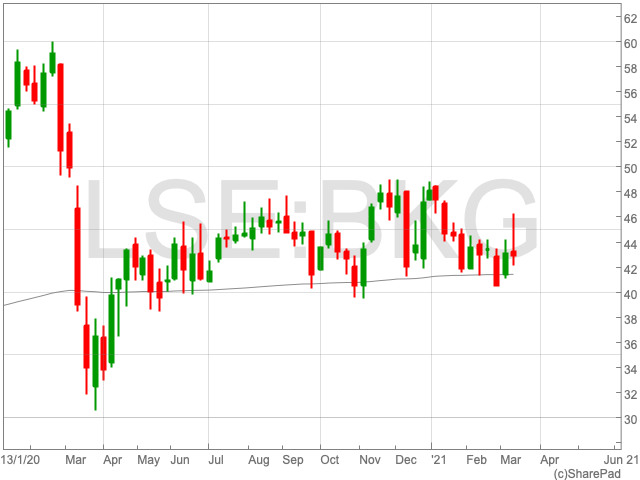

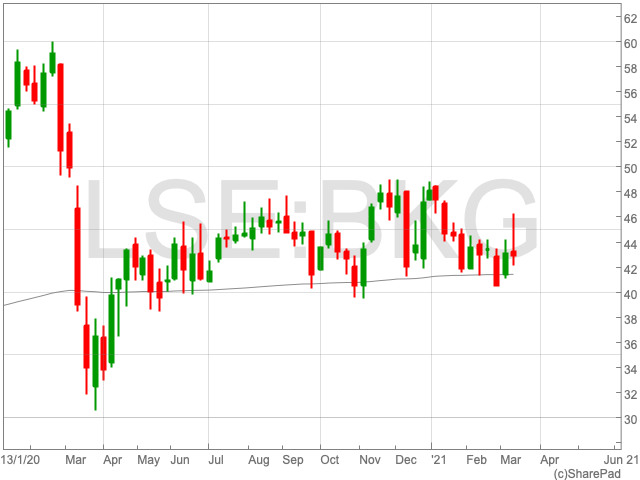

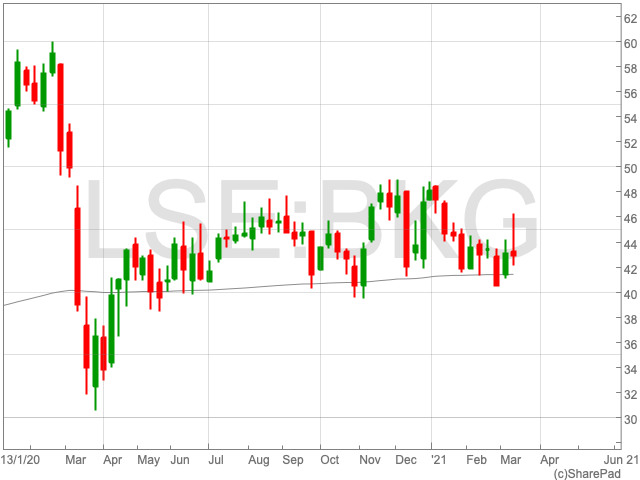

Berkeley Group Share Price

From an all-time high of 5,470p in February 2020, Berkeley Group’s share price plummeted to 3,131p before the end of March, as the pandemic took a stranglehold of the UK economy. Since then the housebuilder’s stock has recovered steadily, reaching as high as 4,889p in December, before coming back down to 4,286p in March.

Government Support for Homebuilders

Property companies received a great deal of support from Rishi Sunak’s budget announcement that could see them to the end of the pandemic.

The Chancellor pledged to “stand behind home buyers”, extending the stamp duty holiday to June. The point at which stamp duty will be paid will remain at £250,000, double its standard level, until the end of September. The budget also included assurance that the government will guarantee mortgages up to 95% of a home’s value.

The policies, in particular the stamp duty waiver, proved to be a success before the pandemic as house prices hit record numbers.

Mark Peck, director at Cheffins, commented on the impact of Sunak’s announcements on the property industry.

“Stamp duty has long been the Treasury’s golden goose and has filled government coffers for centuries, and whilst the lack of stamp duty paid over the past year will have been felt by the government in terms of income, this extension will ensure that the property industry continues its current bull run over the next three months,” Peck said.

The continued support by the government, in addition to the UK economy emerging from lockdown, could make Berkley Group an attractive proposition over the coming months.

Risks

Berkley Group shares took a tumble on Friday as the company’s forecasted profit was downgraded.

The developer predicts it will record a profit of about £504m for the year ending in April, around the same level it generated in 2020, but £20m lower than initially expected.

Berkeley Group also confirmed its reservations are set to fall by 20% during the current financial year as the housebuilder delayed opening sites due to lockdowns.

This is in contrast to its rivals that have wasted no time in building sites to capitalise on the sector’s bright outlook. Russ Mould, investment director at AJ Bell, suggested the stock was less well positioned than its competitors.

“Of all the housebuilders Berkeley seems the least bullish. A flat performance in its financial year to February 2021 is testament to how impressively the business recovered from the pandemic in the second half.

“But while Berkeley still has strong levels of enquiry it is phasing developments to coincide with a reopening of the economy. This may look very clever in time if it sees Berkeley deliver a smoother flow of profit and cash flow than its peers, many of which seem to be operating at 100 miles an hour.

While Berkeley is well poised to capitalise from favourable policies and perpetual demand for housing, the company does risk being outperformed by its competitors over the coming months.