The FTSE 100 tumbled on Thursday as stocks across Europe tanked and the gloomy macroeconomic forecast seemed to finally sink in for investors as recession alarms rang.

“Stock markets were in a terrible mood across Europe, with the FTSE 100 down 1.7%, the CAC 40 dropping by 2.3% and the Dax falling 2.5%,” said AJ Bell investment director Russ Mould.

“There really is a lack of good news for investors to cling onto, and the near-term outlook looks bleak which is shattering confidence.”

Meanwhile, the US markets spiralled, with NASDAQ pre-open trading down 1.8% to 11,479 and the Dow Jones down 1.2% to 30,625.

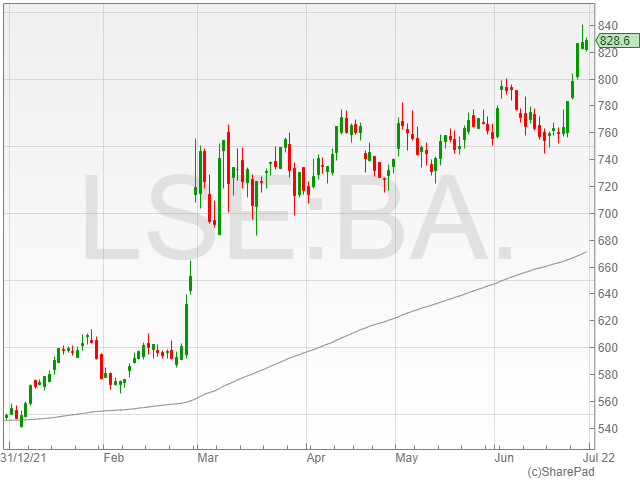

BAE Systems and Bunzl

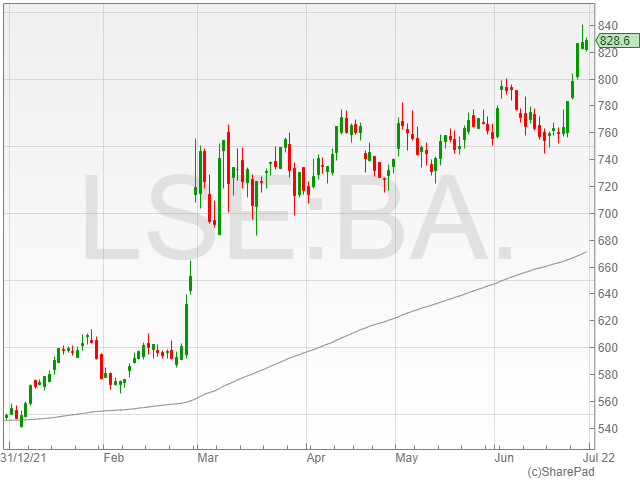

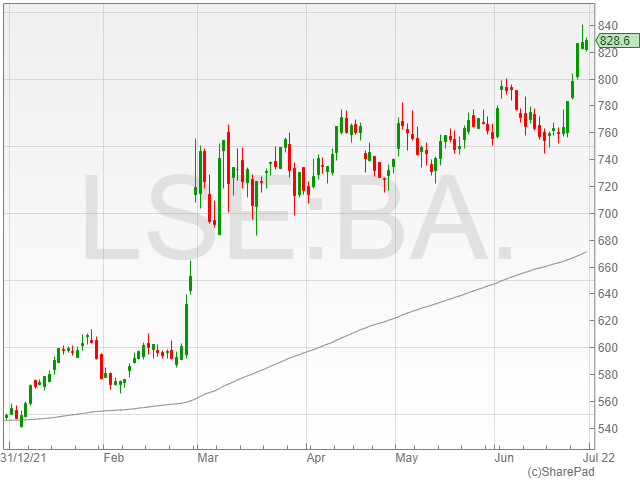

At the time of writing, the only two risers on the FTSE 100 were BAE Systems, with a 0.4% climb to 830.4p, and Bunzl with a 0.3% uptick to 2,681p.

BAE Systems is no doubt raking in the cash after G7 leaders renewed their commitment to Ukraine as Putin’s war escalates, sending demand for heavy arms soaring.

Meanwhile, Bunzl increased its forecast revenues guidance on the back of higher than expected HY1 revenues growth of 16% as a result of higher inflation levels and a series of acquisitions.

