The FTSE 100 fell on Thursday as stocks going ex-dividend wiped a substantial 39 points from the index.

Stocks that moved a trade without eligibility for upcoming dividends included AstraZeneca (LON:AZN), Rio Tinto (LON:RIO), BP (LON:BP), BT Group (LON:BT) and Royal Dutch Shell (LON:RDSB).

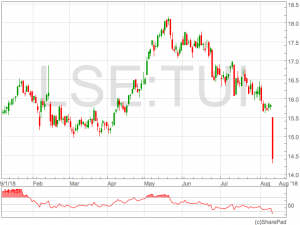

Tui AG (LON:TUI) was the biggest decliner in the FTSE 100 after the travel company announced a 6% increase in revenue but gave a cloudy outlook for the rest of the year. Shares in the group were down over 9% in early trade.

“The London index is being pulled down by oil stocks and travel operator TUI with moves slightly exaggerated as trading floors are quieter than usual because of the summer holidays. Most European indices are also trading in negative territory with the exception of the DAX, which is struggling around the flat line.” said Fiona Cincotta, Senior Analyst at City Index.

Elsewhere, miners built on strength earlier in the week with Glencore and Antofagasta better bid as a rally in commodities and Chinese stock markets cheered investors.

The FTSE 100 has outperformed it’s European peers in the past week as a weaker sterling supports the index.

GBP/USD has come under significant pressure this week as infighting in the Conservative party over its stance on Brexit and controversial comments from Boris Johnson raises questions about their competence to deliver a wholesome Brexit deal for the UK.