Meggitt PLC (LON:MGGT) have reported an impressive set of annual results on Tuesday, however shares have remained in red.

Shares in Meggitt PLC trade at 581p (-2.15%). 25/2/20 10:01BST.

The annual results were impressive reading for the FTSE 100 lister, as organic revenue beat raised guidance.

Across 2019, the aerospace parts firm said that revenue totaled £2.28 billion in 2019. This sees a 9.6% jump from £2.08 billion in 2018 – certainly an impressive statistic for shareholders to take from the update.

Notably, this surge in revenue also meant that pretax profit rose 33% to £286.7 million from £216.1 million.

Orders also rose 10% year on year in 2019, totaling £2.47 billion. Notably performances came from the civil aerospace, defense and energy sectors – all which saw a 8%, 11% and 10% rise in sales respectively.

The firm continued the good news, and declared an interim dividend of 17.50p per share, which sees a 5.1% spike from 16.65p in 2018.

Meggitt did warn shareholders that 2020 could be a tough year for the firm, following production supply issues with Boeing (NYSE:BA) and issues ongoing with the outbreak of the coronavirus.

The firm forecasted by saying that it expects 2020 revenue to lie within the 2% to 4% ball park, and that 2020 underlying operating margin will improve by 30 to 50 basis points.

Tony Wood, Chief Executive, commented:

“Over the last three years, as a result of the successful execution of our strategy, the Group has become a more focused, higher quality and more resilient business, reflected in the delivery of strong levels of organic growth and cash generation.

We delivered another strong set of results in 2019, with organic revenue growth of 8%, ahead of our raised guidance, and good performance across all end markets, particularly Defence.

Our performance was underpinned by growing end-markets and strong execution across our teams during the first full year of our new customer‑aligned organisation. We delivered good progress on our strategic initiatives helping offset the investment made at our fast growing advanced engine composites sites and headwinds caused by adverse mix, supply and trading environment conditions and the grounding of the Boeing 737 MAX, and enabling us to deliver an increase in underlying operating profit of 10% to £403m.

2020 will mark another important year for the Group including the phased transfer into our new, state-of-the-art manufacturing campus at Ansty Park, UK. With a clear strategy, good cash generation and our increasing market share across our growing installed base of 73,000 aircraft, we are well positioned to sustain growth ahead of the market over the medium term.

Reflecting our continuing confidence in the prospects for the Group, the proposed final dividend is 11.95p giving a full year dividend of 17.50p, an increase of 5% and we expect 2020 to be a year of further progress and profitable growth.”

Meggitt also announce Directorate change

In a separate update today, the firm also announced that Sir Nigel Rudd who is Chairman would be stepping down as Chairman and Director of the Company to spend more time on his business and other interests.

Meggitt said that Rudd would be staying in his role until a suitable replacement is found, but will not seek re-election at the 2021 AGM.

Rudd commented: “It has been a privilege and a pleasure to serve as the Chairman of Meggitt. Since 2015, we have focused on establishing Meggitt as a truly world-class, innovative, global aerospace, defence and selected energy business and I am very proud that in 2019 the company returned to the FTSE 100 index. It has been a pleasure to work alongside the Board and senior management team during this time to determine and deliver the Group’s vision and strategy, and lay the groundwork for future growth. I will work to ensure a seamless transition to my successor.

Meggitt win big with DLA

In November, the firm announced that they had won a big contract with the Defense Logistics Agency in Philadeplphia.

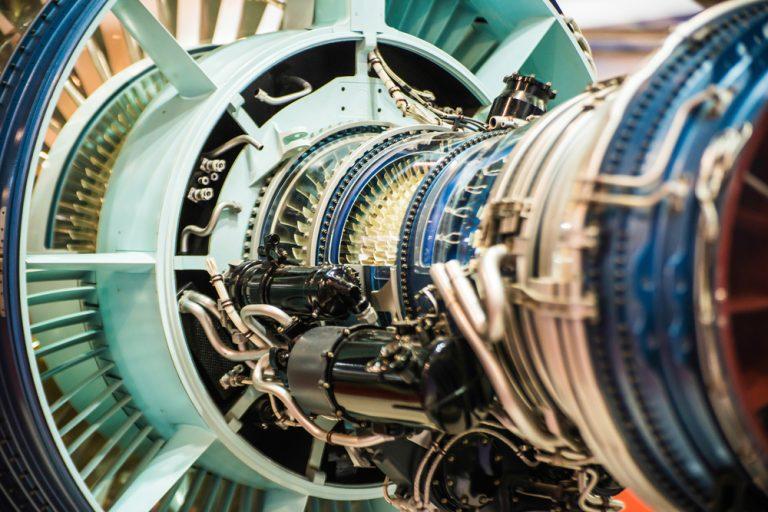

Megitt will supply fuel bladders to the F/A-18 Super Hornet, V-22 Osprey and the CH/MH-53 Super Stallion to the Defense Logistics Agency in Philadelphia.

The Defense Logistics Agency is part of the US Department of Defense, and they manage the global supply chain of equipment for the army, navy and air force.

Specifically, Meggitt will supply fuel bladders for the F/A-18 Super Hornet, V-22 Osprey and CH/MH-53 Super Stallion aircraft.

The terms of the contract are yet to be fully released, however it was reported that the contract extension has a potential value of $130 million. The deal will last six years and deliveries are set to commence in early 2020.

The update provided today is certainly impressive for Meggitt, however the firm will; remain cautious with the worries that they have speculated over – which could lead to a more steady year of trading.