By Jasper Lawler

English football fans are bitterly disappointed by the final result of Euro 2020, but reaching the final marked a turnaround in English football. The long-awaited catch-up trade in UK shares could be the next big turnaround.

——————————

First, let’s be clear – there is no clear link between a national football team winning or being runners up in the European Championship and the performance of that country’s shares… so do not invest on that basis. Not to mention, the FTSE 100 and FTSE 250 indices contain many companies with headquarters outside of England.

So even if you’re feeling proud of the boys in white… do not invest on that basis.

BUT it might just be that the turnaround in British investments coincides with the turnaround in English football.

What’s been happening to the FTSE 100?

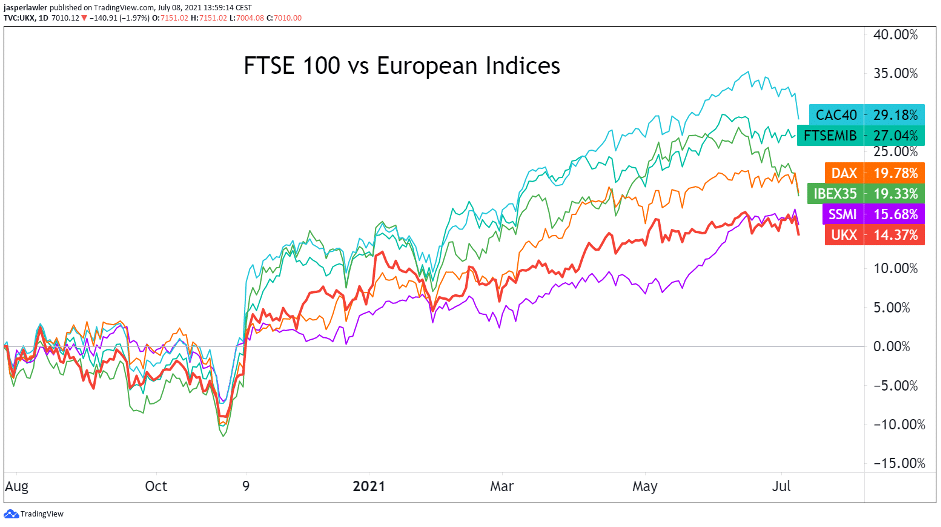

Likely nobody will be complaining about the performance of the UK stocks in their portfolio over the past 12 months. The FTSE 100 index (UKX) – an average of the share prices of top 100 British companies – is up 14% over the period. That is a very respectable annual return by historical standards. However, the other European major indices have fared better – most notably in France, where the CAC 40 index is up 29%, double that of its UK equivalent.

Chart constituents:

CAC 40 – France

FTSE MIB – Italy

DAX – Germany

IBEX 35 – Spain

SSMI – Switzerland

UKX – The United Kingdom

Indices trade ideas

It’s worth noting that these European indices are all available to trade as CFDs. If you believe the FTSE 100 is set do well, you can buy the UK 100 index CFDor if you wish to hedge your portfolio of UK stocks, you can sell the UK 100 CFD.

A third interesting trade idea is a ‘pair trade’ between indices. If you think UK stocks are due a period of outperformance over French stocks, you can simultaneously buy the UK 100 CFDand sell the France 40 CFD. Likewise, if you think the UK slump will continue, you can do the vice versa.

Try your hand at indices trading and register a CFD trading account with LCG

The UK investment Opportunity

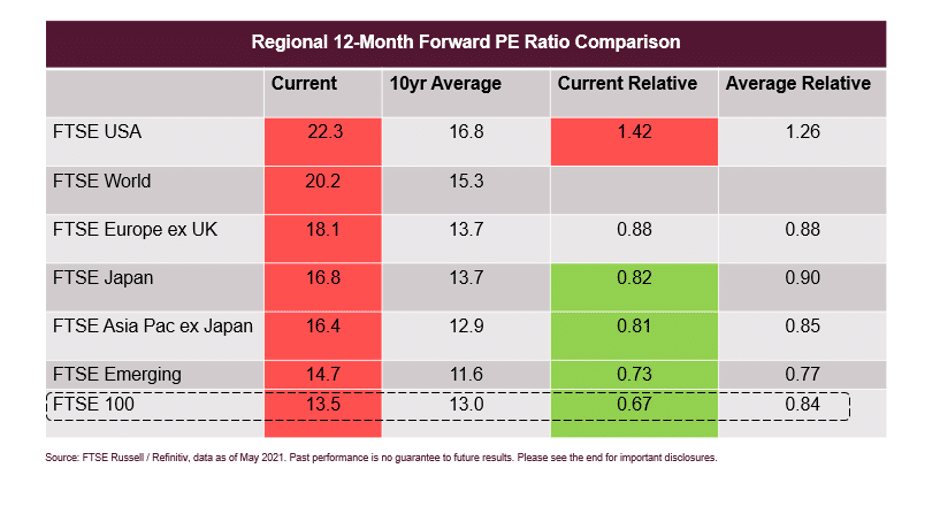

In a nutshell, UK stocks are dramatically undervalued versus their equivalents in Europe.