“The list of risers on the FTSE 100 won’t take investors long to read. [Bunzl], the provider of products that companies need to do business but not actually sell to customers nudged ahead … after upgrading its guidance for the year,” said Mould.

Bunzl CEO Frank van Zanten added: “Bunzl has delivered another period of strong growth. We continue to demonstrate the strength of our business model, supported by the depth and resilience of our supply chains and the agility of our people who have responded to the inflationary environment so successfully.”

“Our acquisition momentum remains strong, with our active pipeline supported by a strong balance sheet.”

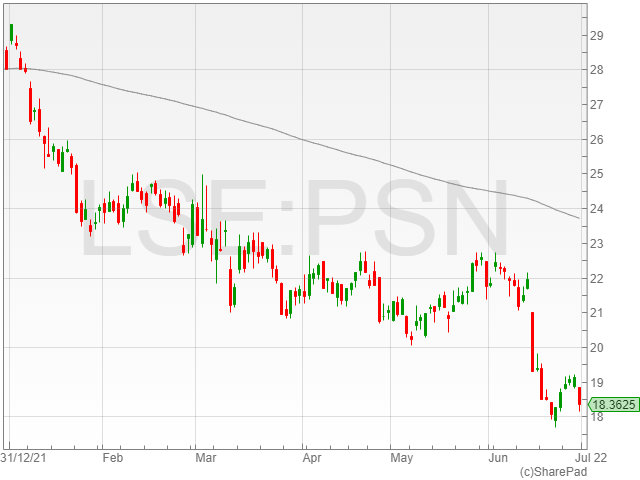

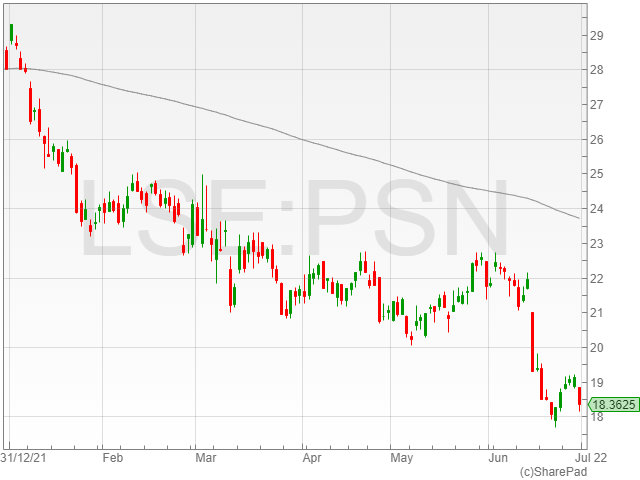

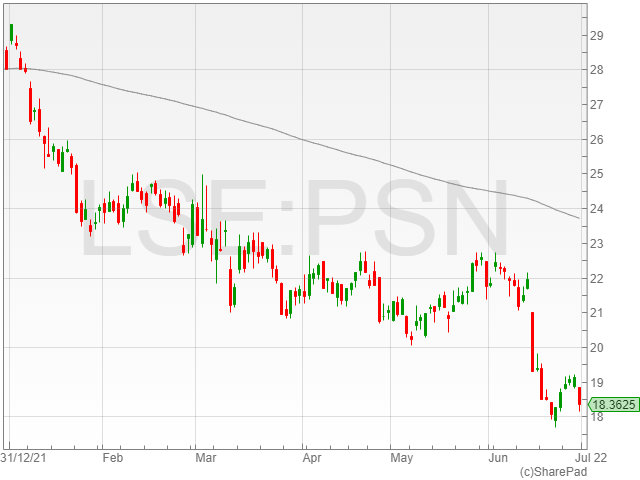

Housing cooldown knocks housebuilders down

Housing stocks were hit particularly hard, as the latest figures from Nationwide revealed a slowed housing price growth of 0.3% compared to 0.9% the last month.

“The price of a typical UK home climbed to a new record high of £271,613, with average prices increasing by over £26,000 in the past year,” said Nationwide chief economist Robert Gardner.

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer enquiries.”

“The market is expected to slow further as pressure on household finances intensifies in the coming quarters, with inflation expected to reach double digits towards the end of the year. Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.”

Barratt Developments shares tumbled 4.3% to 455.4p, Berkeley Group fell 3.1% to 3,659p, Persimmon dropped 3.8% to 1,841.7p and Taylor Wimpey slid 3.8% to 1,841.7p.