George Barrow, co-manager of the Polar Capital Global Financials Trust

Rather than thinking of financials as UK banks plus a couple of insurance stocks, it might be time to see the sector as more like technology or healthcare. Although clearly different in many respects, they are all major global sectors with varied subsectors that diversify risk and offer superior risk-adjusted returns to the well-known large-cap stocks you might otherwise invest in.

Financials is in fact the second-largest global equity sector by market cap, representing 16%1 of the MSCI All Country World Index (ACWI): technology is bigger at 25%, but financials outweighs the next largest sectors – healthcare and industrials (both 11%), and consumer discretionary (10%). It is the most regionally balanced sector, with good exposure to Asia-Pacific and emerging markets. Crucially, it offers excellent diversification benefits against concentrated markets and would be the biggest beneficiary of a rotation from growth to value.

Generally, the sector is economically robust, well-regulated and in our view offers exceptional value. As with technology and healthcare, an informed way to gain exposure to its attractive dynamics, subsectors and themes is through a specialist fund, such as the Polar Capital Global Financials Trust.

Paradigm shift

Following a prolonged period of ultra-low rates which depressed bank returns, the normalisation in interest rates has supported the sector’s profitability. This shift has been recognised by investors, with the sector having outperformed over one and three years2.

The reworking of supply chains, shifts in demographics and the clean energy transition are likely to add to longer-term inflationary pressures. Consequently, we attach a low probability to a repeat of the post-global financial crisis world of zero or negative interest rates, particularly given the unintended social consequences of quantitative easing which exacerbated income inequality. Overall, this points to very different environment for investors to navigate and increases the potential for value stocks to outperform.

The sector dynamics are also attractive as shown by the recent results of the leading UK banks. Regulators’ efforts have paid off and the sector is now extremely well capitalised: indeed, investment returns from UK and European banks are expected to be boosted by strong dividends and share buybacks over the next three years. With around one third of their capital being returned to shareholders, they are projected to sustain around 10% total capital return per annum over the next three years (including dividends and buybacks), assuming a fall in interest rates to around 2%.

Banks and much more

The composition of global financials is also particularly interesting and far broader than many people realise. Banks may account for c43% of the MSCI All Country World Financials Index sector benchmark3, but this is made up of banks from the US, Asia, UK and Europe, and ‘other’, including Canada.

As an example, the Trust’s exposure to North American, UK and European banks (as mentioned above) is complemented by emerging market banks with strong economic growth, increasing penetration of the population, a fast-growing middle class and a shift from public to private sector banks.

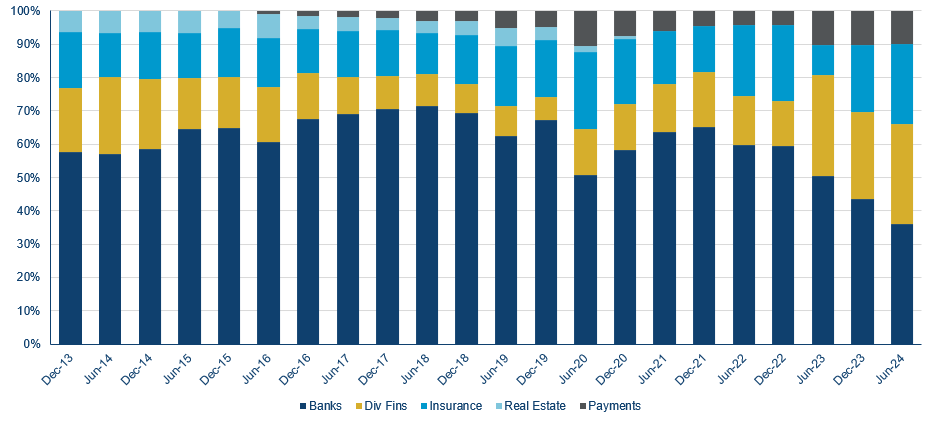

We take genuinely active positions in the financials subsectors

Source: Polar Capital Global Financials Team, September 2024.

