The FTSE 100 was buoyed by shining corporate results from several companies in a busy week for the market, with the blue chip index closing 1.1% higher at 7,428 at close of trading on Friday.

US markets enjoyed a boost with Amazon and Apple reporting sales ahead of market expectations and hopes that the US Federal Reserve might ease back on interest rate hikes, given the US has already entered a technical recession.

The Dow Jones was 0.1% higher at 32,586.1, with the S&P 500 rising 0.5% to 4,093.5 and the NASDAQ up 0.5% to 12,233.5.

“The FTSE 100 continued to grind upwards on [Friday], putting it on course to end a pivotal week in positive territory,” said AJ Bell investment director Russ Mould.

“Also helping sentiment was good news from Amazon and Apple, with both managing to deliver better-than-expected sales despite rising prices and a weakening consumer outlook.”

“It says something about the looking glass nature of investing right now that seemingly bad news in the shape of the US meeting the technical conditions for a recession – even if the ultimate arbiter the National Bureau of Economic Research is still to deliver its verdict – is seen as a positive development as it might lead the Fed to ease back on rate hikes.”

NatWest

NatWest shares gained 8.2% to 248.9p as the banking giant exceeded market expectations with a £2.6 billion operating profit in the interim.

The firm announced a 13.1% return on tangible equity and a cost:income ratio of 58.3% from 67.6% in the previous year.

NatWest reported a total dividend of 20.3p for the HY1 2022 period.

“In a mixed UK bank reporting season so far, there’s no question who is getting the gold star,” said Mould.

“Natwest has knocked it out of the park with its latest results. It’s hard to see what more it could have done to impress the market.”

Croda

Croda shares increased 5% to 7,498p on the back of a tripled HY1 profit linked to high demand in its Consumer Care business.

The company saw a pre-tax profit spike to £636.5 million against £204.1 million the last year.

Croda reported an 8% rise in its interim dividend to 47p from 43.5p in the previous year.

Rightmove

Rightmove shares fell 0.5% to 639.6p, despite a 9% revenue growth to £162.7 million in HY1 2022 from £149.9 million the last year as a result of increased digital products used by customers.

The property site confirmed a 6% operating profit rise to £121.3 million compared to £114.9 million year-on-year.

“This is another decent set of results from Rightmove, helped by a housing market that has remained robust,” said Wealth Club head of equities Charlie Huggins.

“How long can that last with interest rates rising and inflation at a 40-year high? Only time will tell. However, even if the housing market stalls, there are reasons to think Rightmove could prove resilient.”

AstraZeneca

AstraZeneca shares dipped 0.2% to 10,844p after HY1 2022 revenues climbed to 48% to $22.2 billion, reflecting growth in all divisions, except for Other Medicines.

The pharmaceutical giant saw a 71% spike in operating profits to £1.4 billion, excluding the impact of its Alexion acquisition, exchange rates and one-off expenses.

“Drug maker AstraZeneca is something of a stock market rarity right now – a company trading at fresh record highs in 2022,” said Mould.

“But it appeared to fall victim to profit taking this morning as it beat expectations for the second quarter and raised its full-year guidance, yet got only raspberries in response from investors.”

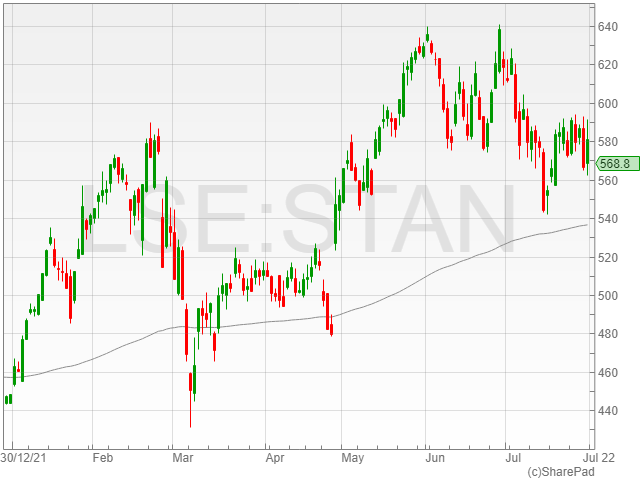

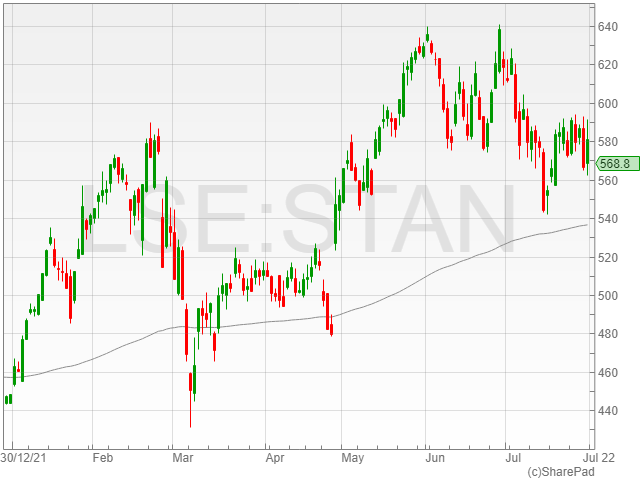

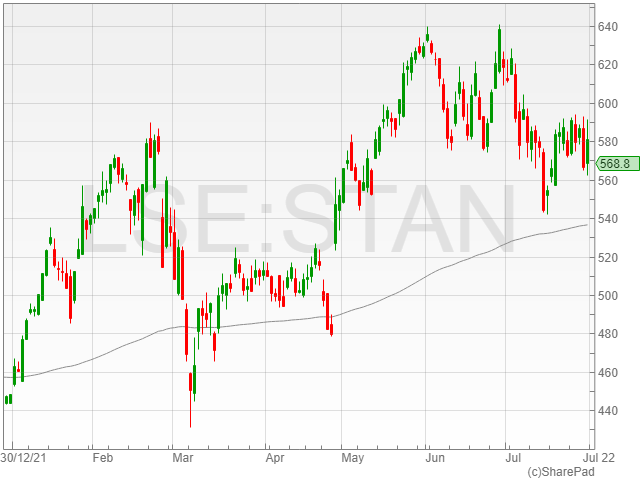

Standard Chartered

Standard Chartered shares fell 0.4%% to 564.2p as its pre-tax profits grew 8.2% to $2.7 billion against $2.5 billion year-on-year in HY1 2022.

The banking firm reported an operating income climb of 7.7% to $8.2 billion compared to $7.6 billion the last year.

The group mentioned a dividend of 4c per share in the period.

Standard Charted also announced the launch of a $5 billion share buyback over the next three years, after its recent $750 million buyback in the interim term.

Glencore

Glencore shares climbed 2.7% to 461.8p following a mixed bag of production results, with rising output of cobalt, nickel and ferrochrome and coal.

However, the mining group announced falling copper production as a result of geotechnical constraints in Katanga, the basis change from its Ernest Henry sale in January 2022, Collahuasi mine sequencing and lower copper units produced from the miner’s zinc sector.

Glencore further mentioned falling zinc, gold, silver and lead production across the interim term.

The company reported its unchanged FY production guidance remained unaltered, with the exception of a lowered copper production expectation.

“Our full year production guidance remains unchanged with the exception of copper, where the ongoing geotechnical constraints relating to Katanga’s open pit and continued management of higher levels of acid-consuming ore, largely account for the reduced guidance of 1,060kt (previously 1,110kt),” said Glencore CEO Gary Nagle.