P/E’s are much lower in the UK – ie stock prices in the UK do not reflect company earnings as well as they do on the continent. And that’s saying something, because European shares are way undervalued versus the US.

Here’s the thing though – you don’t buy shares just because they are undervalued – because they are normally undervalued for a reason – and it often gets worse before it gets better.

So what could usher in the UK turnaround? Firstly….

Why the UK stock market underperformance?

We surely can’t blame it on a loss of national confidence because of football…

We attribute the underperformance to two things:

- The industries represented in the index and their exposure to ‘value vs growth’ trades

- Lingering Brexit uncertainty – especially as relates to financial services

FTSE 100 industry membership

The table below breaks down how many companies the FTSE 100 has from each industry group (sector).

| Industry | Number of stocks |

| Basic Materials | 10 |

| Construction and Materials | 1 |

| Consumer Discretionary | 19 |

| Consumer Staples | 10 |

| Energy | 2 |

| Financials | 20 |

| Health Care | 4 |

| Industrials | 19 |

| Property | 4 |

| Technology | 4 |

| Telecommunications | 2 |

| Utilities | 4 |

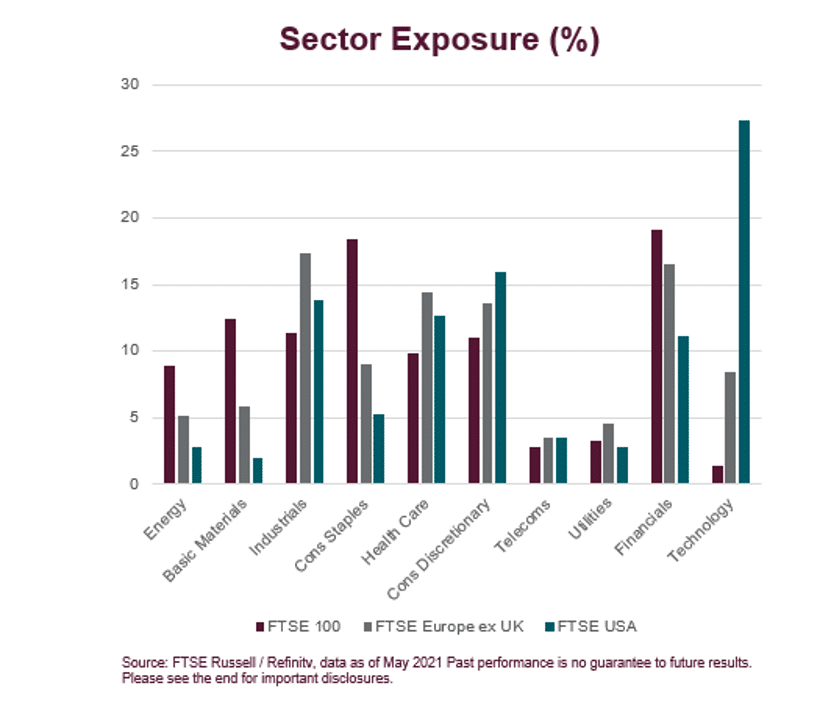

On the basis of the number of shares, the UK index is heavily geared towards consumer discretionary, financial, and industrial sectors.

Sector exposure can also be looked at according to weighting on the index. The below chart contrasts the UK, Europe and the US. Here the standout sector is technology, where the US is in a different universe to the UK.

Technology represents ‘growth’ stocks – while sectors like banks and miners represent ‘cyclical or value’ stocks

Brexit

The UK has now formally left the European Union and there has not been in a resulting crash in the economy or the stock market- of course. But questions remain, especially because the Brexit deal did not cover financial services – Britain’s biggest contributor to GDP.

In February, Amsterdam saw more equity trading than London- though London has since taken back the crown, it is illustrative of the changes afoot.

Uncertainty for Britain’s financial sector clearly has direct implications for investing in the 20 companies on the FTSE 100 involved in finance – but it also indirectly impacts other sectors through the currency. With the British pound lingering around 1.40 to the US dollar (GBP/USD), and at risk of more geopolitical uncertainty, international investors will be less inclined to invest in UK assets.

How does the British catch-up happen?

