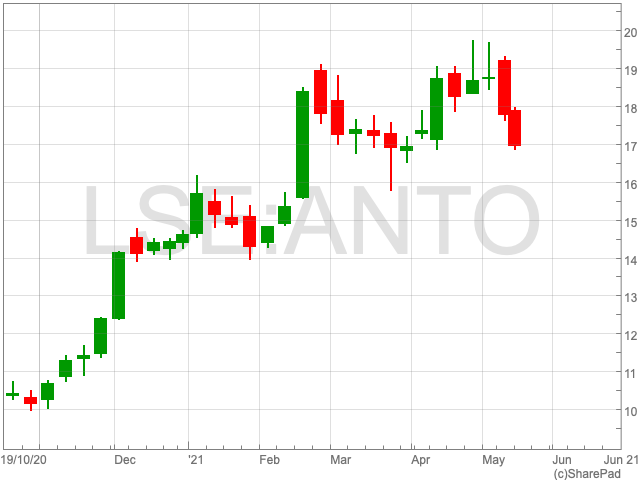

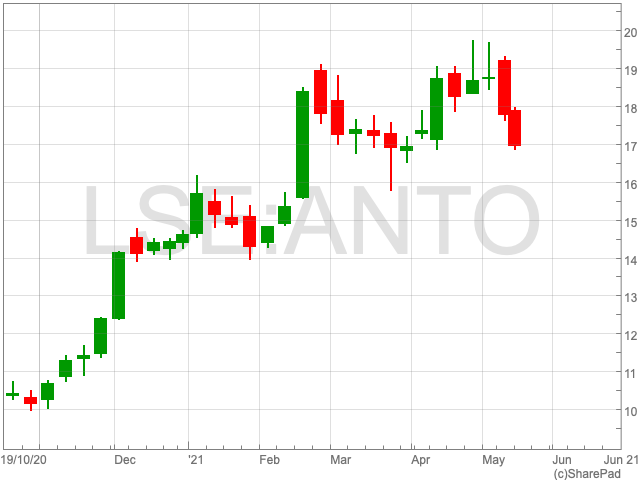

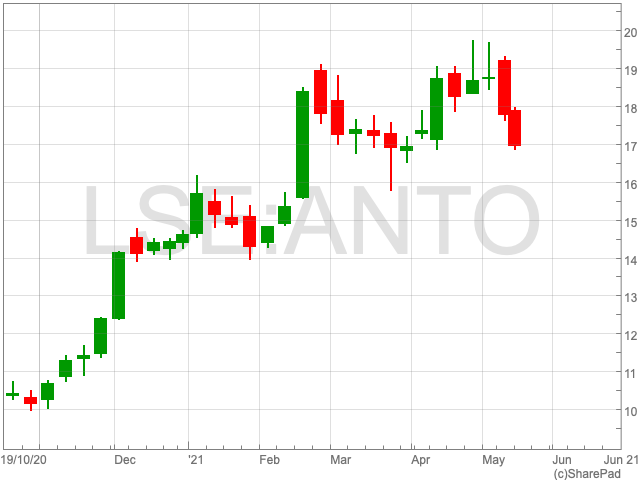

Antofagasta share price

The Antofagasta share price is down by just under 5% on Monday to 1,694.16p per share. It followed on from last week when the FTSE 100 mining giant lost ground. The retreat came after a bull run that started at the end of 2020 as the price of copper soared. Investors are curious as to whether copper can sustain its recent highs, as well as the impact of Antofagasta’s climate pledge on the outlook of its share price.

Copper

The red metal is the most significant contributor to Antofagasta’s revenue and is on a robust run during 2021. At the time of writing, it is valued at just below $10,200 per tonne. Copper hit a record high earlier this month as demand for the commodity soared on the back of a five-day holiday in China. The question now is if copper can keep the momentum that was established in 2020 amid talk of a supercycle.

A note released by Goldman Sachs recently about copper will be of interest to Antofagasta investors. “Copper is the new oil”, the note read. The New York-based investment bank predicted that the red metal will reach $11,000 this year. Looking further ahead, Goldman predicts that copper could reach $15,000 per tonne by 2025.

Antofagasta Emissions Target

Antofagasta confirmed its intention of reducing its carbon emissions by 30% by 2025. The goal comes as the Chilean mining company said it has met prior targets of reducing “Scope 1” and “Scope 2” emissions by 300,000 tonnes of CO2e by 2022. Antofagasta’s mission over the longer-term is to achieve carbon neutrality by 2050.

Iván Arriagada, Chief Executive Officer of Antofagasta said: “Copper will be a key enabler of a modern low carbon economy. It’s essential we work with all our stakeholders to produce it in a sustainable and responsible way.”

The role that copper is set to play in the provision of renewable energy is well documented. What is less clear is the impact of the announcement over emissions targets on the Antofagsta share price. Investors, who are increasingly conscious of ESG factors, may consider it the bare minimum.