Global stock markets were rocked on Thursday as the growing threat of inflation and slow growth sent equities deep into the red.

The FTSE 100 as sank over 2% as UK GDP fell by 0.1% in March, raising fears of a global recession after US GDP contracted 0.4% in the first quarter.

“The FTSE 100 tumbled after weak UK GDP numbers and higher than expected US inflation figures stoked fears about a global economic slowdown. Investors were quick to dump commodity producers on the grounds that demand could fall in the coming months,” says Russ Mould, Investment Director, AJ Bell.

The price of oil fell 2% to $105 barrel as fears of a recession lead to oil giants Shell and BP shares falling 3% to 2,246p and 4.2% to 402p, respectively.

BP shares remained down despite the oil company making a bid for two individual offshore wind leases in the Netherlands in line with its plans to generate €2bn worth of clean energy investments in the country.

FTSE 100 Risers

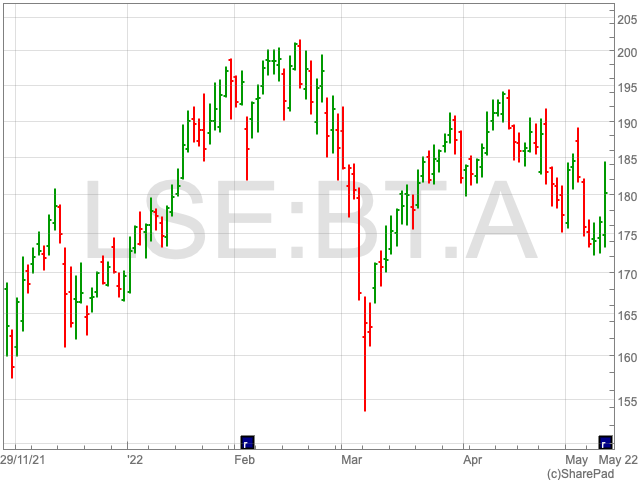

BT Group rose 0.3% to 177p after the telecommunication announced a 9% rise in pretax profit and its joint venture with Warner Bros Discovery to combine its sports broadcasting units.

JD Sports shares rallied 2.4% to 121p as the sports fashion company said it had combated supply chain pressures with a sales growth of 5% YoY in the first few weeks of its financial year, leading to the group raising its profit guidance.

“Sentiment towards JD has soured this year due to worries about consumer spending. JD’s latest trading update implies it is holding up well in a difficult market, but that wasn’t enough to win over investors, with the share price only nudging up 2% on the news,” stated Mould.

Coca-Cola HBC shares gained 1.4% to 1,620p after the company reported group revenue growth of 31% to €1.8bn with established markets up 20%, developing markets gaining 40% and emerging markets increasing 36%.

The group said it expected to have a “much smaller presence” in Russia after exiting the country due to its invasion of Ukraine.

Compass Group shares were trading up 0.3% to 1,699p following its momentum gained on Wednesday when the group reported a 36% rise to £11.5bn in revenue and a 375% jump to £632m in pretax profit.

FTSE 100 Fallers

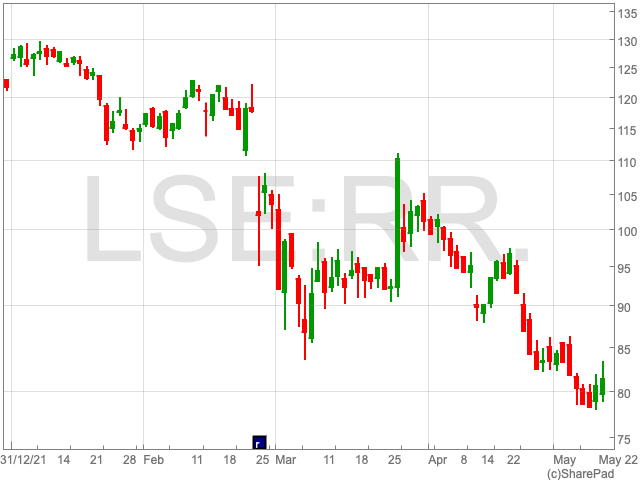

Engine maker Rolls Royce saw its shares fall 0.3% to 80.3p despite the company reiterating its guidance for the year with its YTD performance in line with management expectations.

Rolls Royce shares are “another stock struggling to get a break” even though the group reported a “reassuring trading update,” said Mould. He said “investor sentiment is poor” in a recovering aviation sector and an opportunistic defence sector, and would need a “barrage of good news to trigger a strong share price rise in the current environment.”

Mining shares tumbled on Thursday as investor confidence was shaken from commodity stocks dragging the FTSE 100. Glencore and Fresnillo shares fell 7% to 443p and 719p, Anglo American and Antofagasta shares dropped 6.5% to 3,189p and 1,325p and, Rio Tinto and Endeavour mining shares lost 5.5% to 5,067p and 1,827p.

Hargreaves Lansdown shares lost 6.7% to 834p after the group recorded a fall of 16% in group revenue in the first quarter, which was in line with management expectations. The group also stated that assets under administration for the quarter dropped by £600m due to adverse market movements.

Tech-heavy Scottish Mortgage Investment Trust shares sunk 6.7% to 729p as “investors feared portfolio company valuations would be worth less based on discounted cash flow models because of rising interest rates” according to Mould.