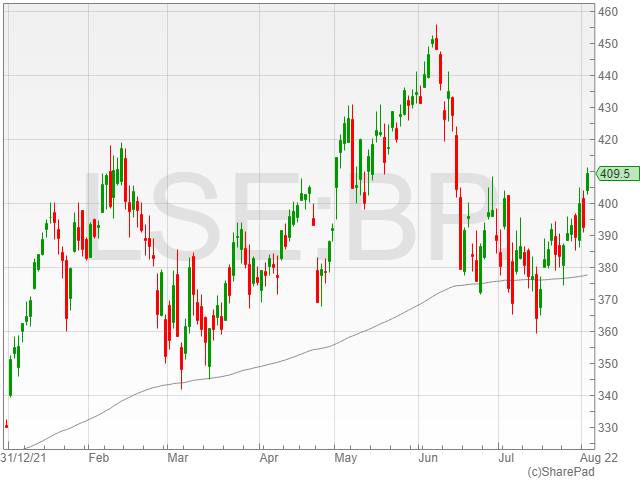

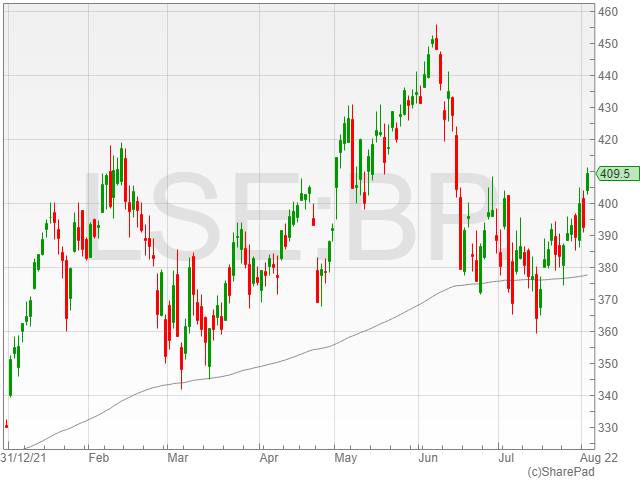

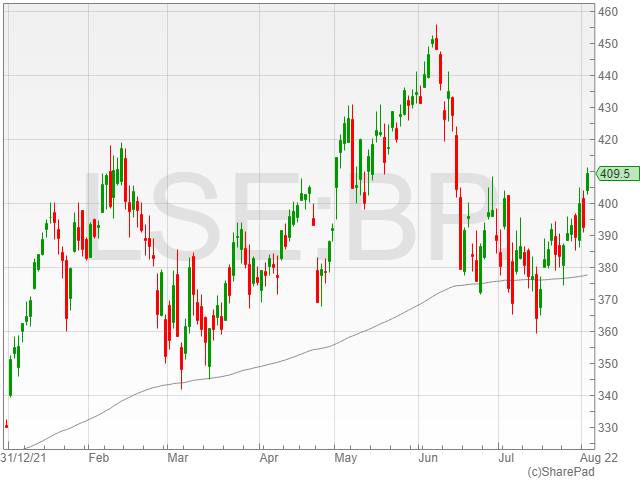

BP shares gained 3.6% to 406.7p in early morning trading on Tuesday following a reported strong Q2 for the energy giant, including an 85% surge in revenue to $69.5 billion.

The oil and gas company noted an underlying profit growth to $8.5 billion compared to $2.8 billion year-on-year, driven by strong realised refining margins, strong oil trading performance and higher liquids realisations.

BP added its profits were slightly offset by an average gas marketing and trading contribution, including an impact from the ongoing outage at Freeport LNG.

The company confirmed a profit of $9.3 billion compared to a loss of $20.4 billion in the last quarter, related to BP’s exit from its stake in Russian business Rosneft in March this year.

BP mentioned an operating cash flow of $10.9 billion against $5.4 billion the year before, and a net debt reduction to $22.8 billion compared to $32.7 billion.

Share buybacks and dividend

The energy firm also highlighted the completion of its $2.5 billion share buyback on 22 July, with $2.3 billion in shares repurchased in Q2.

The group announced an additional $3.5 billion share buyback scheduled for completion before its Q3 results, following its strong financial results for Q2 2022 and anticipation of high prices to continue going forward.

“BP’s expecting higher oil prices to continue into the third quarter and whilst that’s not good news for consumers, who are battling with higher energy and petrol prices already, it’s good news for cash flows,” said Hargreaves Lansdown equity analyst Matt Britzman.

“In the accommodative environment we’re seeing, BP’s able to push up its dividend and push on with a fresh $3.5bn buyback having only just finished a $2.5bn programme.”

“Markets reacted favourably to what was a set of results that beat estimates across pretty much all metrics.”

BP recommended a dividend of 6c per share, raising its dividend by 10% from 5.4c year-on-year.