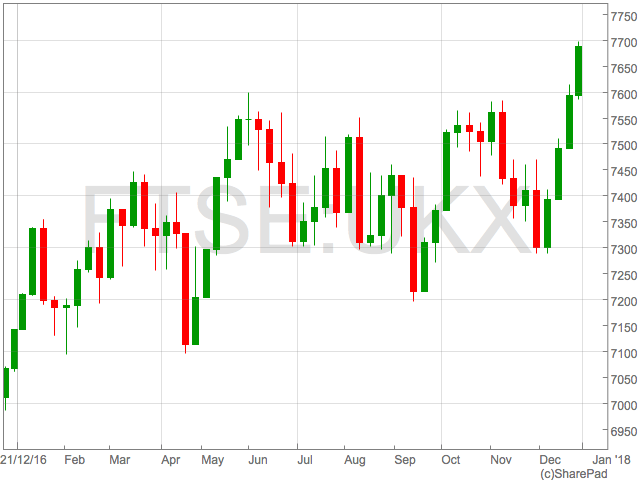

The FTSE 100 closed on Friday at 7687 as London-listed stocks added to gains throughout the festive period enjoyed in a so-called ‘Santa’s Rally’.

The FTSE 100 closed 2017 up around 7% in a year that was characterised by extremely low volatility throughout a persistent backdrop of political uncertainty and high equity valuations.

The best performer in the FTSE 100 this year was NMC Healthcare, the middle eastern healthcare company who joined the index in Q$ 2017. The stock enjoyed an impressive 80% gain in 2017 following strong growth in their hospital business based in Abu Dhabi.

The best performer in the FTSE 100 this year was NMC Healthcare, the middle eastern healthcare company who joined the index in Q$ 2017. The stock enjoyed an impressive 80% gain in 2017 following strong growth in their hospital business based in Abu Dhabi.

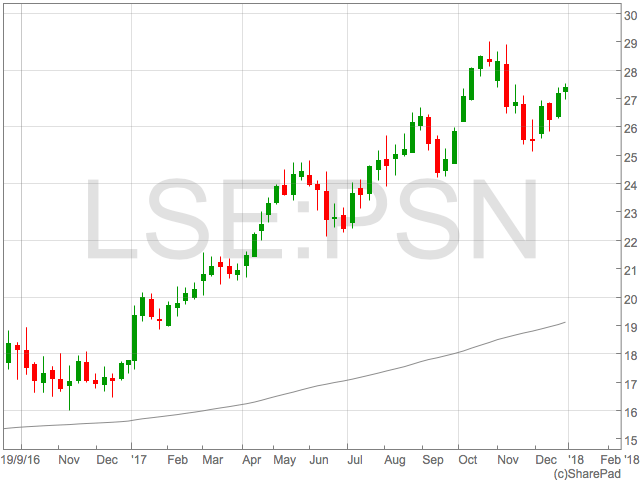

Other string gainers this year included Persimmon and Berkeley Group Holdings who were up 54% and 50% respectively. The housebuilders posted significant profit increases despite fears over a Brexit induced UK economic slowdown.

A major contributor to their success was the governments support for first-time buyers in the form of the Help to Buy Scheme which some have blamed for creating artificially high house prices.

Miners also posted respectable gains this year after commodity prices rallied, ending years of decline. Copper miner Antofagasta was up 49% while Glencore rose 41%.

Miners also posted respectable gains this year after commodity prices rallied, ending years of decline. Copper miner Antofagasta was up 49% while Glencore rose 41%.

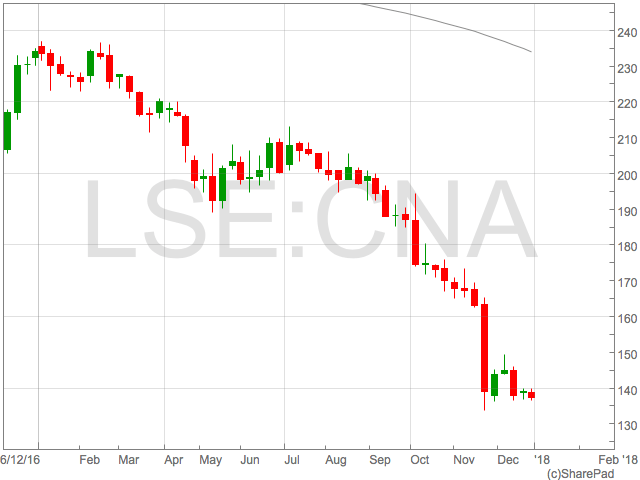

Bottom of the FTSE 100 for 2017 was Centrica, down around 40%. Fears of a price cap for energy suppliers hit the entire sector with National Grid and SSE down between 15%-16%, but news that Centrica were shedding large numbers of customers led to investors dumping shares.

Other causalities of 2017 include WPP and ITV who felt the pain of slowing advertising revenues and failed to realign their businesses with digital content consumption trends.

Other causalities of 2017 include WPP and ITV who felt the pain of slowing advertising revenues and failed to realign their businesses with digital content consumption trends.

BT Group shares also suffered after they failed to recover from and Italian accounting scandal and analysts questioned the investment in TV rights as opposed to their core broadband business.