Otherwise, the subsectors are insurance (c20%: including general, life and multi-line insurers, brokers and reinsurance); diversified financials (c27%: financial exchanges and data, asset management and diversified financial services as well as some niche areas); and payments (c10%: most notably the large credit card operators but also core banking software providers).

Active management

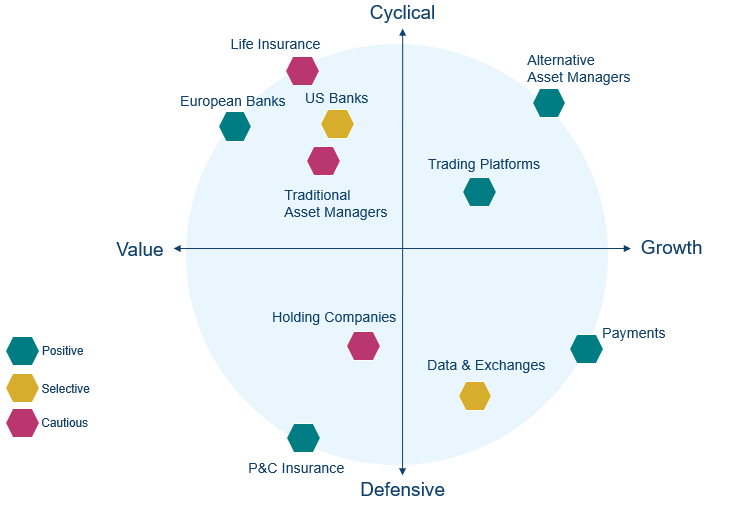

The sector is widely diversified, but as active managers we can also use our insight and experience to allocate to the most attractive regions, subsectors and themes – including technology which is increasing the value of the proprietary data held by financial exchanges (see the chart above). In practice, this means that while financials are overall considered to be value investments, within the Trust we have sub-themes around quality, cyclical and recovery sectors and stocks (see the chart below).

As active managers, we can take advantage of different subsector dynamics

Source: Polar Capital Global Financials Team, September 2024.

Within insurance, which has a low sensitivity to interest rates, reinsurers are experiencing the hardest market for 10+ years, reflecting the higher frequency and severity of losses related to climate change and social inflation. Returns on equity have risen materially from below the cost of capital to the mid-high teens, with this summer’s active hurricane season set to sustain the hard market for at least another year.

The ‘secret sauce’ in the Trust, however, is arguably the diversified financials subsector, which includes financial exchanges and data, trading platforms and alternative asset managers. These can be difficult for generalist investors to follow, but the returns can be compelling as some of the companies are at the forefront of innovation and benefitting from structural trends in the sector.

Summary

The real kicker, however, is valuations: at 12x, the 2025 P/E multiple4 for the financials sector is still low compared to 22x for the broad market (MSCI ACWI)5, and relative to its historical levels. In our view, it is discounting a significant and unlikely deterioration in the macroeconomic environment. The potential for rerating is clear, particularly if there is a general rebalancing of the market away from technology.

Discover the Polar Capital Global Financials Trust

1 MSCI, September 2024

2 MSCI All Country World Financials Index versus MSCI ACWI to 30 September 2024; Polar Capital, Bloomberg.

3 MSCI, September 2024.

4 P/E stands for price-to-earnings ratio, which relates a company’s share price to its earnings per share.

5 Polar Capital, September 2024.

This is a marketing communication. Capital at risk. For informational purposes only. This material is not intended to provide advice of any kind. Issued by Polar Capital LLP and Polar Capital (Europe) SAS. Polar Capital LLP is authorised and regulated by the United Kingdom’s Financial Conduct Authority (“FCA”) and the United States’ Securities and Exchange Commission (“SEC”). Registered address: 16 Palace Street, London SW1E 5JD. Polar Capital (Europe) SAS is authorised and regulated by France’s Autorité des marchés financiers (AMF). Registered address: 18 Rue de Londres, Paris 75009, France. Past performance is not indicative of future results. Some information contained herein has been obtained from third party source and has not been independently verified by Polar Capital. All opinions and estimates constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital, and may not be achieved.