

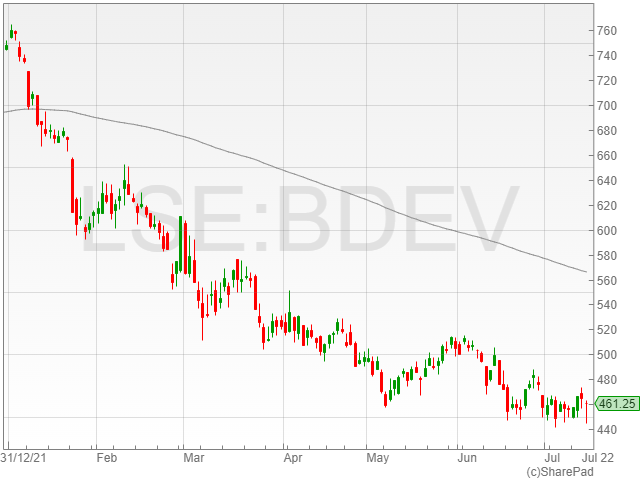

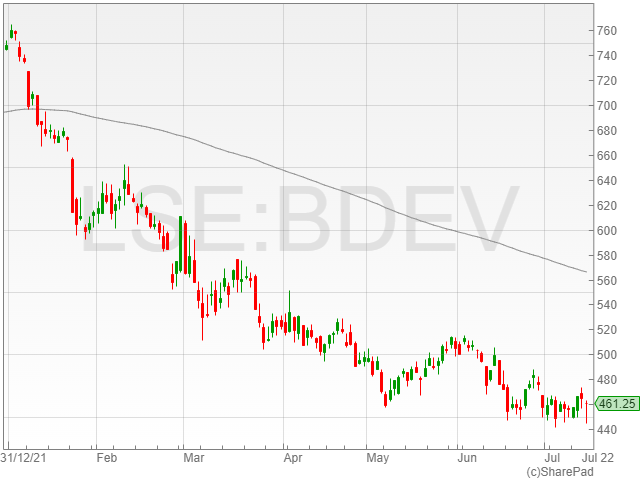

Barratt Developments shares were down 0.9% to 460.9p in late morning trading on Thursday, after the company announced an underlying pre-tax profit slightly ahead of market expectations between £1.05 billion and £1.06 billion in its FY 2022 trading update.

The housing developer reported a return to pre-pandemic completion levels, with 17,908 completions over the financial term against 17,243 the previous year.

The company noted total completions were impacted by the deferral into FY 2023 of a London apartment block comprised of 221 homes, reflecting resource delays in the construction process.

Barratt Developments highlighted an average selling price for private homes up to £341,000, rising to £375,400 for houses sold in the forward order book.

“Another housebuilder, another set of results pointing to resilient housing demand. Completions were slightly lower than expected but came in ahead of pre-pandemic levels,” said Hargreaves Lansdown equity analyst Matt Britzman.

“More crucially though, demand looks to be holding up in the forward order book despite rising house prices.”

“Testament to the ongoing resilience of the private house buyer, seemingly undeterred by a drop in real income as inflation and a cost-of-living crisis start to take their toll.”

The firm also mentioned build cost inflation of 6% across the period, although the level is currently at 9% to 10%.

“It almost feels inevitable that a broader easing of demand is on the cards given the wider conditions and news that build costs are running 9-10% higher at the minute is a little hard to stomach,” said Britzman.

“Nonetheless, Barratt’s doing all it can to make hay while the sun shines, with a significant increase in the value of land buying last year – propped up by a very healthy net cash position on the balance sheet.”

“Not for the first time, planning delays are being called out as a headwind – not something housebuilders want to battle with given everything else that’s going on.”

Barratt Developments commented it intended to declare an ordinary dividend based on FY 2022 dividend cover of 2.25 times its adjusted net income.