Hargreaves Lansdown has announced a 12-month fixed-rate deal of 2.36% from Kent Reliance on its Active Savings platform.

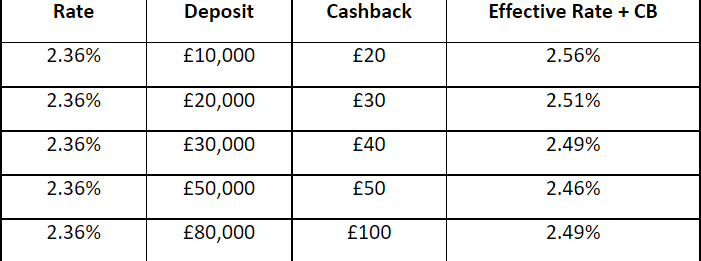

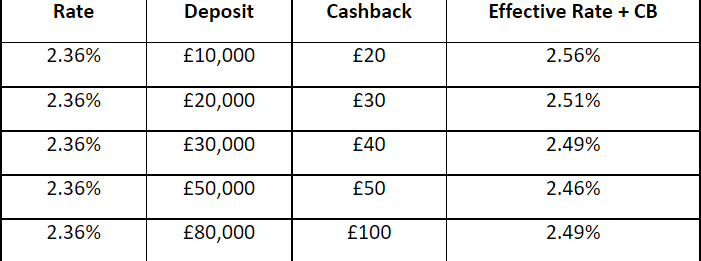

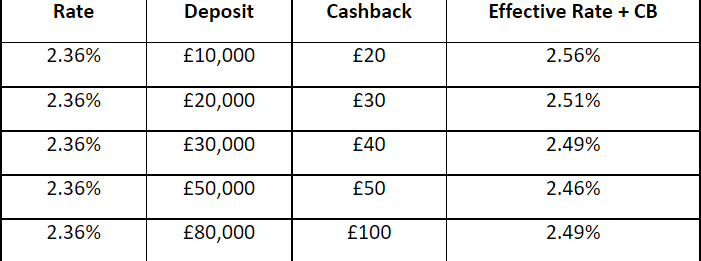

The company reported that the deal increases up to 2.56% with cash back offer, representing the highest available rate in over five years.

Kent Reliance was also the first to offer rates in excess of 2% in April for more than two years.

Hargreaves Lansdown commented that there were increased short-term rates available too, with nine months at 2.25% with Charter Savings Bank and six months at 1.9% with Kent Reliance.

Charter Savings Bank is also offerings 2.45% for 18 months and 2.8% for 36 months.

“The additional reward for giving up access to your savings is increasing, and for 12-month fixes it now stands at 0.99%,” said Hargreaves Lansdown head of active savings Tom Higham.

“This is the additional interest earned by taking out the top 12-month, over the top easy access (no strings attached) rate. A little over 6 months ago this additional reward for fixing for a year was 0.50%.”

“What this shows is that banks have been relatively quick to pass on rate increases to their fixed-term products but are moving much slower on easy access repricing.”

The firm mentioned that the current cash back offer on Active Savings could increase the best 12-month rate available to 2.56% on a £10,000 deposit, which has not been seen for a long time.

Hargreaves Lansdown highlighted the potential for real-term savings loss for consumers on the back of rising Bank of England interest rates, which stand at 1% and are estimated to grow to 2% by the close of 2022, and rise to 2.5% by the middle of 2023, with the Bank expected to scale them back later in 2023.

The firm warned that consumers should not rely on large banks to offer competitive savings rates, and drew attention to Barclays, which pays 0.01% on its flagship easy access product despite four base rate increases and and a £1 billion share buyback programme amid £2.2 billion in profits for Q1 2022.

“Leaving your savings in your current account or high street bank savings account is now costing you hundreds of pounds per £10,000 of savings,” said Higham.

“Savings platforms like Active Savings offer a convenient and secure way to get the most out of your cash savings. With inflation (CPI) at 9% and forecast to rise still, it’s more important than ever to offset what you can by getting your cash savings working harder.”