The FTSE 100 was up 1.5% to 7,610.8 in early afternoon trading on Thursday, as the market enjoyed a rally despite the Bank of England’s decision to hike interest rates to 1%.

The gains in the market could be linked to the Federal Reserve’s 0.5% interest rates hike, which came 0.25% below the expected 0.75% jump, giving investors cause for celebration with a wide slate of sectors gaining across the FTSE 100.

“The reason why the market jumped was down to previous fears that the central bank would be even more aggressive with rate rises to curb inflation,” said AJ Bell investment director Russ Mould.

“There was a lot of chatter about whether the Fed would have been bold enough to deliver three quarters of a percentage point rise. Federal Reserve chair Jay Powell gave the answer the market was looking for – no, that is not ‘actively’ being considered.”

“Investors breathed a sigh of relief and hence share prices went up.”

A slate of positive results from companies including Shell and Next boosted the market, as Next defied inflation fears of high street decline with a 285% surge in retail growth, and Shell profits tripled to $9.1 billion on the back of skyrocketing oil prices.

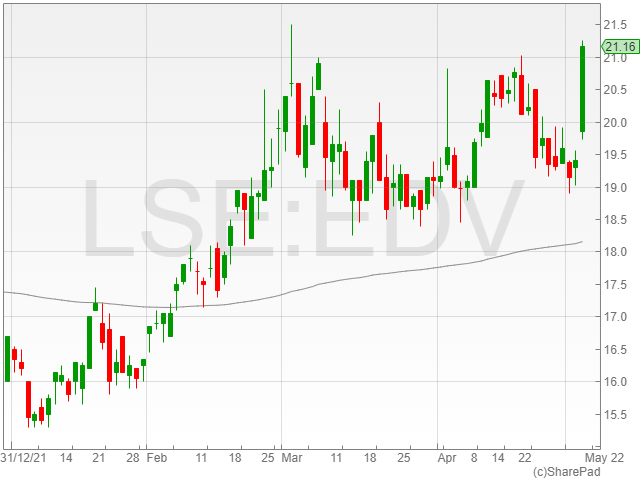

Endeavour Mining shares surged 9.1% to 21,190p after the firm reported climbing revenue on the back of an 8.5% year-on-year increase in gold prices and increased levels of production.

Mondi shares gained 6.9% on the back of strong Q1 2022 results, with a 63% rise in pre-tax underlying earnings to €574 million compared to €353 million the previous year.

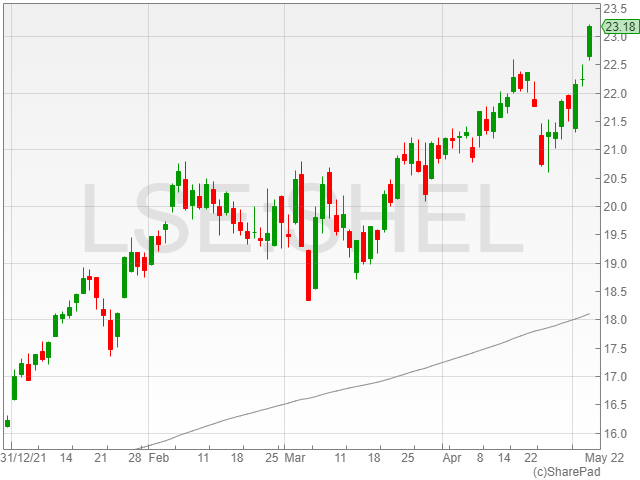

Shell shares gained 4.1% following the energy giant’s massive profits boost despite its Russian operations exit, as the company tripled its profits for Q1 2022 to $9.1 billion against $3.2 billion the last year.

The oil and gas company attributed its profits to soaring oil prices, with Brent crude exceeding $120 per barrel in March this year and currently at $110 per barrel on the back of scarcity fears due to Russia’s war in Ukraine.

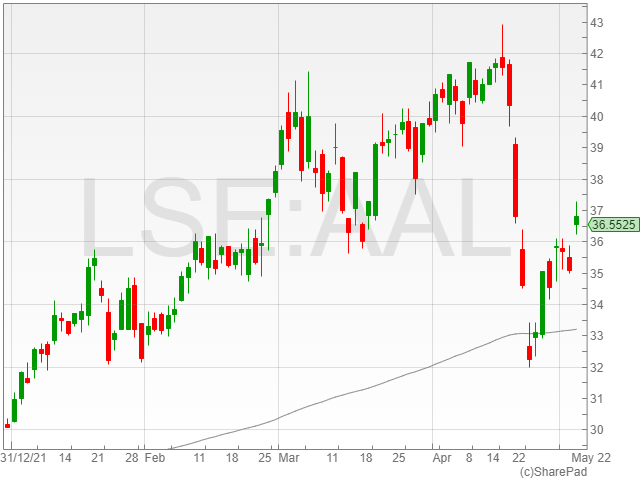

Anglo American shares rose 4% to 36,500p after the mining company announced the appointment of Tim Livesey as a non-executive director of the firm.

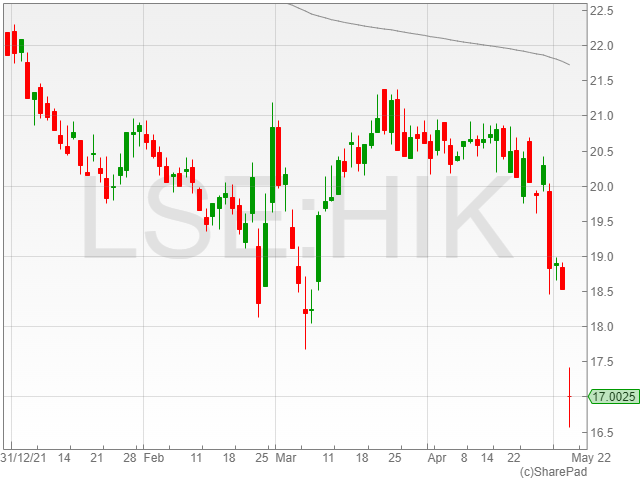

Hikma shares plummeted 8.2% on the back of an announced delay to its Jazz Pharmaceuticals generic version of Xyrem, the company’s treatment for narcolepsy, causing a downgraded revision of its generics business guidance.