Rolls Royce (RR) stated that its trading has been in line with expectations since the start of 2022 and said there is no change in its guidance for the rest of the year, in a trading update on Thursday.

Rolls Royce forecasts “positive momentum” in its FY22 performance regardless of the constraints and “macroeconomic uncertainties”, as the group said it is ready for the expected growth in its end markets.

The group addressed supply chain disruptions and said it is under control as Rolls Royce has sourcing agreements and hedging policies in place to limit volatility in raw material inflation and allows for “near-term protection”. The group added that it upped its inventory to reduce the impact of the disruption.

In its Civil Aerospace segment, Rolls Royce noted a 42% increase in its large engine long term service agreement flying hours compared to Q1 2021.

Pandemic restrictions have eased allowing for travel to commence after an almost 2-year pause, however, flights to China have been operating at a lower rate as the pandemic led to another lockdown. Business Aviation’s flying hours for the group remained robust.

The group expects footfall in its shops and deliveries of original equipment associated with installed and spare engines to rise in 2022.

Rolls Royce announced a deal with Qantas for 12 Airbus A350-1000s to support Qantas’ long-haul Project Sunrise initiative which will be powered by RR’s Trent XWB-97 engines. The group added that Qantas also promised to ink a TotalCare service agreement for the engines that will operate the 12 planes.

Rolls Royce’s Defence segment reported a robust order backlog which will help in revenue growth which in turn will allow mitigation of risks associated with inflation and supply chain disruptions. However, it reiterated that its operating margins will be lower than 2021 owing to more investments toward contract wins in its Defence segment.

The group’s long term growth forecast for Defence is supported by the rise in defence budgets for governments.

Order intakes in Power Systems for the first quarter have been quite solid across the board, notably in the power generation and defence end sectors.

The first engines for power generating, construction, and industrial uses have been licenced for operation using sustainable fuels, and hydrogen engines are being developed said, Rolls Royce.

Rolls-Royce Electrical and Rolls-Royce SMR, it is New Market businesses, that keep making headway, backed by Rolls-Royce and third-party investments.

The multi-year UK Generic Design Assessment process for the SMR design has begun, and the UK Government’s recent commitment to nuclear energy works in favour of Rolls Royce.

It conducted successful flight testing of a hybrid-electric demonstrator aircraft driven by a parallel-hybrid propulsion system at Rolls-Royce Electrical, in collaboration with aircraft producer Tecnam and engine maker Rotax.

Rolls Royce’s disposal programme is aimed to pay off debt and has a target of gaining £2bn, which they are confident they will gain from the total proceeds of the sale of ITP Aero. The sale of ITP Aero is expected to reach fruition in H1 2022 subject to regulatory approvals.

Tomorrow, May 13th, RR will hold a site visit at the Civil Aerospace facilities in Derby where visitors can have a tour and ask questions during its presentation.

The group will outline its main Civil Aerospace value drivers, showcase the operational side of the business, as well as provide a broader understanding of how the changes they have made have improved the adaptability of the business, positioning it to boost earnings and deliver long-term sustainable growth.

Rolls Royce’s medium-term forecast for Civil Aerospace will be presented, based on the decisions it has taken to strengthen cost efficiency and productivity, as well as the prevailing presumed recovery in demand, which is subject to risks given the current market and macroeconomic conditions.

Civil Aerospace’s underlying revenue is expected to expand at a low double-digit percentage compound annual growth rate starting in 2021, with an operating margin in the high single digits and trade cash flow comfortably exceeding operating profit, according to the group.

Rolls Royce will publish half-year results in August 2022.

Laura Hoy, Equity Analyst, Hargreaves Lansdown said, “Rolls Royce hasn’t been able to catch a break over the past few years, but we’re finally starting to see green shoots amid a budding recovery.”

“The Defense business continues to be a beacon of strength, and although it comes at the expense of near-term profits, it’s the right move to continue investing in future growth. Progress in New Business is also reassuring and the UK government’s commitment to nuclear energy should mean there are some new contracts up for grabs on the horizon.”

“The biggest thing on our minds is cash flow, which management still expects to be in the black by year-end. This is a key turning point for Rolls, which has seen its debt pile balloon as billions walk out the door to keep operations turning over.”

“The £2bn sale of ITP Aero will help get this under control, but ultimately we’ll need to see a business capable of standing on its own two legs before popping the champagne.”

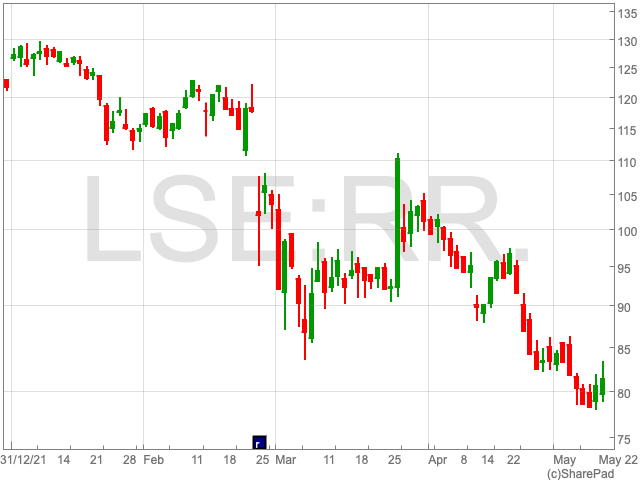

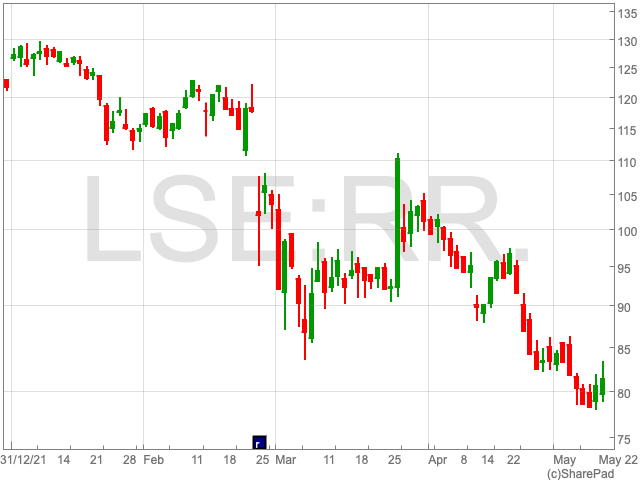

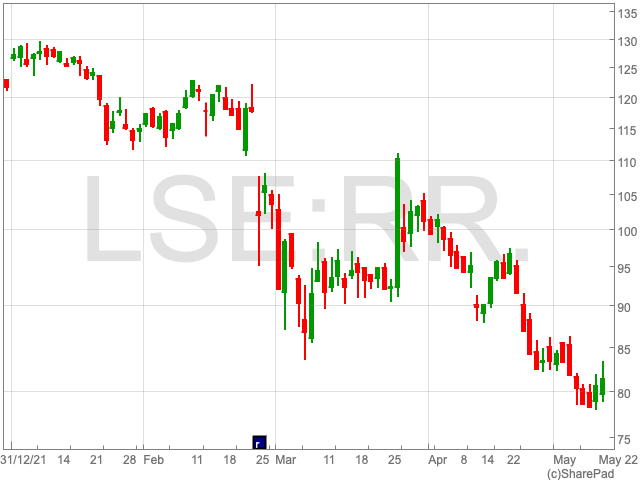

Rolls Royce shares gained 1% to 81.35p after the group announced its positive outlook for 2022.