The FTSE 100 continued it’s fall on Thursday as the Bank of England held interest rates at 0.5% but moved closer to a rate hike.

The Bank of Englands chief economist Andy Haldane changed his stance and voted for a hike in rates, meaning the MPC were split 6-3, increasing the chance of a rate hike at the next meeting set for 2nd August.

The minutes released alongside the interest rate decision pointed to the softness in the UK economy experienced in the fast half of this year being reversed, providing justification for members of the MPC to seek interest rates later in the year.

“As widely anticipated, the Bank of England Monetary Policy Committee has kept interest rates on ice at 0.5%. With recent data showing UK CPI at 2.4% – above target but below recent highs – and wage growth also being pegged back, there was no chance of a shock rise this week.

“The Bank of England does, however, appear to be standing firm on its desire to hike rates in August, even in the wake of recent weaker than expected economic data. After abandoning its widely signalled rate hike in May, Mark Carney is determined to shake off the moniker of the ‘unreliable boyfriend’ if he can,”said Ed Monk, associate director for Personal Investing at Fidelity International.

FTSE 100 sinks

The announcement drove a sharp decline in the FTSE 100 as sterling rallied strongly against the dollar.

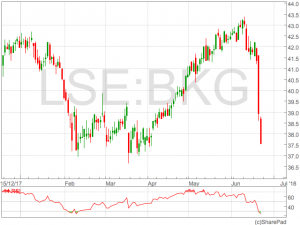

Some of the biggest fallers in the FTSE 100 were again the house builders who were still reeling from a trading update from Berkeley Group suggesting the housing market was set for a lull which could see thier profits fall – something unlikely to be helped by rising rates.

Taylor Wimpey (LON:TW), Persimmon (LON:PSN), Barratt Developments (LON:BDEV) and Berkeley Group (LON:BKG) were down between 2.9% and 3.7% on Thursday.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

Some analysts questioned the substance of the today’s balance sheet comments from the Bank of England suggesting any meaningful action was still some way.

Today’s plans to bring in an unwind of QE from years and years away to merely years away could be seen as bid to remind investors that sterling can rise as well as fall.

— WorldFirst (@World_First) 21 June 2018