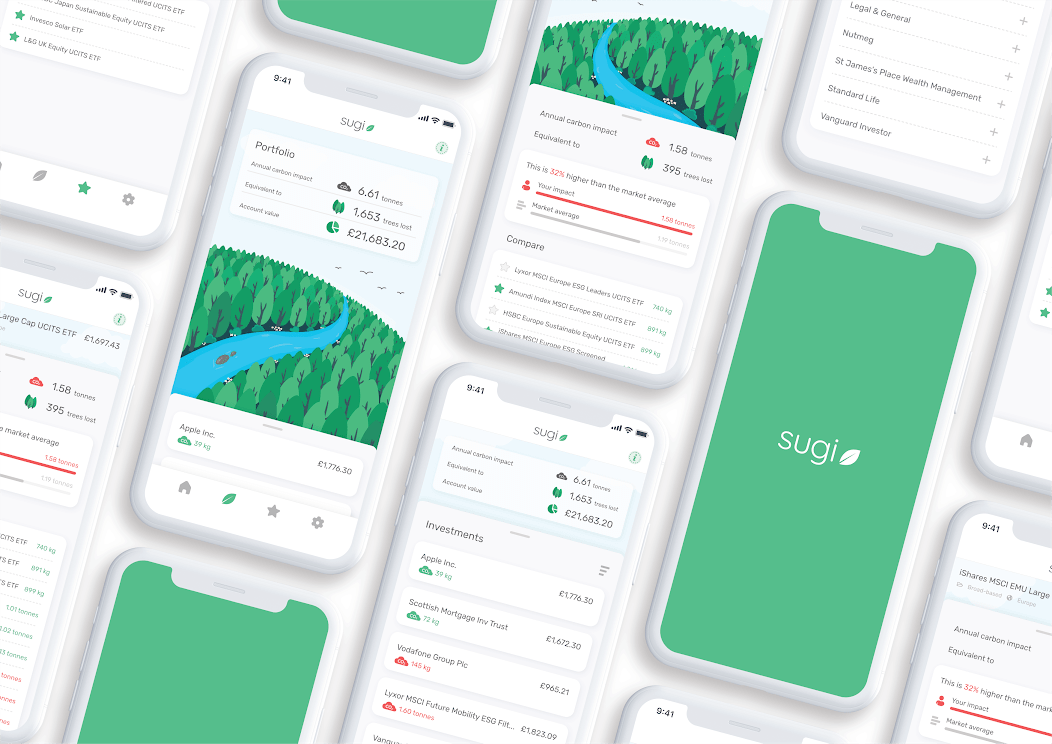

The first platform for retail investors to track the carbon impact of their investments – an app named Sugi – launched on Tuesday with the aim of helping investors ‘build a greener portfolio’ in line with their values.

Sugi, powered by Moneyhub’s Open Finance data and intelligence API, is a free to use app aimed at retail investors who want to compare the carbon footprint of their investments against industry benchmarks.

It was founded in 2019 by CEO Josh Gregory, who hailed Sugi’s launch as a step towards simpler and more accessible green investment:

“While COVID has accelerated awareness and demand of green investing, it’s hard for retail investors to take action.

“Sustainable investing is full of jargon and investors are rightly concerned about greenwashing. Another problem is ESG ratings: they’re meant to simplify complex issues but are themselves very confusing – even for experienced retail investors. All of this ultimately stops more people getting involved.

“Working with Moneyhub, the platform with the most comprehensive financial data connections on the market, allows us to give our users unparalleled access to their investment information in one place.

“By providing users with simple, objective data, Sugi aims to make green investing easier, understandable and more accessible for everyone”.

Unlike the “complex” ESG ratings targeted at institutional investors and asset managers, Sugi shows its users the annual carbon impact of each investment in absolute numbers, and compares the figures against an industry average and carbon data for similar investments.

The app contains carbon data for over 15,000 listed equities – 95% of the listed equities market – and over 3,500 exchange traded funds, as well as certain actively managed funds.

Sugi has stated its intention to introduce a broader range of funds and more environmental data “in the coming months”.

Users can link their investment portfolios – which can include ISAs and SIPPs – to Sugi via Moneyhub’s Open Finance API, enabling them to access “personalised impact data”.

Samantha Seaton, CEO at Moneyhub, commented on Sugi’s launch:

“Until now, aligning an individual investor’s portfolio with their own values has been virtually impossible, but by utilising the power of Open Banking and Open Finance, we are able to make it easy for investors to build greener portfolios.

“Our partnership with Sugi demonstrates the true potential of Open Finance and its ability to solve real-world, complex financial issues, beyond account aggregation and payments.

“We are thrilled to be working alongside Sugi to deliver a product that is not only the first of its kind in the UK, but will make a positive impact on our planet as well”.

The launch is one of a number of new additions to the increasingly climate-conscious economy, after PM Boris Johnson announced the launch of a ‘green revolution’ to mark London’s Climate Action Week.

It follows on the coattails of Chancellor Rishi Sunak’s ‘green gilts’ announcement last week.