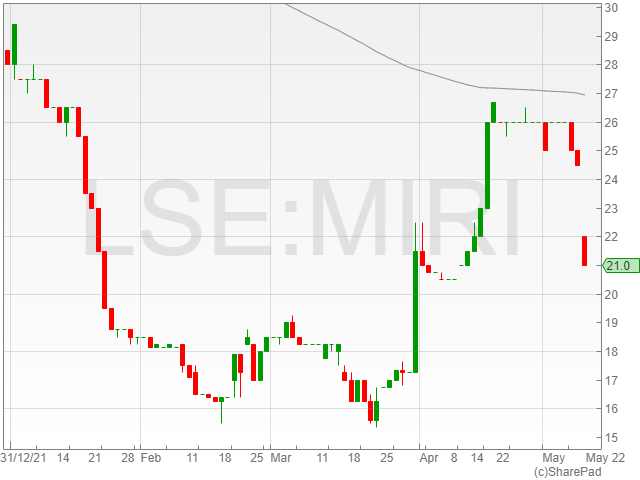

Mirriad Advertising shares dropped 18.3% to 20p in late morning trading on Wednesday, following a widened operation loss to £12 million in its 2021 final results against a £9.1 million loss in 2020.

Mirriad Advertising confirmed broadly flat revenue year-on-year of £2 million compared to £2.2 million the previous year, with a 182% US revenue increase to £884,000 as a result of sales resource investments.

The marketing firm highlighted an increased EBITDA loss to £11.6 million compared to £8.6 million in 2020, as a result of rising operating costs due to an increase in underlying staff numbers from 106 to 130 and a slight fall in gross margin.

The company confirmed a cash position of £24.5 million in net cash against £35.4 million in 2020, alongside net assets on 31 December 2021 of £24.9 million compared to £35.3 million in tracking cash holding.

The advertising group said its current trading and outlook was in line with market expectations, and highlighted strong momentum in the US with plans to grow in Europe and rework its partnership with Tencent in China, prioritising a divergence from a minimum revenue guarantee model.

“Looking at 2022, Mirriad expects to capitalise on the significant opportunities in the North American market and our launch into the programmatic realm. We will also continue to nurture strong existing relationships in Europe and manage the move away from a minimum revenue guarantee model with Tencent in China,” said Mirriad Advertising CEO Stephen Beringer.

“The clear gains in impact and reach we can deliver, all whilst consistently being found to be viewers’ preferred format, are hugely significant in the context of increasing challenges for traditional ad formats.”

The firm added that it expected to announce new board members to enhance its existing team and drive the upcoming phase of its business growth in 2022.

“I am pleased with our progress in building the number and breadth of leading supply partners working with Mirriad. This sits alongside the fact we have significantly increased active relationships and campaigns run on the demand side with blue chip advertisers and the largest agency groups in the world,” said Beringer.

“Our strategy remains very focused on driving adoption and integrating with the media buying ecosystem to make the inventory accessible to the entire market and to automate the transactions programmatically. As we build out against our key pillars, using our agreed KPIs as benchmarks, we will establish Mirriad as a standard and achieve scale.”