Firstly, let’s establish what won’t do it. The FTSE 100 is not going to be composed of technology and growth stocks overnight. This will take some long-term structural shift in the economy to yield big companies in these fields. New centres of excellence in London, Manchester and around Oxford and Cambridge universities will hopefully deliver, but not in the near term.

So what can change?

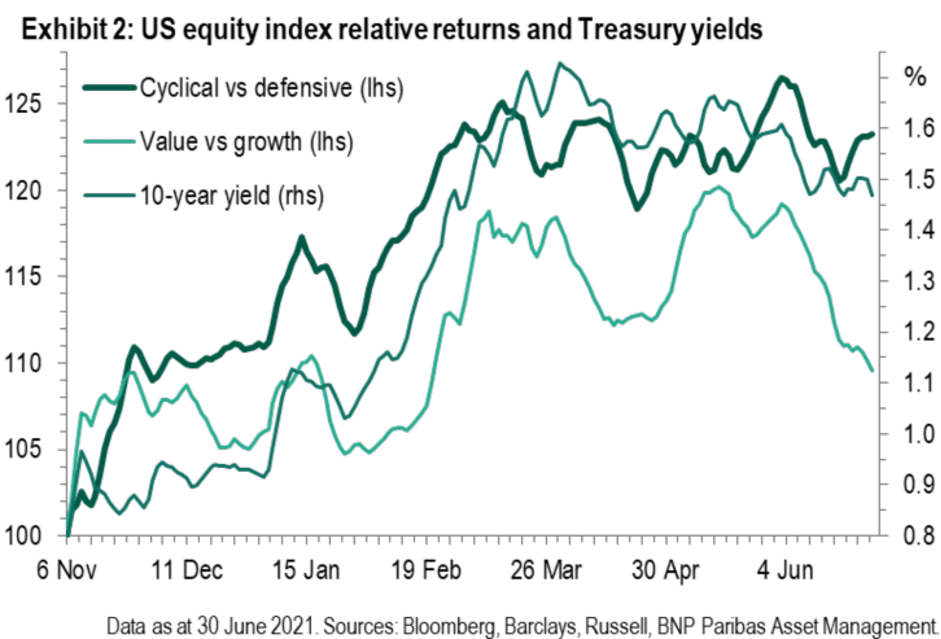

- The Reflation trade

In the last two months, bond yields as well as the ‘value vs growth trade’ has gone flat (see chart below). In that same period, UK stock markets have also turned cold because UK stocks fall largely in the cyclical / value camp, as we already outlined.

The Federal Reserve calling inflation expectations ‘transitory’ caused a sharp reversal in bond yields, which encouraged investors to buy the dip in growth stocks.

But there is a rising belief that while inflation may cool off short term, higher inflation will be more durable.

“Every day I see evidence of inflation not being transitory, and I have concern that the Fed is falling behind,” – Mohammed El-Erian

“We’re seeing very substantial inflation… We’re raising prices, people are raising prices to us. And it’s being accepted.” – Warren Buffett

“With employment, the Fed wants to see outcomes, with inflation, they insist it’s transitory. It’s an intellectual incongruity that risks damaging their credibility if they’re wrong.” – Paul Tudor Jones

Value stocks have not sold off heavily- it is appears to be more of a pause, implying possibly more gains to come.

If economic data starts to corroborate what these top investors are warning about inflation, then that could prompt the bounce in bond yields and value trades that will support a return to form for the FTSE 100.

Financial services

The UK and EU agreeing a beneficial deal for the City of London is probably not something to hang your hat on, but still some return of certainty is likely – and that will support investor belief in the UK economy and improve valuations in some major components of the FTSE 100.

LCG offers CFDs in all the largest UK company shares as well as global indices. Register for a CFD trading account with LCG

Spread betting and CFD trading carry a high level of risk to your capital and can result in loss of your deposits. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 78% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information provided within this communication has been prepared by London Capital Group Limited (LCG) and is intended for informative purposes only. It is not intended for investment, or commercial advice or an offer or solicitation for the purchase or sale of any financial instrument. Any opinions, news, research, analysis, prices, other information or links to third-party contained within this communication is provided as general market commentary and does not constitute investment advice and is not intended for any form of commercial use. LCG shall not accept liability for any loss, damager including, but without limitation, to any loss or profit which may arise directly or indirectly from use of or reliance on such information.

The information in this article is not directed at residents of EU as well as Australia, Belgium, Canada, New Zealand, Singapore or the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

London Capital Group (LCG) is a company registered in England and Wales under registered number: 3218125. LCG is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of: 182110. The registered address for LCG is: 80 Cheapside, London EC2V 6EE.