Lloyds has remained a darling of UK investors despite the crushing cost of living crisis and ongoing recession alarm bells. With market commentators increasingly suggesting there may be a recession on the horizon, how much could Lloyds shares be capped in the short-term by a period of economic contraction in the UK?

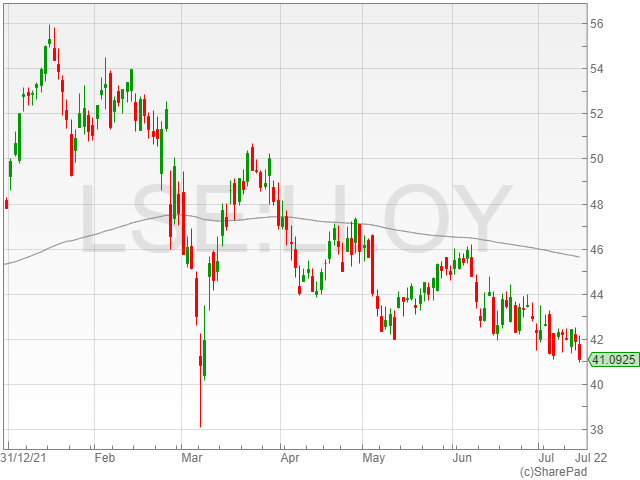

The Lloyds share price has thus far remained resilient and held the important support level at 40p. Indeed, at these lower levels, Lloyds does seem attractively valued.

Lloyds has a current PE ratio of 5.4 and a forward PE ratio of 6.4, indicating analysts expect a mild drop in earnings in the coming months.

The firm is currently undervalued when compared to its UK banking peers, so even with the anticipated drop in earnings, the shares are still great value against their competitors.

Compared to other FTSE 100 banking groups, Barclays has a PE ratio of 3.6 and a forward PE ratio of 5, however Natwest has a PE ratio of 9.1 with a forward PE ratio of 7.7, while Standard Chartered has a similar PE ratio of 9.1 against a forward PE ratio of 7.2.

It is worth noting that Lloyds boasts a strong dividend yield of 4.8%, and a dividend cover of 3.9, which suggests the bank has ample room to increase dividends, despite the risk of a recession.

Furthermore, the stock price has fallen 14% year-to-date, leaving a key opening to potentially buy the dip and take advantage of the shares while they remain undervalued compared to peer banking groups.

Recession Fears

As a retail bank, Lloyds is sensitive to reduced consumer spending, however. The bank is the largest mortgage lender in the UK, and the company already highlighted trouble in that department in its Q1 2022 financial results.

The firm noted a £72m impairment to its mortgage book in Q1 2022 which suggests the first sign of pressure of mortgage holders after an impairment credit in the same period a year prior. A downturn in economic activity could see further impairments.

The cost of living crisis has already seen hints of a slowdown in the UK housing market as the house prices become unattainable for a rising number of consumers who currently have their sights set on paring spending back to the essentials.

However, despite the recession alarm bells, interest rates are set to continue rising from their current levels of 1.25% as the Bank of England seeks to stamp out the secondary effects of surging 9.1% inflation. This will benefit the Net Interest Margin for Lloyds and the general banking industry.

Furthermore, the generous dividend payments seem to be locked in for the coming months, and the company appears well-positioned to weather the short-to-medium term shocks of a recession.

Lloyds handed out a dividend of 2p per share at the end of 2021, and launched a £2 billion share buyback earlier this year as a reflection of its strong capital position.

The Lloyds share price will probably suffer a dent if recession settles in, but the company will likely recover, and its capital position appears sufficient to handle the disruption and bounce back from any market chaos.