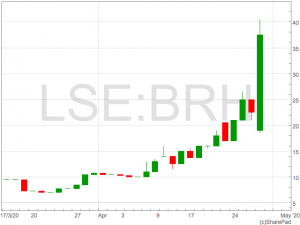

Shares in AIM-listed Braveheart Investments (LON:BRH) rocketed on Wednesday after the investment company announced the results of a placing to help grow their portfolio.

The Braveheart Investments share price was up 71% to 38p on Wednesday.

The jump followed a successful £275,000 placing at 17p. Th proceeds will be used to expand the company’s portfolio with investments already earmarked for the cash.

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

Braveheart Investment’s portfolio is focused on technology companies with high levels of intellectual property.

Trevor Brown, Braveheart CEO, commented: “We are delighted to have been able to raise this extra funding and to have also increased our shareholder base. The balance sheet of Braveheart remains strong and so we will be able to provide financial support to our Strategic Investments if it is required to keep up their momentum in development.”