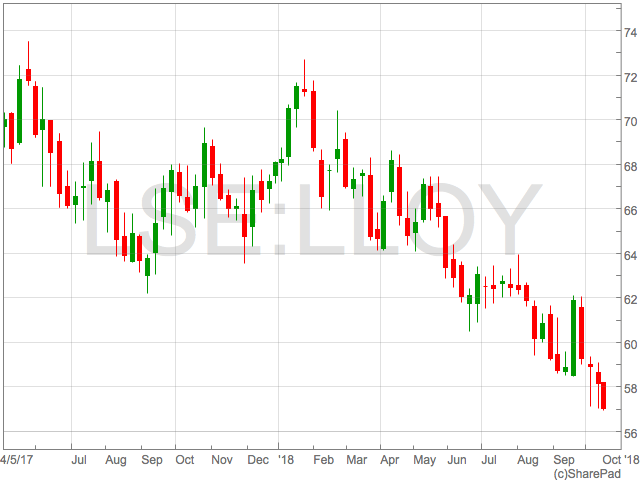

Lloyds (LON:LLOY) share price continued its decline on Tuesday as it broke through 57p for the first time since late 2016.

Lloyds share price has been in a steady decline since January 2018 when the stock formed a double top in the 73p area.

A culmination of fears over Brexit and a slowdown in the UK economy has hit Lloyds shares and the rest of the UK banking sector with those earning a greater proportion of their revenue in the UK being hit the hardest.

Lloyds trades at a significantly cheaper 12-month trailing price-to-earnings ratio than FTSE 100 peer HSBC plc which trades at 17.2x earnings. Lloyds now trades at 10.7x historical earnings.

Lloyds trades at a significantly cheaper 12-month trailing price-to-earnings ratio than FTSE 100 peer HSBC plc which trades at 17.2x earnings. Lloyds now trades at 10.7x historical earnings.

The global exposure of HSBC gives the bank a greater degree of diversification than Lloyds which earns the majority of its revenue in the UK.

UK weakness

However, some investment managers point to the underlying strength of HSBC’s financials as reason for positive sentiment surrounding the stock.

Steve Clayton, manager of the HL Select UK Income Shares fund said of recent results:

“Financially HSBC is in a strong place, with a common equity tier 1 ratio of 14% and an advances to deposits ratio of just 72%.

“The group has announced another quarterly dividend of 10 cents per share, exactly as expected.”

HSBC’s common equity tier 1 ratio of 14% compares to 13.9% of Lloyds so the marginal difference in recent measures of financial soundness suggests the market could be pricing Lloyds for deterioration in the near future.

This is likely to stem from the uncertainty created by Brexit and a softening in the UK housing market. According to data from Halifax, average house prices fell 1.4% in September. This came after recent news that mortgage activity was slowing across the UK.

UK Housing market

Lloyd’s has a £267m exposure to the UK housing market through its open mortgage book with an average loan to value of 43.5%. The health of its mortgage book has been good in recent years as the UK economy steadily expands and house price increases.

However, interest rate hikes and a reduction in overseas cash flowing into the UK property market has hit house prices and any further pullback could see recent buyers in negative equity and a souring of Lloyd’s mortgage book.

As of June 2018, 1.5% of Lloyd’s mainstream mortgages were in arrears of more than 3 months.